PPP fraud has become a massive problem, costing taxpayers billions. The U.S. Small Business Administration’s Office of Inspector General estimated that approximately $64 billion of the PPP’s funds were assigned to fraudulent recipients. This level of fraud reduces government resources and harms legitimate small businesses that truly need financial aid.

In this post, you’ll learn how these scams work, how to recognize PPP fraudsters, the warning signs, and how to protect yourself or your business if you’re affected.

Need support after a scam? Join our community today.

What is PPP Fraud?

The Paycheck Protection Program (PPP) was created to help small businesses stay afloat by providing forgivable loans for payroll, rent, and utilities. The goal was to offer financial relief during difficult times, such as the COVID-19 pandemic, but the program quickly became a fraudster target. Fast access to funds with no repayment was the motivating factor.

The program officially ended in May 2021, but its impact continues. According to research cited by The New York Times, an estimated $76 billion in PPP funds were obtained fraudulently—nearly 10% of the program’s total $800 billion budget. This fraud hurt taxpayers and reduced the support available for legitimate businesses.

When Does PPP Fraud Start?

PPP fraud happens when someone deliberately provides false information to obtain a loan or illegally uses the funds for personal gain. Some common tactics PPP fraudsters used include:

- Falsifying business records to appear eligible for a loan.

- Inflating employee numbers to qualify for larger amounts.

- Collaborating with third parties to fabricate documentation or organize schemes to defraud the PPP.

- Submitting several PPP loan applications under different business names or entities to fraudulently obtain additional funds.

How to Recognize PPP Fraudsters?

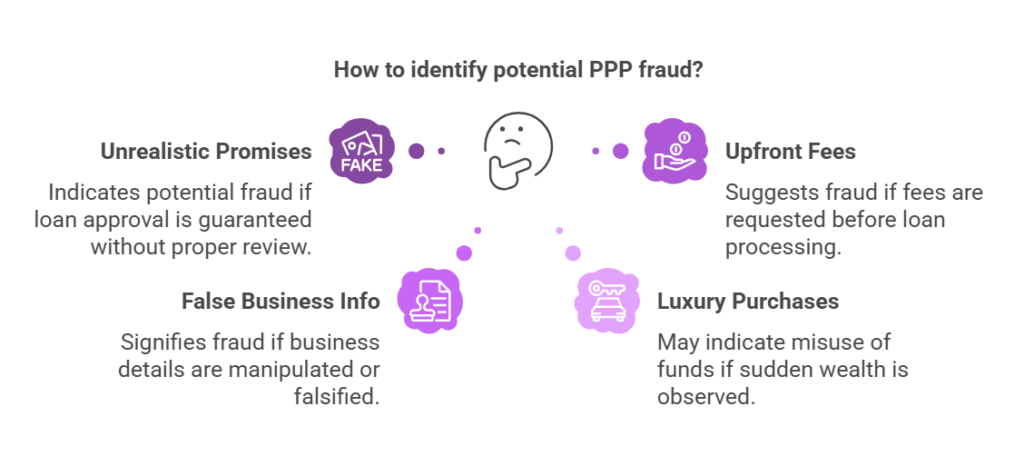

PPP fraud can take many forms, but there are clear indicators that something isn’t right. Learning about fraud detection methods can help you recognize and respond to suspicious activity. If you come across any of the following situations, proceed with caution:

1. Unrealistic Promises About Loan Approval

A PPP loan required businesses to meet specific criteria, and approvals were handled by banks and the Small Business Administration (SBA). No third party could guarantee approval.

2. Requests for Upfront Fees

Applying for a PPP loan never required an upfront payment. Lenders received their compensation from the government, not from applicants. If someone asks for a fee to speed up or process an application, it was likely a scam.

3. False or Fake Business Information

Fraudsters often create fake business websites or manipulate financial data to qualify for bigger loans. Some falsely claimed to have a high number of employees, while others submitted altered or inconsistent paperwork. In some cases, businesses that previously didn’t exist suddenly appeared in loan records with no verifiable history of operations.

4. Unusual Luxury Purchases

While this applies more to detecting fraud after the fact, it’s worth noting. If someone you knew received a PPP loan and suddenly exhibited unexplained wealth, such as luxury cars or extravagant vacations, but their business seemed unstable or unclear, it could have indicated misuse of funds.

5. Unsolicited Offers

The PPP officially ended in May 2021, yet scammers continue to contact people claiming they can still secure loans. Unsolicited emails, calls, or messages offering PPP funds long after the program closed are almost certainly fraudulent.

How to Protect Yourself and Your Business from PPP Fraud?

Avoiding PPP fraudsters starts with taking the right precautions. Here’s what you can do to protect yourself and your business from this type of fraud:

1. Use Trusted Sources

Always seek information from official sources, such as the Small Business Administration (SBA) website or your bank. Scammers often pretend to be financial experts, offering to help with loan applications. If someone contacts you unexpectedly and claims to have insider knowledge, it’s best to ignore them.

2. Verify All Your Loan Application

Federal authorities are actively investigating PPP loan recipients as audits intensify. Many businesses are under scrutiny due to missing documentation or unclear financial records, often caused by trusting the wrong consultants. If your company received PPP funds, now is the time to review past decisions and prepare for inquiries.

3. Protect Your Sensitive Information

Scammers frequently steal Social Security numbers, bank account details, and Employer Identification Numbers (EINs) to commit fraud. Never share this information unless you are certain you are dealing with a legitimate institution, and be cautious with emails or phone calls. Check if a number is a fraud before sharing any confidential data.

4. Ask the Right Questions

Fraudsters frequently avoid direct answers or pressure victims into making quick decisions. If someone offers assistance with a financial program, ask about their experience, credentials, and fees. Legitimate professionals are transparent, while scammers rely on confusion and urgency.

5. Report Suspicious Activity

If you suspect fraud, whether it’s a fake offer or illegal use of PPP funds, report it immediately to the appropriate authorities. The SBA Office of Inspector General and financial institutions have fraud hotlines to investigate suspicious activity. Reporting scams helps authorities take action against fraudsters and protect businesses.

6. Stay Updated on Fraud Trends

Fraud tactics change, and scammers continuously find new ways to target financial aid programs. Stay informed by following updates from reliable sources such as the SBA, the Federal Trade Commission (FTC), and Cryptoscam Defense Network (CDN). Knowing new scam techniques can help you recognize fraud before it affects you.

Have questions about dealing with scams? Contact us for support.

What to Do If You Are Under Investigation for PPP Fraud?

Facing allegations of PPP fraud can be overwhelming. Authorities are cracking down on PPP fraudsters, and taking the right steps early can make a difference. If you or your company are under scrutiny, here’s what you should do:

1. Consult Legal Counsel

Seek an experienced attorney specializing in federal fraud investigations immediately. They can guide you through the process, explain allegations, and present potential legal strategies. Avoid making any statements to investigators or third parties without legal representation, as unadvised communications could harm your defense.

2. Preserve and Organize Documentation

Collect all pertinent records, including loan applications, financial statements, correspondence, and any documents related to the use of PPP funds. Maintaining organized records helps your legal team to evaluate the situation accurately and prepare an effective defense.

3. Cooperate with Investigations

While protecting your rights is essential, cooperating with authorities can prove your intention to resolve the issue transparently. However, verify that any cooperation is planned under the guidance of your legal counsel to prevent self-incrimination or miscommunication.

4. Consider Restitution or Settlement

If applicable, discuss with your attorney the possibility of negotiating a settlement or restitution. Proactively addressing any financial discrepancies can sometimes mitigate penalties and provide accountability.

5. Implement Preventive Measures

Review and optimize your internal policies to prevent future issues. This includes establishing robust compliance programs, managing regular audits, and checking that all financial activities align with legal and ethical standards.

PPP Fraudsters Caught: Real Cases and Legal Consequences

PPP fraud has led to high-profile investigations and legal actions across the U.S. Many people and businesses attempted to exploit the system, but authorities continue to pursue fraudulent cases aggressively.

Here are some real examples of PPP fraudsters who were caught:

1. Former TV Anchor and Husband Indicted for PPP Fraud

Former TV news anchor Stephanie Hockridge-Reis, 41, and her husband, Nathan Reis, 45, have been indicted by the U.S. Department of Justice for allegedly committing fraud related to the Paycheck Protection Program (PPP). They are accused of submitting false loan applications, fabricating payroll records and tax documents.

Prosecutors claim the couple also charged illegal fees and recruited others to assist in fraudulent applications. Their company, Blueacorn, allegedly earned nearly $300 million by prioritizing larger clients to maximize commissions. Hockridge-Reis and her husband reportedly obtained $300,000 in PPP loans for themselves.

2. Detroit Man Pleads Guilty in $14M PPP Fraud Scheme

Marc Andrew Martin, 46, of Detroit, has pleaded guilty to conspiracy to commit fraud in a $14 million Paycheck Protection Program (PPP) loan scheme.

Court records show that Martin and others, including Michigan CPA Matthew Parker, defrauded lenders of over $14 million in COVID-19 relief loans between March 2020 and August 2021. Parker recruited hundreds of small businesses in Pittsburgh and Detroit, falsifying loan applications.

The Small Business Administration approved 226 of them, totaling approximately $14.5 million. Martin referred about $1.9 million in fraudulent loans to Parker, who pleaded guilty in May 2024. His sentencing is set for July 10, 2025, with him facing up to 30 years in prison and a $1 million fine.

Recognize PPP Fraud Risks and Take Action With CDN

PPP fraud has shown how easily financial aid programs can be exploited and serves as a lesson for anyone seeking government assistance. If you applied for a PPP loan or plan to use similar programs, staying informed is important. Verifying information and seeking professional advice can help prevent costly mistakes.

Fraud prevention is a shared effort, and that’s exactly what we do at Cryptoscam Defense Network. Our mission is to expose scams, educate the public, and help people protect themselves from financial fraud. Awareness of these risks protects both your business and the integrity of financial aid programs.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future frauds.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Photos via Freepik.

![busy-businesswoman-working-home-office[1]_11zon Stressed woman holding glasses, financial documents on table, worried about PPP fraudsters and business scams](https://cryptoscamdefensenetwork.com/wp-content/uploads/2025/03/busy-businesswoman-working-home-office1_11zon-scaled.webp)