Many homeowners aged 65 or older feel there’s no real way to reduce the taxes they pay on their homes, but a property tax exemption for seniors can actually provide meaningful relief. According to The Tax Foundation, property taxes account for nearly 30% of state and local revenue in the United States, a huge problem for many retirees.

In this post, we’ll explain what the 65+ property tax exemption is, how it works, and how you can apply for it. You’ll also find a practical example from Iowa, which can help you understand how this senior tax benefit works in different areas, whether you live there or want a point of reference.

Need support after a scam? Join our community today.

What Is a Property Tax Exemption for Seniors?

The property tax exemption for seniors changes the taxable value of the home, which is the number counties use to calculate the yearly tax. Once the exemption is applied, that starting value is reduced, and the final tax amount reflects that change, even if the county tax rate stays the same.

A few important points to remember:

- Applies only to the taxable value; the local tax rate stays the same.

- Affects the calculation from the beginning, before any tax credits are added.

- Works differently from credits, which are applied after the tax amount is calculated.

- It is treated as a separate program from tax credits, since each has a different purpose.

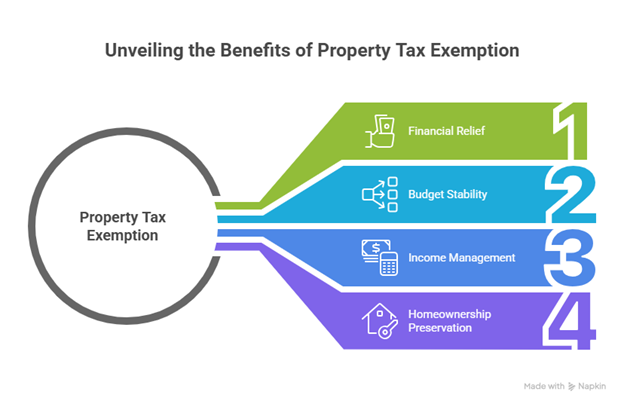

Why is the Property Tax Exemption Helpful for Older Homeowners?

The difference is felt in the yearly budget. When the taxable value of your home goes down, your property tax does too, leaving more room for daily expenses, medications, or basic services. For older homeowners, even modest tax relief can make a notable difference when income is fixed.

Here’s why this exemption is especially useful:

- Creates breathing room in monthly budgets by reducing property tax costs.

- Helps stabilize finances for homeowners living on a fixed income.

- Reduces the risk of late payments, especially in areas where property values are reassessed frequently.

Programs in states like Iowa aim to support aging residents in staying in their primary homes without added financial pressure. This is a core goal of many property tax relief initiatives focused on older adults.

Steps To Apply For The Property Tax Exemption For Seniors

Applying for the property tax exemption for seniors is much easier when the steps are clearly defined. According to the U.S. Census Bureau, nearly 54% of homeowners aged 65 and older depend on a fixed income, which makes cutting the annual tax bill especially helpful when programs like this are available.

1. Verify If You Qualify for the Property Tax Exemption

Confirm that you meet the conditions set by your county. While each state has its own variations, most share these baseline requirements for tax exemption eligibility:

- Being 65 or older on January 1 of the fiscal year

- Using the home as your primary residence

- Appearing on record as the legal owner

The county assessor’s website is usually the fastest place to check your eligibility. There you’ll find instructions, document lists, and examples for special cases. Many offices also answer phone calls if you need to clarify something before filing.

2. Complete the Correct Form

Each state uses a different form for the property tax exemption for seniors, and some counties link it to other programs like the 65+ property tax exemption or the homestead exemption.

To avoid delays or rejection, take a moment to confirm which form applies in your area. Pay close attention to:

- Marking the home correctly as your primary residence

- Filling out the parcel number exactly as shown on your tax records

- Signing and dating the form according to the fiscal year requested

3. Submit and Confirm Before the Deadline

Filing on time means the exemption applies for the next tax cycle. Many states use July 1 as the cutoff date, though counties may adjust it. To keep the process organized, consider these points:

- Check the deadline posted on your local assessor’s website

- Save a receipt or confirmation number if you submit the form online

- Review the status a few weeks later to ensure it was processed

- Keep any approval notices for your personal records

Have questions about dealing with scams? Contact us for support.

Example In Iowa: Homestead Tax Exemption For Residents Aged 65 And Older

In Iowa, the homestead exemption for seniors has been active since 2023. Starting in 2024, eligible homeowners aged 65 and older can remove up to $6,500 from their home’s taxable value.

What Does Iowa Offer?

The exemption applies in two stages, depending on the fiscal year:

- In 2023, it reduced the taxable value by $3,250

- Starting in 2024, the exemption increased to $6,500

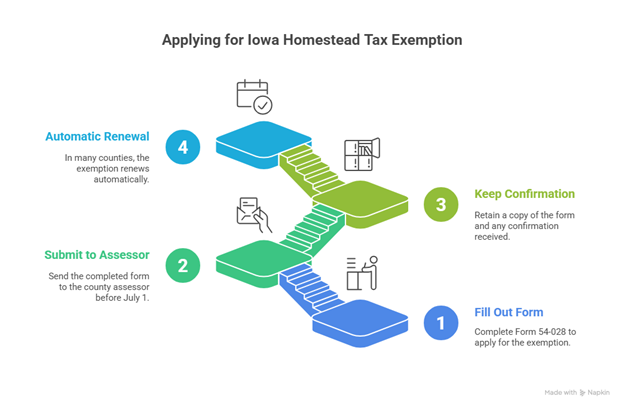

How to Apply for the Homestead Tax Exemption in Iowa?

Applying is simple once you have the right form and know where to submit it. Here’s what to do:

- Fill out Form 54-028, which covers both the homestead exemption and the homestead tax credit

- Submit it to your county assessor before July 1 if you’re applying for the first time

- Keep a copy and any confirmation you receive for your records

- Check if your exemption renews automatically, which is the case in many counties

You can download the form from the official State of Iowa portal, where you’ll also find a list of documents to verify that the property is your primary residence.

How To Make The Most Of This Benefit Once You Turn 65

Using the 65+ property tax exemption isn’t just about saving a few dollars; it’s a way to stay in the home you’ve worked hard to keep. Taking simple steps like checking if you qualify, submitting the form on time, and making sure your homestead exemption is active can help reduce financial pressure before it becomes a real problem.

If you’re facing the stress of falling behind or worrying about your home, our guide on how to stop property tax foreclosure offers clear actions to help you protect what matters most. No one should lose their home over something that could have been prevented with the right information.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.