When unpaid taxes on a home pile up, you may wonder if the property is still an asset or a financial burden. According to ITEP, property taxes account for three out of every four local tax dollars in the United States, which helps explain why the collection process moves so quickly.

This post explores whether your home is an asset or a liability when property taxes are overdue. It also explains what to focus on during the first 48 hours and shares practical ways to protect home equity while managing the debt.

Need support after a scam? Join our community today.

Is My Home an Asset or a Liability?

A home is an asset when it adds value, such as when it slowly increases in value and builds equity. It becomes a liability when it takes too much cash, creates more debt, or adds expenses that are hard to avoid.

The Simple Rule (Cash-In vs. Cash-Out)

To decide if your home is an asset or a liability, look at whether there is money left after paying all required costs. This simple check helps you see if the home supports your finances or takes money away from more urgent needs.

You can use this formula as a quick reference:

(Income/benefits + estimated appreciation) – (total costs + risk) = result

If the result is positive, the home works as an asset. If it reduces your available cash, it acts as a liability, even when the market value looks strong.

How to Identify Your Home’s Status and Its Impact on Your Finances

When money feels tight, housing is often the first expense people review. This method helps show if the property brings stability or takes up resources, especially when property taxes start putting pressure on the monthly budget.

Express Checklist

This checklist helps you see if your home supports financial stability or adds pressure. Answer each question honestly:

- Do you have an emergency fund for several months?

- Is the full monthly payment (mortgage + insurance + property taxes) manageable?

- Could you sell the property without losing money if needed?

- Does the home support stability, or does it limit necessary budget adjustments?

All “no” shows a potential shift to the liability side, even if the market value looks good.

Example

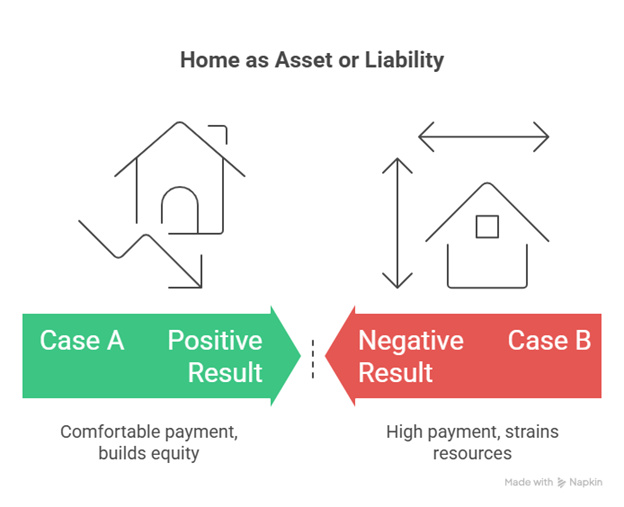

- Case A: Someone buys a home with a payment they can comfortably afford and builds equity over time. Even if the value increases slowly, the home remains an asset because it does not compromise basic needs.

- Case B: Another person buys a nice home, but the monthly payment takes up a large share of their income. Higher property taxes, repairs, and less financial breathing room turn the home into a liability, even if the market value goes up.

👉 Check if you can buy a house if you owe taxes to understand how tax debt affects keeping or buying a home.

What Signs Indicate That Your Home Works As An Asset

A home works as an asset when equity grows, monthly costs stay manageable, and maintenance does not depend on borrowing money.

Federal Reserve data show that housing makes up a large part of net worth for middle-income families. This makes the question “Is your home an asset or a liability?” come up more often than many people expect.

When doubts appear, it helps to look for signs that show how the property supports your financial stability. Here are the most common signs:

1. Home Equity Growth

Home equity grows when you pay down your mortgage or when the value of the property increases.

- Example: If your mortgage balance drops from $240,000 to $230,000 and your home value rises from $260,000 to $270,000, your equity increases without selling the home. This usually signals that the property is helping improve your financial position over time.

2. Total Costs Within A Steady Range

A home is an asset when payments are current, and you don’t need credit to cover expenses.

- Example: If your mortgage, insurance, and property taxes fit comfortably within your budget, the home supports itself. If repairs or unexpected costs require loans or credit cards, the property may start putting pressure on your cash flow.

3. Flexibility

Flexibility is another sign that your home supports financial stability. A property that gives you options, such as renting, selling, or refinancing, helps you avoid being locked into a payment that exceeds your budget.

- Example: If local demand is strong, rent the home to cover the mortgage or give you time to adjust your plans. Being able to sell without a loss or refinance for a lower payment can also create more breathing room each month.

👉 Check how to check if your taxes are paid to confirm your current status and avoid confusion.

What Signs Indicate That Your Home Works As A Liability

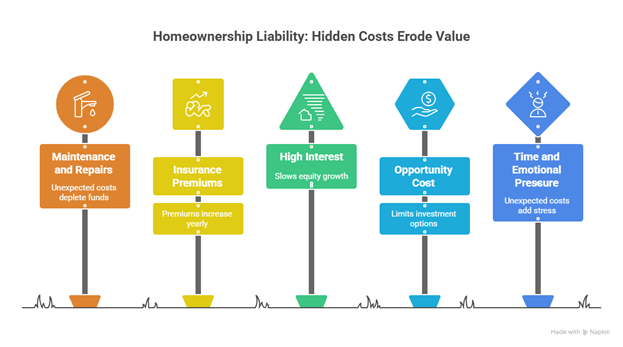

A home can go up in value over time and still turn into a problem if the periodic costs put pressure on your budget. When interest, maintenance, insurance, and property taxes take up a big part of your income, the home starts to feel like a liability, even when the market looks strong.

Some expenses sneak up on you and can drain your cash without warning. These often surprise homeowners.

1. Maintenance And Repairs

Repair costs can come out of nowhere: a small leak, a broken pump, or an air conditioning malfunction in summer can quickly use up savings.

- Example: Someone had a stable budget until a $1,200 roof repair forced them to cut back on other basic expenses.

2. Insurance

Insurance bills can go up over time. In areas exposed to hurricanes, fires, or floods, insurers may ask for extra coverage. These changes raise the cost of owning a home, even when the owner does nothing different.

- Example: A homeowner paying $1,400 per year saw the bill jump to $1,900 after a regional review, adding pressure to the household budget.

3. Interest

In the early years of a mortgage, most monthly payments go toward interest instead of lowering the balance. This slows down how fast equity builds.

- Example: A person pays $1,600 each month, but only $350 goes toward the loan balance. The rest covers interest, delaying real progress.

4. Opportunity Cost

When a huge share of your money is tied up in your home, it can limit your ability to invest, save for emergencies, or move for a better job.

- Example: Someone has $150,000 tied up in home equity but cannot use it without selling or refinancing. This limits options that require cash.

5. Time and Emotional Pressure

Owning a home comes with constant demands, such as bills, upkeep, repairs, and paperwork. When money feels tight, surprise costs add stress and disrupt daily life.

- Example: A family with high monthly payments faces an urgent plumbing repair. This pushes other bills aside and creates weeks of tension.

5. Early Warning Signs

A home may be acting like a liability when certain patterns show up:

- Missing payments more often

- Using credit to cover basic housing costs

- Putting off repairs that affect safety or daily living

When these signs keep showing up, the home may be draining resources you need elsewhere, even if things look fine on paper.

Have questions about dealing with scams? Contact us for support.

How to Catch Up on Property Taxes Step by Step

Taking care of an overdue balance early can make a real difference. This plan walks you through simple steps to regain control, confirm the exact amount owed, and move forward without turning the process into something complicated.

1. Verify the Status and Exact Amount with Your Local Authority

Counties publish the full balance, added fees, and updated deadlines. For this reason, checking the official portal confirms the exact amount owed and the time period involved. This step also shows if any interest was added or if a payment was posted late, helping avoid confusion as you move forward.

- Example: Some Texas counties allow homeowners to check updated balances online using an account number.

2. Ask About Payment Options Before the Situation Moves Further

Many counties offer payment plans, temporary arrangements, or set dates that pause extra charges while you work on the balance. Reaching out early helps keep the account manageable and gives you time to organize each payment.

- Example: In Georgia, some counties allow installment plans that stop extra fees from adding up while the agreement is active.

3. Keep Records of Everything

Save receipts, case numbers, and notes from conversations. These records help if the county files show mistakes. They also make it easier to fix issues if a payment is marked late or applied to the wrong period.

- Example: A digital receipt confirmed that a payment was sent on time, which stopped an incorrect charge from being added.

4. Act Quickly If Your Mortgage Was Supposed to Cover the Property Taxes

If your mortgage payment should have covered property taxes and did not, contact your servicer right away. Gather account statements and request a formal review. The Consumer Financial Protection Bureau (CFPB) advises responding as soon as you receive a county notice.

- Example: A homeowner in Colorado found that the servicer missed the annual tax payment. After submitting records, the balance was corrected before extra penalties were added.

👉 Check how the tax and property terms glossary helps you decode the terms that shape your property tax situation.

What to Do When Your Home and Unpaid Taxes Create Pressure

When you’re facing money stress, the question “Is your home an asset or a liability?” feels harder to answer. If the numbers don’t fit your budget anymore, it helps to take a fresh look at how property taxes are affecting your finances.

Check your liquidity signals, things like available cash, payment flexibility, or emergency savings. At Cryptoscam Defense Network, we offer guidance for homeowners with overdue balances or those feeling lost after receiving a tax notice.

✅ Download our Fraud Report Toolkit to easily collect, organize, and report scam cases, with dropdowns for scam types, payment methods, platforms, and direct links to agencies like the FTC, FBI, IC3, CFPB, BBB, and more.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Frequently Asked Questions (FAQ) About Property Taxes and Home Value

Does My Home Count as an Asset in My Net Worth?

It can, as long as it leaves enough margin after covering fixed expenses and property taxes. Data from the Federal Reserve shows that housing represents a major share of wealth for many middle-wealth households.

A home is an asset when it supports financial stability rather than creating pressure through monthly debt.

What Is Home Equity and How Can It Be Calculated in a Simple Way?

Home equity is the difference between your home’s estimated value and the remaining mortgage balance. It increases when the market value rises or the principal goes down. This gives a direct view of how much of the property is truly yours.

Can Property Taxes Put My Home at Risk?

Yes, when the balance continues unpaid. Late charges can raise the total amount owed, and some states allow the sale of a tax lien or the start of a tax sale. These actions may move forward even during periods of appreciation.

What Signs Suggest That Selling May Be a Better Option Than Trying to Hold the Property?

Signals appear when the monthly budget feels tight, the equity barely moves, and time-sensitive expenses force adjustments. If staying in the home requires cutting savings or delaying bills, it may be time to review alternatives and see if selling offers the liquidity needed for other goals.