Property Tax Notices often create stress because they come with shifting amounts, legal phrasing that feels distant, and deadlines that are not always clarified. The situation becomes even more confusing for taxpayers when each jurisdiction uses a different layout and terminology, which complicates annual comparisons.

According to National Mortgage News, 5.1% of homeowners in the United States reported property tax delinquency in 2024, compared with 4.5% the year before. This post explains why these notices change and offers a step-by-step guide on how to read and understand your property tax bill.

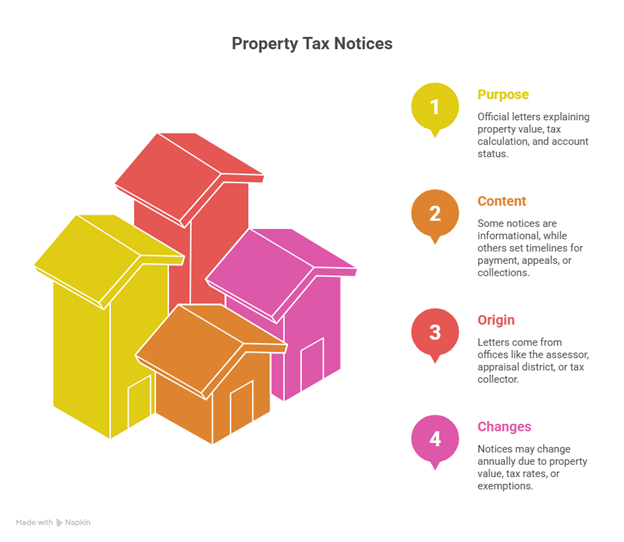

What Are Property Tax Notices?

Property tax notices are official letters used to explain the value assigned to a property, how the tax is calculated, and the current status of the account. Some are informational, while others set timelines for payment, appeals, or actions related to collections.

These letters come from offices such as the assessor, the appraisal district, or the tax collector. Each one represents a different stage in the property tax process and may change yearly due to updates in the property’s assessed value, local tax rates, or applicable property tax exemptions.

👉 Learn how property tax debt can affect buying a home and what to expect before you move forward.

How To Read A Property Tax Notice Step By Step

Many property tax notices look similar, but each one can mean something different. Taking a closer look helps you avoid common mistakes, like confusing an informational letter with a bill, thinking your property’s value hasn’t changed, or missing the deadline to dispute a charge.

A close reading also supports the homeowner’s rights, including asking for a review, challenging a valuation, or checking for record errors. This guide walks through each section to ensure you catch every detail that may affect the final amount:

What Should You Check First In The Header And The Dates?

The header brings together the information that confirms if the document belongs to the right property and what action is expected. These points need attention before moving to the rest of the notice:

- Owner name: confirms the notice is linked to the correct person.

- Account number or parcel ID: identifies the tax record assigned to the property.

- Property address: verifies that the document matches the right location.

- Notice date: marks when the period to respond or challenge begins.

- Deadline to act: usually shown at the top or the side and indicates the last day to file a protest, pay, or request a review.

Example

- Owner: Ana Rodríguez

- Account Number / Parcel ID: 2187-450-992

- Property Address: 7425 Lakewood Ridge Dr., Austin, TX 78723

- Notice Date: April 12, 2026

- Deadline to File Protest: May 15, 2026

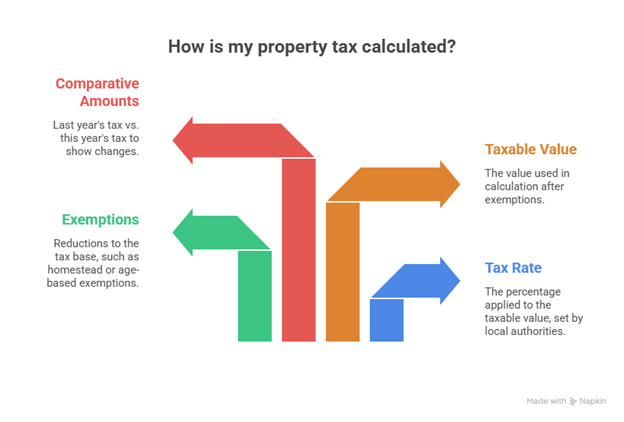

How To Interpret Market Value, Assessed Value, And Taxable Value In The Notice

Many property tax notices include three figures that have different purposes:

- Market value: the estimated worth of the property according to the local authority.

- Assessed value: the tax base calculated from the market value, adjusted under local rules.

- Taxable value: the amount used to determine the final tax once approved exemptions have been applied.

Example

If a property is listed at 300,000 dollars and the jurisdiction applies a 90% rate to define the assessed value, the tax base would reach 270,000 dollars. With a homestead exemption of 25,000 dollars, the taxable value would be adjusted to 245,000 dollars.

What Do The Rates, Exemptions, And Final Amounts Tell You?

This section of the property tax notice shows how the final tax is calculated and which elements influence the number shown in the letter. Key points include:

- Tax rate (millage rate): the percentage applied to the taxable value. Each city, school district, or local office sets its own rate.

- Exemptions: these reduce the tax base. Common examples include homestead, age-based exemptions, disability, or veteran status. If an exemption is removed in error or no longer applies, the tax may increase.

- Taxable value: the figure used in the calculation once exemptions have been deducted.

- Comparative amounts: some notices display last year’s tax alongside the updated number to show how the total changed.

Example

- Rate: 2.1%

- Taxable value: 245,000 dollars

- Annual tax: 5,145 dollars

👉 Check why people miss property tax payments to get a clearer view of the risks before they grow.

How To Interpret A Property Tax Notice Without Missing Details

When property tax notices arrive during tense financial moments, it’s common to feel like your budget is already under pressure. These notices affect important personal decisions, especially when the amounts change from one year to the next.

That’s often when a familiar question comes up: Is your home an asset or a liability? In times of uncertainty or delay, knowing how to read your notice can make a big difference. At IowaTaxCare, we offer advice to help you review risks, understand your real options, and decide what actions are worth taking.

Frequently Asked Questions (FAQ) About Property Tax Notices

Is A Property Tax Notice The Same As A Tax Bill?

No. Some notices only share the assigned value or a proposed rate, while the property tax bill requests payment. Even when a notice states “this is not a bill,” it may trigger deadlines for appeals, reviews, or updates. Ignoring it can cause common pitfalls, such as losing the right to challenge a valuation.

What Should I Do If I Believe My Property Tax Assessment Is Too High?

Start by checking that the property details listed are correct.

Then consider these actions:

- Ask for a breakdown of how the value was calculated.

- Collect recent comparable sales.

- File a protest within the timeframe set by your county.

- Seek guidance if the case involves complex discrepancies or if property-owner rights may have been affected.

What Happens If I Never Receive A Property Tax Notice In The Mail?

The tax obligation remains active even if the notice doesn’t arrive.

To avoid unexpected issues:

- Visit the local valuation and tax portals.

- Update mailing and email information.

- Review digital account statements to confirm whether any amount is pending.