Being in a redemption period brings steady tension: notices keep arriving, charges add up, and new doubts appear about what rights remain as the owner. According to the Mortgage Bankers Association, 0.20% of mortgage loans entered foreclosure during the third quarter of 2025.

Overall delinquency reached nearly 4%, a sign of how many households are under financial strain. This post explains how the statutory right of redemption works, how to protect your rights, and what those rights include, so you know what to expect from the right of redemption.

👉Check what you risk when a notice of delinquency is ignored and how this warning can affect your home.

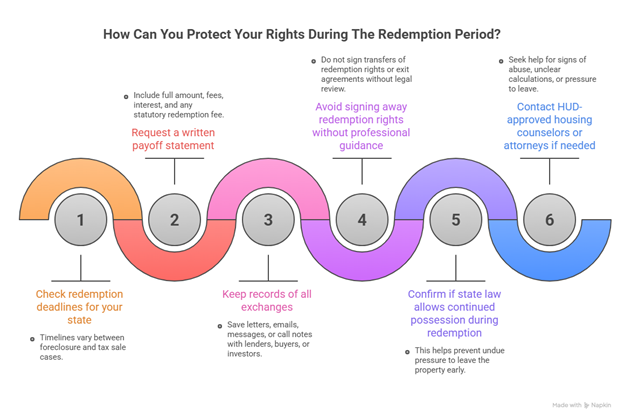

How Can You Protect Your Rights During The Redemption Period?

Protecting these rights during a redemption period calls for a clear sequence of actions: checking deadlines, keeping lawful possession when state rules allow it, asking for written information, and keeping a record of every exchange.

It also helps to avoid signing away the right of redemption without professional guidance. The steps below offer a simple path to stay organized and lower exposure to risk:

- Review the redemption time that applies in your state, since timelines vary between foreclosure and tax sale cases.

- Request a written payoff statement with the full amount, fees, interest, and any redemption fee statutory that applies.

- Keep copies of letters, emails, messages, or call notes involving lenders, buyers, or investors.

- Avoid signing transfers of all right of redemption or any exit agreement without legal review.

- Confirm whether state law allows continued possession during the redemption period, which helps prevent undue pressure.

- Contact HUD-approved housing counselors or attorneys if there are signs of abuse, unclear calculations, or pressure to leave the property early.

👉Check the property tax glossary for homeowners to understand the terms that shape your balance, your notices, and the next steps you face.

What Rights Does A Person Have During The Redemption Period?

During a redemption period, some rights are active, and many homeowners are unaware of them. This window gives you one last chance to act, check outstanding amounts, buy time, or even reclaim the property, depending on the rules in your state.

Here, each right is explained with context and examples:

1. Right To Recover The Property By Paying The Full Debt

The redemption period allows you to pay the full debt tied to the foreclosure. This amount usually includes the loan balance, accrued interest, court costs, and charges permitted under state law.

- Context: this right may apply before or after the sale, depending on the state.

- Example: even if the home has already been sold at auction, state law may give the owner a set time to recover it by paying the required amount.

2. State-Recognized Legal Right Of Redemption

In some states, this right is known as the statutory right of redemption. It does not come from the mortgage contract but from state law.

- Context: this post-sale right varies across the country, and each state sets its own timeframe.

- Example: in Michigan, the window may last up to six months, giving homeowners extra room to stabilize their financial situation.

3. Right To Know The Exact Amount Required To Redeem

During the redemption period, the homeowner may ask for a complete breakdown of what is needed to exercise the right of redemption.

- Context: the amount must list each item separately, including interest and any redemption fee allowed under state rules.

- Example: if a lender includes fees that do not apply, the homeowner can request an adjustment before making the payment.

4. Right To Remain In The Property During The Legal Window

In states that recognize all right of redemption after the sale, the homeowner may stay in the property until the window closes.

- Context: this right is not available everywhere, and when it is, it offers extra time to review legal options.

- Example: a family may continue living in the home while exploring possible solutions before the deadline arrives.

5. Right To Challenge Mistakes In Amounts, Dates, Or Notices

The redemption period also gives homeowners space to check mistakes in the foreclosure process.

- Context: errors in notices or calculations may affect parts of the legal procedure.

- Example: a notice sent outside the required timeframe may allow the case to be reviewed again.

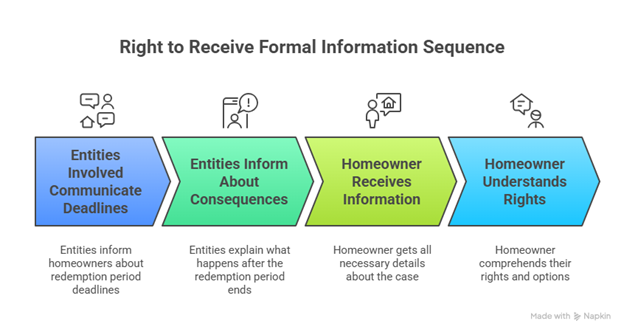

6. Right To Receive Formal Information About Timelines And Consequences

Entities involved must communicate the deadlines for the redemption period and what happens once the redemption period ends.

- Context: incomplete or confusing information may affect the homeowner’s rights, and the homeowner is entitled to receive all details related to the case.

- Example: a notice missing key dates may create uncertainty about when the legal window closes.

A Fact That Helps Put The Context In Perspective

According to Scott Langley, about half of U.S. states offer a legal redemption right that allows a homeowner to reclaim a property after a foreclosure sale. This means fewer than 50 states provide this post-sale window, and many do not include it at all.

👉Check what delinquent tax means and how it shapes penalties, deadlines, and the pressure that follows.

Learn The Rights That Still Protect You During Your Redemption Period

Seeing your redemption period with a calm, informed perspective helps you understand which steps protect your home and your financial stability. The window moves quickly, so signing agreements or handing over the property without checking which rights remain active may create setbacks that can be avoided.

During moments of pressure, steady guidance offers direction. At IowaTaxCare, we support homeowners facing unpaid balances or tax notices with resources, such as explaining why people miss property tax payments. Reaching out to housing or legal counselors helps you review your case with confidence and move forward.