When property taxes go unpaid, the window to act narrows faster than many people realize. Knowing the difference between a county payment plan and a tax lien timeline helps you understand if you still have options or if things have already moved into the legal process.

In this post, you’ll learn how a county payment plan works, what to consider before accepting a property tax payment plan, and how to read a tax lien timeline so the process doesn’t continue.

How to Compare a County Payment Plan vs. a Tax Lien Timeline?

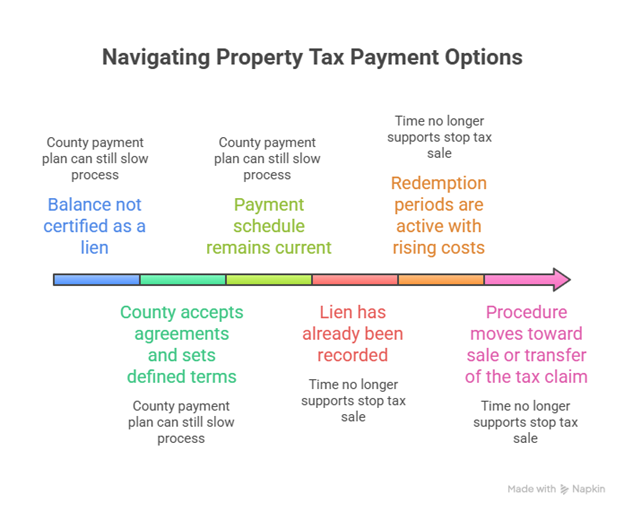

The comparison comes down to legal timing, costs that continue to build, and the possibility of losing decision space. A county payment plan focuses on bringing the balance current before stricter stages appear. A tax lien timeline moves toward formal consequences when no action takes place.

The difference between the two is about prevention versus reaction. A property tax payment plan applies when the balance still supports agreements with the county and requires consistency with dates and payments. In contrast, a tax lien timeline begins after missed deadlines, following schedules set in law with limited flexibility.

Signs You Can Still Use a Payment Plan

- The balance has not been certified as a lien.

- The county accepts agreements and sets defined terms.

- The payment schedule remains current.

Signs It’s Too Late to Stop a Tax Sale

- The lien has already been recorded.

- Redemption periods are active with rising costs.

- The procedure moves toward the sale or transfer of the tax claim.

👉 Check how property tax notices work and why timing matters when unpaid taxes start limiting your options.

How Does A County Payment Plan Work, And When Does It Make Sense?

A county payment plan divides the balance before the county moves into stricter collection stages. This approach leaves room to bring the account current while legal space still exists. The turning point depends on when the request is made and the terms the county sets.

How a Property Tax Payment Plan Works

- A direct agreement with the local tax authority.

- Monthly installments with stated interest and charges.

- Strict compliance, where a missed payment restarts notices and increases exposure to tax sale.

When It Makes Sense to Use It

- The balance has not reached lien certification.

- The agreement formally pauses steps within the procedure.

- The schedule fits the household budget, avoiding restarts that complicate stop tax sales and increase the need for delinquent property tax help.

👉 According to National Mortgage News, the property tax delinquency rate reached 5.1% in 2025, up from 4.5% in 2024. That means more homeowners are getting caught in later, harder stages of the tax collection process.

What Is A Tax Lien Timeline, And Why Do Your Options Narrow Over Time?

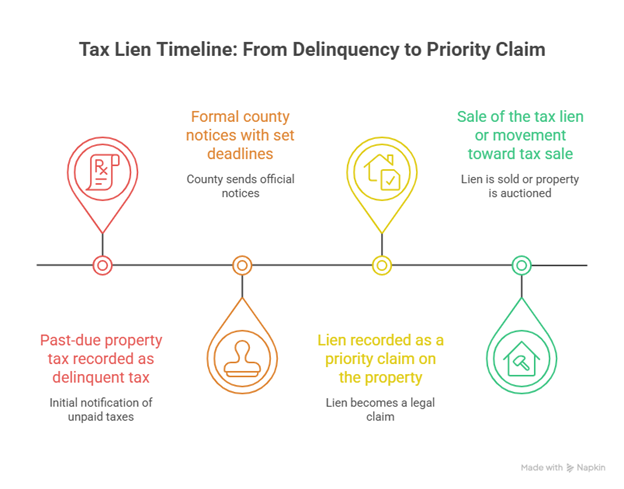

A tax lien timeline is the step-by-step process counties follow when property taxes aren’t paid on time. It starts with a missed due date and moves through official actions that get harder to reverse the longer things are left unaddressed.

Each notice adds extra fees and sets firm deadlines. As these letters keep coming, the situation moves deeper into legal territory, and chances to make a deal get fewer.

Common stages of a tax lien timeline

- Past-due property taxes are recorded as a delinquent tax.

- Formal county notices with set deadlines.

- Lien recorded as a priority claim on the property.

- The lien is sold, or the case heads toward a tax sale.

👉 According to Mortgage Orb, timing has a big impact on how this plays out. In states where liens are part of the process, 6.2% of property owners were behind on taxes in 2025, higher than the 4.9% in states that go straight to a property sale.

That gap highlights how, in some places, unpaid taxes go through more steps before any final decision is made.

Questions to Ask Before Accepting a County Payment Plan

Jumping into a plan without checking the details can make things worse instead of helping you catch up. Taking a moment before signing gives you a chance to see how the agreement fits within the overall process. This checklist helps you think it through:

- Does the agreement officially pause the lien process?

- What happens if a payment is late or missed?

- Do interest and extra charges keep adding up during the plan?

- Is the agreement recorded? Under what terms could enforcement start again?

👉 Check the property tax glossary for homeowners to understand the terms that shape your balance, your notices, and the next steps you face.

When Room Still Exists: How To Act Before The Process Limits Options

Deciding between a county payment plan and a tax lien timeline isn’t just about what feels easier now; it’s about choosing the option that still gives you room to act. A county payment plan helps you organize your unpaid balance, as long as it starts at the right time.

A tax lien timeline continues forward under defined rules that leave little space for adjustment. At IowaTaxCare, support is available for property owners dealing with unpaid balances or tax notices. Contact us now to get guidance that’s honest, direct, and focused on your situation.