Apple Pay is designed to be quick and secure, but scams still happen. A fake seller, a convincing phishing link, or even someone pretending to be a friend can trick you into sending money you didn’t mean to. And once the payment is gone, it’s not always obvious how to get it back.

In this post, you’ll learn how to get money back from Apple Pay if scammed, what steps to take right after it happens, and how to raise your chances of recovering the money through Apple, your bank, and official reports.

Need support after a scam? Join our community today.

How to Get Money Back from Apple Pay If Scammed?

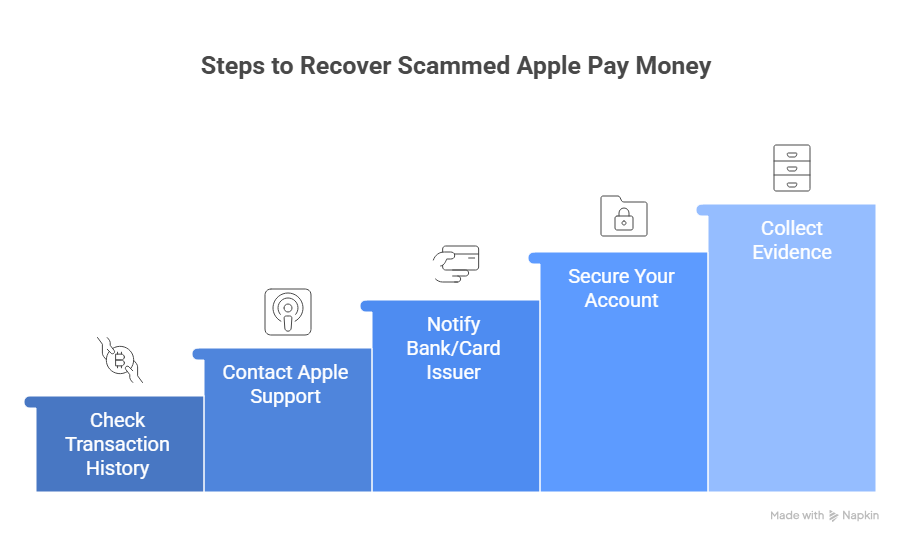

If you were scammed while using Apple Pay, the first thing to do is act quickly. As soon as you notice a suspicious or unauthorized charge, report it right away. The faster you take action, the greater your chances of recovering your money:

- Check your transaction history: Open the Wallet app and confirm the payment details. Take screenshots of the charge, the recipient, and any messages connected to the scam. These will be useful later if you file a dispute.

- Contact Apple Support right away: Go to Apple’s support page or call their help line. Explain that you’ve been scammed and ask if they can cancel or refund the payment. Apple’s ability to reverse transactions is limited, but reporting quickly puts the case on record.

- Notify your bank or card issuer: Apple Pay transactions are processed through the card linked to your account. Call your bank and request a dispute or chargeback for the unauthorized payment. Banks often have stronger refund policies than Apple.

- Secure your account: If you shared login details or clicked on a phishing link, change your Apple ID password and enable two-factor authentication immediately. This helps prevent further fraud.

- Collect all evidence: Save emails, text messages, or marketplace conversations with the scammer. The more proof you have, the stronger your case when you dispute the payment.

👉 At this point, the goal isn’t just to ask for your money back. It’s to create a trail of evidence and alerts with Apple and your bank, so every possible channel is open for recovery.

How to Request a Refund Through Apple Pay?

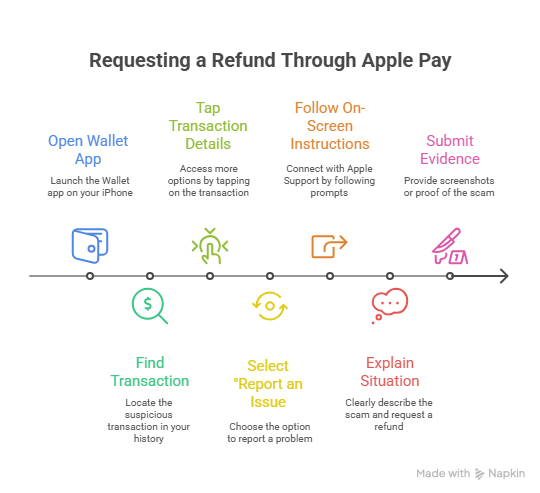

Before turning to your bank or the authorities, it makes sense to start with Apple itself. Apple Pay has a built-in process for disputing transactions, and while refunds are not guaranteed, creating an official record of the scam is an important first step.

If you notice a suspicious charge or realize that you got scammed on Apple Pay, your first move should be to file a dispute directly with Apple.

- Open the Wallet app on your iPhone.

- Find the transaction that looks suspicious or fraudulent.

- Tap on the transaction details to see more options.

- Select “Report an Issue”.

- Follow the on-screen instructions to connect with Apple Support.

- Explain the situation clearly, tell them you got scammed on Apple Pay, and request a refund.

- Submit any evidence you have, screenshots, messages, or proof that the product/service was never delivered.

👉 This process creates an official record with Apple and starts your refund request. Even if Apple cannot reverse the payment immediately, this step is needed to move forward with your bank or other authorities.

Have questions about dealing with scams? Contact us for support.

What to Expect When Contacting Apple Support?

It’s important to know that Apple Pay is not a bank. Apple acts as a payment processor, and in many cases, they cannot reverse payments once completed. Still, contacting Apple is necessary because:

- It creates an official record of the scam.

- Apple can sometimes stop a payment if reported very quickly.

- In rare cases, they may issue a refund if the transaction qualifies as unauthorized.

Be ready for the possibility that Apple may initially deny your request. Many users report that their first attempt was rejected, but persistence and evidence can help.

How to Get Money Back from Your Bank?

Apple Pay transactions are always linked to a debit or credit card. This means your bank or card issuer can often provide stronger protection than Apple itself. If Apple Support cannot refund your money, the next step is to contact your bank directly.

Why Banks Offer Stronger Protection Than Apple?

Banks and credit card companies are required to follow strict consumer protection laws. For example, credit cards usually include chargeback rights, allowing you to dispute fraudulent or unauthorized payments. Debit cards may also offer fraud protection, though the rules can vary depending on the bank.

Steps to File a Chargeback or Dispute

- Call your bank immediately. Explain that you got scammed on Apple Pay and request to dispute the charge.

- Provide documentation. Send screenshots of the Apple Pay transaction, messages with the scammer, or any proof that shows you didn’t receive what you paid for.

- Follow their instructions. Banks may ask you to fill out a dispute form online or in person.

- Keep records. Save every email or letter from the bank so you can follow up if needed.

Why Reporting Apple Pay Scams to Authorities?

If you got scammed on Apple Pay, filing reports with official authorities can strengthen your case. While Apple and your bank are the first places to contact, law enforcement and consumer protection agencies can provide extra weight to your claim and may even help prevent the scammer from targeting others.

When to Contact the Police or Consumer Protection Agencies

- Local police: If the scammer is identifiable, for example, through marketplace conversations or phone numbers, filing a police report adds credibility to your dispute. Some banks require a police report before approving a chargeback.

- Consumer protection agencies: In the U.S., you can report Apple Pay scams to the Federal Trade Commission (FTC) and the Internet Crime Complaint Center (IC3). In other countries, look for your national consumer authority.

- Apple’s fraud team: Submitting your evidence directly to Apple helps them track scam trends and block bad actors.

How Official Reports Help Strengthen Refund Claims

- Banks and Apple often take disputes more seriously when backed by an official police or regulatory report.

- Filing fraud reports shows that you acted responsibly and quickly.

- If your bank denies the refund at first, attaching a case number from the authorities can raise your chances on appeal.

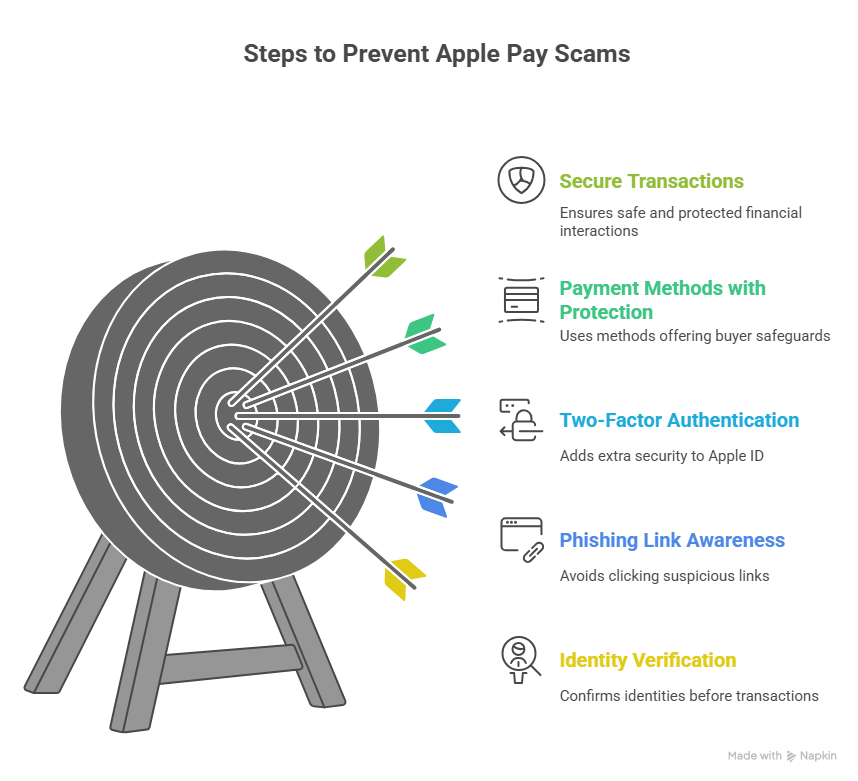

How Can You Prevent Future Apple Pay Scams?

Even if you manage to get your money back, prevention is the safest strategy. Here are practical ways to reduce your risk of falling victim again:

- Verify sellers before paying: Avoid sending money through Apple Pay to people you don’t know personally. Scammers frequently pose as sellers on social media or marketplace platforms.

- Be cautious with urgent requests: If someone claims to be a friend or relative asking for money, confirm their identity through another channel before sending anything.

- Watch out for phishing links: Don’t click on links in texts or emails that look suspicious, even if they appear to be from Apple. Always log in directly through the official Apple website or app.

- Use two-factor authentication: Add an extra layer of protection to your Apple ID to prevent unauthorized access.

- Prefer payment methods with buyer protection: For high-value purchases, consider using PayPal or a credit card that offers stronger buyer protection than Apple Pay.

Report Apple Pay Scams Fast with Cryptoscam Defense Network

Apple Pay doesn’t guarantee buyer protection, but you’re not powerless. Acting fast, documenting every detail, and pushing both Apple and your bank gives you the best chance of a refund. Treat scams as a reminder: stay cautious, question unusual requests, and choose payment methods with stronger protection for risky transactions.

At Cryptoscam Defense Network, our mission is to make the digital world safer by providing fraud detection techniques, scam awareness resources, and prevention strategies. We don’t recover funds, but we give you the knowledge and tools to recognize scams early and protect your digital assets before it’s too late.

✅ Download our free toolkit to easily collect, organize, and report scam cases, with dropdowns for scam types, payment methods, platforms, and direct links to agencies like the FTC, FBI IC3, CFPB, BBB, and more.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Frequently Asked Questions (FAQs) About How to Get Money Back from Apple Pay

Does Apple Pay Protect Against Scams?

The short answer is no: Apple Pay does not always protect you against scams. While the system is secure against technical threats like card skimming, it cannot prevent you from being tricked into sending money.

Can You Get Scammed on Apple Pay?

Yes. Apple Pay itself is secure, but scammers target people, not the technology. Common examples include:

- Fake online sellers asking for Apple Pay as payment and disappearing after receiving money.

- Phishing emails or texts that look like they’re from Apple, asking you to confirm payment details.

- Impersonation scams, where someone pretends to be a friend or relative in urgent need of money.

Does Apple Pay Protect the Buyer?

No. Apple Pay does not provide strong buyer protection. If you authorized the payment, Apple may classify it as valid even if it was part of a scam. In these cases, your bank or card issuer usually offers better protection through chargebacks.

- Apple may not refund if you willingly sent money to a scammer.

- Your bank or card issuer usually provides better protection through chargebacks.

- Apple will only step in if the transaction was clearly unauthorized (e.g., someone hacked your account).

Photos via Freepik.