Receiving a notice of delinquency rarely arrives at a calm time. Many people leave the letter unopened while managing a limited income. According to data from Cotality, the property tax delinquency rate in the U.S. reached 5.1% in 2025, a trend that has gradually increased in recent years.

This post walks through what this notice represents, how it connects with property tax notices, and which details deserve attention to keep the situation from moving forward with little room to respond.

What Is A Notice Of Delinquency?

A notice of delinquency is a formally written notice confirming that a tax debt is still pending, continues automatically if no response is recorded. When this notice is issued, the case has already passed earlier steps.

Before this point, property tax notices and unpaid property tax letters were sent to flag missed payments. The notice of delinquency is issued when those messages receive no response. At that stage, the tax authority records the delinquency as active, and the case enters a more serious administrative phase.

Why Should A Notice Of Delinquency Not Be Ignored?

Data from the American Housing Survey, published by the U.S. Census Bureau, shows that millions of households report delays in property tax payments at some point during the year. In many cases, these situations begin with a missed payment and continue when formal notices are received with no response.

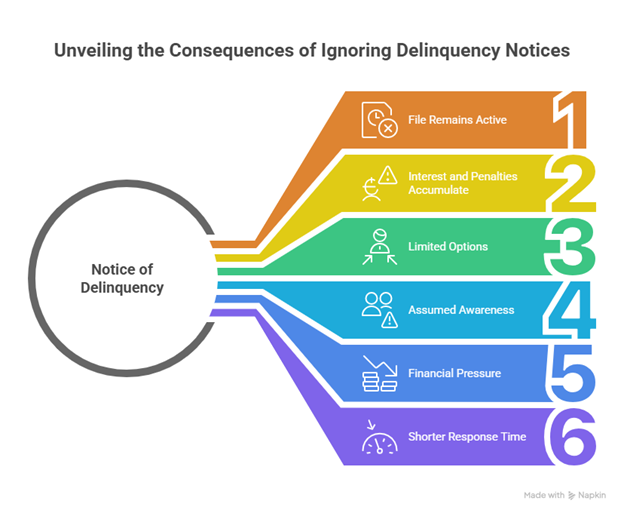

Ignoring a notice of delinquency does not pause the administrative process. Often, it continues while the owner focuses on other urgent financial matters. These are common reasons this notice requires attention:

- The file is active without a reply: Tax authorities can continue recording the debt and move forward with the next steps.

- Interest and penalties continue to add up: Charges keep accumulating once the notice is left unattended, even when the original amount appeared manageable.

- Available options become more limited: As the process moves ahead, some early alternatives are no longer offered, which narrows flexibility.

- Later notices assume prior awareness: Subsequent property tax notices often presume familiarity with the case, which can deepen confusion if the first letter was never reviewed.

- Financial pressure leads to delay: Under economic strain, these letters are frequently set aside “for later,” while the impact grows with each administrative cycle.

- Later notices arrive with less time to respond: Follow-up tax delinquency notices may arrive with shorter timelines, just as the situation becomes more complex.

Before reviewing specific details, it helps to place each notice within the overall process. Not all tax documents communicate the same message or carry the same level of urgency. The comparison below shows how a case typically develops.

Difference Between Early Notices And A Notice Of Delinquency

| Notice stage | What it communicates | What usually follows if there is no response |

| Initial notice | Reminder of a pending payment | Basic charges are applied |

| Property tax warnings | Ongoing delay notice | Interest and charges increase |

| Notice of delinquency | Formal record of an active debt | The case moves into administrative action |

| Later tax delinquency notices | Notice of upcoming measures | Fewer alternatives remain |

Why Do Many People Delay Action When Facing Property Tax Notices?

In many situations, a late response is not linked to a lack of interest. It usually reflects pressure building on several fronts at once, which pushes decisions to the background even when the notice feels serious.

Some common factors behind this behavior include:

- Too many documents arriving at the same time: Tax letters tend to show up alongside medical bills, bank statements, and other urgent paperwork. Faced with that stack, some messages stay unopened or receive only a glance.

- Uncertainty about what the notice represents: Many people hesitate because they are unsure whether a letter is final, preliminary, or sent in error. That doubt leads to waiting while trying to make sense of its status.

- Emotional strain tied to financial limits: Opening a notice means confronting amounts, deadlines, and decisions. When cash is tight, setting the letter aside can feel like a way to ease immediate stress.

- Memories of past tax experiences: Those who previously dealt with confusing or lengthy procedures often expect a similar path ahead. That expectation slows action when new property tax notices arrive.

- Lack of nearby guidance: Without someone to help interpret the notice, many people hesitate to move forward. This is common in households without regular tax support.

- Early delays that feel manageable at first: A missed step may appear minor. When unpaid property tax letters arrive later, the situation already feels heavier, making the first move harder.

👉 Check if your home is an asset or a liability to see how rising property taxes can quietly shift a paid-off home from security to strain.

Real Cases: Ignoring Tax Notices Can Lead to a Lien

In several counties in Massachusetts and New York, similar situations appear again and again. Property tax notices arrive during periods of personal pressure, and what follows is rarely sudden. It usually builds through delayed responses that move a case toward a notice of delinquency and later into a tax lien.

The cases below are drawn from records published by state and municipal authorities:

1. The Mucciaccio Family In Easton, Massachusetts

One widely referenced case involves the Mucciaccio brothers in Easton, Massachusetts, where unpaid property taxes ended in a tax lien and the loss of their home.

- What happened: The brothers had owned their home for years but faced financial pressure after medical expenses and other obligations. During that period, property tax payments stopped in 2016.

- How the situation started: The town placed a tax lien on the property, which had an assessed value of approximately USD 276,000. That lien was later sold to a private investor for about USD 4,300.

- Final result: In 2019, the investor enforced the lien and gained ownership of the property. Despite attempts to address the balance months later, the home was lost.

2. City Of Albany, New York: In Rem Tax Lien Foreclosure

In New York, similar outcomes appear through in rem tax lien foreclosure cases, which often involve residential, commercial, and vacant properties.

- What happened: In Albany County, several properties with unpaid taxes dating back to 2012 were placed on an official delinquent tax list.

- County action: After no response from registered owners, the city moved forward with an in rem foreclosure petition filed with the court.

- Later developments: After procedural steps that included filings and reinstatements, the court issued foreclosure judgments in 2022, transferring ownership to the municipality.

These documented cases reflect how tax notices left unanswered during periods of stress or uncertainty can progress quietly through administrative channels, often reaching legal stages that leave little room to respond once they arrive.

What To Do If You Have Already Received A Notice Of Delinquency

Receiving a notice of delinquency can feel overwhelming, especially during a period of financial pressure or personal stress. Still, even at this stage, there are steps available, though they tend to narrow as time passes.

Taking a calm, structured approach helps maintain perspective and reduce pressure.

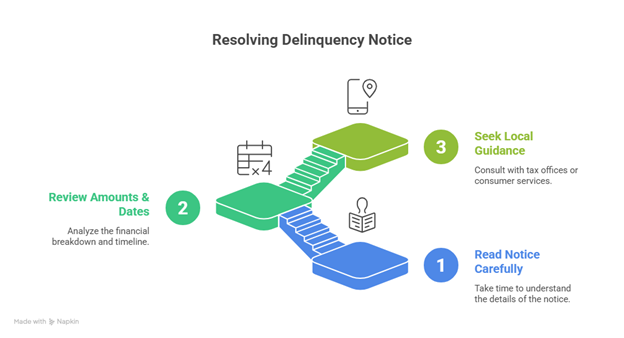

1. Read The Notice Carefully, Without Rushing

A notice of delinquency usually contains more detail than it seems at first sight. Dates, references to specific tax periods, and mentions of upcoming administrative actions often appear across different sections. Reading the document slowly helps separate the original tax amount from later additions.

- Example: A homeowner takes time to review the notice and realizes the balance relates to one tax year rather than multiple years. That realization changes how the situation feels and makes it easier to focus attention on a single period instead of an ongoing issue.

2. Review Amounts, Dates, And Added Charges

After the initial reading, looking closely at the numbers helps clarify how the balance reached its current level. In many cases, interest and administrative charges were added after earlier property tax notices, increasing the total over time. Seeing each item listed separately offers a clearer picture of what remains unresolved.

- Example: When comparing the notice with an older bill, a property owner sees that the original tax amount was manageable, while later charges account for a significant portion of the total. With that information, conversations with the tax office become more specific and grounded.

3. Reach Out For Local Guidance Before Deciding Next Steps

A notice of delinquency often creates the sense that options have already run out. In practice, local tax offices and consumer guidance services can still explain what stage the case is in and what responses remain available at that moment.

What Does This Notice Mean For Your Home And Your Next Real Steps?

When unpaid taxes start to weigh on daily decisions, the pressure comes less from the numbers and more from uncertainty. Once a notice of delinquency arrives, deadlines feel closer, notices begin to stack up, and it becomes harder to see where things stand.

At IowaTaxCare, we’re here to support homeowners who feel overwhelmed or nervous about how to move forward. If you’re not sure whether your taxes were paid or just want to understand where things stand, check if your taxes are paid to take the first step.