When a property tax notice arrives in your mailbox, it’s common to feel tension and experience a rush of repetitive thoughts about the unpaid balance. Property tax stress is more common than it looks: according to Bankrate, 47% of adults in the United States say that money hurts their mental health.

In this post, you’ll find property tax help steps to walk you through your property tax notices without panic, address the emotional weight of the process, and manage assessments that bring uncertainty. Each point is structured to support you during a moment that often feels overwhelming.

How to Get Property Tax Help When Stress Takes Over

Property tax stress often shows up when a letter from the county arrives, and your mind starts building scenes of loss, debt, or conflict. In that first moment, the goal is to resist the impulse to shut down, look clearly at what’s in front of you, and use property tax help resources that allow you to move forward in small, steady steps.

What Signs Tell You That Stress Is Taking Over Your Focus?

- You avoid opening mail related to taxes.

- You keep circling the same worries without reaching decisions.

- You find it difficult to focus on work, family, or other tasks.

- You notice tension in your body when you see amounts or deadlines.

What Early Moves Can Help You Regain A Sense Of Control?

- Open the notice with enough time, not in a rush.

- Look for three details first: total balance, due date, and the tax year it refers to.

- Write your questions on a sheet of paper or in a document: “How did they calculate this value?”, “Are there penalties?”, “Can I request a review?”.

- Set aside a moment in the day to read the letter without interruptions, with pen and paper at hand.

👉 Check the property tax glossary for homeowners to make sense of the terms that shape your balance, your notices, and the next steps you face.

What Property Tax Help Techniques Can Ease Physical And Emotional Stress?

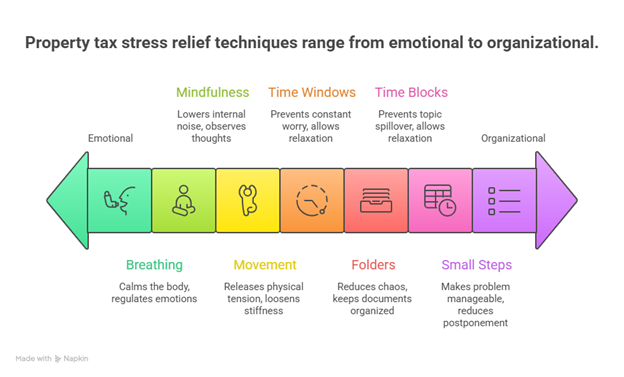

When property tax stress hits, your body can stay tense for hours. Calming techniques and small, clear steps make it easier to read notices, deal with late balances, or search for delinquent property taxes help, and what to do about unpaid property taxes.

1. Emotional Coping Strategies

The goal isn’t to shut off worry, but to stop it from taking over when you need to focus on numbers and options. Research in Frontiers in Psychology notes that slow, controlled breathing can lower the body’s stress response and support better emotional regulation.

These simple breathing and mindfulness techniques offer support any time tax issues are on your mind:

- 4–7–8 breathing: Inhale through your nose for 4 seconds, hold your breath for 7 seconds, and exhale gently through your mouth for 8 seconds. Repeat this cycle a few times before opening a letter or checking the county portal.

- Short mindfulness pauses: Sit for 5–10 minutes, focus on your breathing, and notice thoughts without getting caught in them. This can reduce mental noise.

- Physical movement to release pressure: A short walk, light stretching, or going up and down stairs can loosen tension, especially in the neck, shoulders, and jaw, places that tighten when tax worries stay on your mind all day.

- Time windows for tax tasks: Stress gets worse when tax concerns are always running in the background. Choose a set time in your day to review your situation, search for property tax help, or read about delinquent property tax help so the rest of your day can feel more open.

2. Organization to Reduce Mental Pressure

Emotional tools work better when you pair them with some structure around your documents and deadlines:

- Create folders for tax materials: Gather notices, receipts, emails, and any official communication. This cuts down the chaos when you’re reviewing your property tax help options or trying to figure out what to do about unpaid property taxes.

- Set time blocks to take action: Pick specific times during the week to go over paperwork, write down questions, or make calls. This keeps the task from spreading into every free moment.

- Break things into small steps: Instead of thinking, “I have to fix my taxes,” try breaking it down into actions like “check the due date,” “note the total amount,” or “ask about payment plans.” This makes it feel easier to handle and less tempting to avoid.

👉 Check what delinquent tax means and how it shapes penalties, deadlines, and the pressure that follows.

Review Your Case with Property Tax Help

The stress that comes with property taxes does not need to rule every decision you take. Having property tax help, keeping your documents in order, and using emotional coping tools lets you look at your situation from another angle, see your options with more confidence, and move forward without reacting from fear.

In tense moments, expert guidance gives your next step a direction. At IowaTaxCare, homeowners with past-due balances or county notices receive clear resources, such as the guide on why people miss property tax payments, so you can review your case with support and protect your home. Contact us!