When letters about past-due property taxes arrive, many homeowners already know they need property tax help, yet they keep postponing that step. Fear of owing more, embarrassment around money conversations, and property tax stress often lead to letters staying unread on the table or in a mail tray.

According to The Mortgage Point, delinquency in property taxes reached 5.1% in 2025, and fees owed were rising fast in many U.S. counties. In this post, we explain why so many people wait before asking for support, how that delay limits their options, and what changes when they reach out in time.

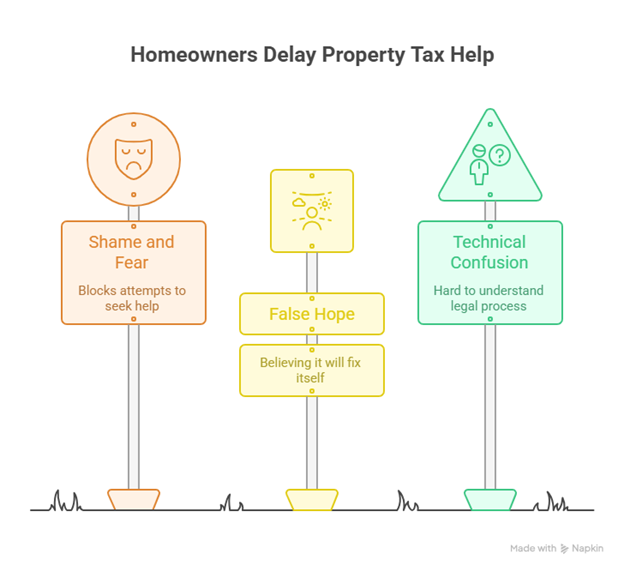

Why Homeowners Delay Seeking Property Tax Help

Many homeowners wait to seek property tax help because they feel shame, fear, confusion, and hold on to the idea that “later it will sort itself out.” That mix of emotions and doubts causes stress to grow quietly until the delinquency turns into something difficult to manage.

1. Shame, Guilt, and Fear of Being Judged

For many people, owing taxes feels like a personal failure. Thoughts such as “I’m irresponsible” or “they will think I handle money badly” appear again and again, and that blocks any attempt to talk about property tax help. This pattern usually looks like this:

- A constant sense of failure each time a past-due tax notice arrives.

- Worry that family, friends, or county staff will judge their finances.

- Avoided calls to the tax office or to professionals who offer property tax help because they expect criticism.

- Rising physical and emotional tension: trouble sleeping, recurring worry, and mental exhaustion.

2. The Hope That “It Will Fix Itself” and Ways of Avoiding the Problem

Another common reason for delaying property tax help is holding on to the idea that “next month will be different” without changing how the budget works. Letters are kept closed, the county portal goes unchecked, and property tax stress grows quietly in the background. This pattern often looks like this:

- Keeping county notices in a drawer or folder instead of sitting down to read them.

- Looking at the balance due and telling yourself, “There will be money later”, without adjusting expenses.

- Paying only a small part of the bill to feel that “something was done,” even though the real debt keeps increasing.

- Turning to fast credit options without reviewing how new payments will interact with future property tax bills.

3. Not Really Reading Letters, Interest Charges, or the Legal Process

The technical side carries a lot of weight. Letters are full of legal terms, accumulated amounts, and deadlines that rarely come with plain language explanations. Without expert guidance on property tax help, it is difficult to see which stage of delinquency someone is in. Situations like these are common:

- Letters with references to statutes, county codes, and account numbers create even more confusion.

- Notices where taxes, interest, penalties, and administrative costs are included in a single block of text.

- Technical wording that mentions tax liens, debt certifications, or auctions without explaining what came before.

- Difficulty deciding what should be paid first, on what schedule, and who should receive each payment.

👉 Check the reasons why missed tax payments often start with small gaps in monthly budgets.

What Changes When You Ask For Property Tax Help Early?

Asking for property tax help as soon as the first late notices arrive stops the growth of interest charges, opens more legal and payment options, and increases the chances of keeping the home and its equity.

The earlier you act, the more room there is to negotiate, adjust the plan, and relieve stress before the case turns overwhelming.

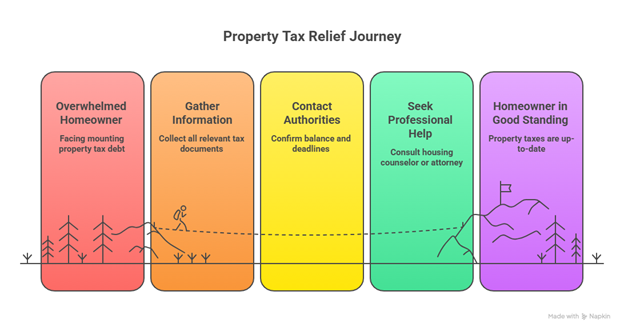

Immediate Steps: What To Do In The Next 7–30 Days

In the first weeks, the main focus is to move out of the fog and turn the problem into a concrete plan. The goal is not to solve everything in a single day, but to organize the information and use property tax help before the situation moves forward.

What should you do?

- Gather all tax letters, account statements, and previous receipts in one place.

- Call the county tax office to confirm the exact balance, interest, and upcoming deadlines.

- Schedule a call with a certified housing counselor or an attorney with experience in property tax cases.

- Ask about relief programs that match your profile (income, age, disability) and write down the basic requirements.

- Ask if there are formal payment plans and what conditions you need to meet to qualify.

According to the DC Housing Finance Agency (DCHFA), the HomeSaver program in Washington, D.C., shows the impact of seeking property tax help early: 95% of participating homeowners kept their homes 24 months after receiving support to catch up on their housing payments, including property taxes

👉 Learn where property tax notices are recorded and how each record in your file can shape your next steps with property taxes.

Take Control Now With Property Tax Help That Makes a Difference

When too much time passes before seeking property tax help, interest starts to grow, letters feel more urgent, and the risk of losing the home goes up. Each overdue bill closes doors that were available at the beginning and makes it harder to find a realistic way out.

Talking early with a trusted resource eases property tax stress and helps turn a delinquency notice into a concrete plan. At IowaTaxCare, we walk you through your options, from payment agreements to choices explained in county payment plans vs. tax liens. Contact us!

Frequently Asked Questions (FAQ) About Property Tax Help

How Long Can I Wait Before Seeking Property Tax Help?

The safest approach is to ask for property tax help from the first cycle of delinquency. Many counties move toward high interest, legal fees, and risk of tax sale within roughly 1–3 years, so each unpaid bill cuts down the room to negotiate timelines and amounts.

What Happens If I Already Have Years of Delinquency and Need Delinquent Property Taxes Help?

Even with years of debt, there are usually paths available: payment agreements, relief programs, or selling before the auction. However, as past-due balances keep adding up, the options tend to become more rigid, so it is better to seek delinquent property taxes help before the case reaches court or a tax sale.