When property tax notices are sent during periods of financial strain, it is important to know exactly where they are recorded. According to the American Housing Survey, more than 5% of homeowners reported tax delays in 2025, which explains why many owners look for reliable county records.

This post walks you through where these notices can be checked, the systems each county uses, and how to access the details that show the current status of a property.

Where Property Tax Notices Are Recorded

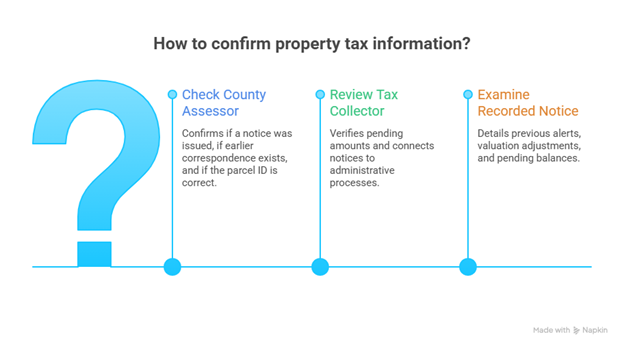

Property tax notices are stored in the systems managed by the county assessor and the tax collector, not the county recorder’s office. These databases keep the notices issued for each parcel, the amounts pending, and the periods reviewed.

They are the main reference when someone wants to confirm what the county has documented. Some information commonly reviewed in these systems includes:

- If a notice was issued during the current tax cycle.

- If earlier correspondence is linked to the parcel.

- If the parcel ID matches the correct record.

- If there are differences between what the owner received and what appears in the county system.

- If the notice is connected to a broader administrative process, such as valuation reviews or adjustments.

What a Recorded Notice Includes in These Systems

A recorded notice is reviewed when someone wants to confirm what the county kept on file about a previous alert. These systems show each step taken with the account before more formal documents appear, which helps track the process quickly.

This review can show if the notice was sent, if a valuation adjustment was entered, or if it’s related to other property tax notices from the same tax year. The information usually found includes:

- Notices were issued in earlier cycles.

- Changes in assessed value made by the assessor.

- Balances are still pending on the account.

- Added charges linked to previous amounts.

- Issue dates and internal notes that explain the sequence of actions.

These details help compare tax periods and understand if there is a link to later documents, including a tax lien recorded.

👉 Check if your home is an asset or a liability to see how rising property taxes can quietly shift a paid-off home from security to strain.

What Is a Tax Lien and Why Does It Appear as a Tax Lien Recorded?

A tax lien is a legal entry a county uses when a local tax is still unpaid after repeated notices. Unlike property tax notices, a lien places a claim on the property and becomes part of the public record. Once filed, it appears as a tax lien recorded in the county recorder’s office.

Example

Think of an owner who ignored multiple property tax notices, assuming there was still room to settle the balance. Weeks later, while checking the county portal to see the updated amount, a file labeled tax lien recorded appears.

This file confirms that the lien was entered in the county recorder’s office, and it now affects any attempt to sell or refinance the home.

How To Check Recorded Tax Lien Step by Step

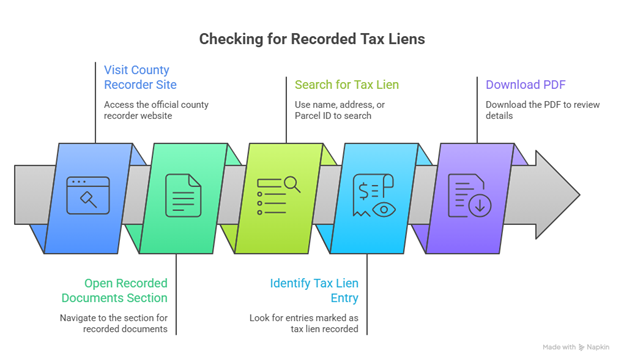

When a debt notice is sent and there is doubt about whether a tax lien already exists, the most direct way to confirm it is through the county’s official registry. Below is a simple guide to review a recorded notice through any county recorder website:

- Visit the official county recorder site.

- Open the section labeled “Recorded Documents” or its equivalent.

- Search using a name, address, or Parcel ID.

- Look for entries marked as tax lien recorded.

- Download the PDF to review dates, amounts, and status.

These steps help verify if the county has already created a record that could affect a future sale or refinancing process.

👉 Check the reasons why missed tax payments often start with small gaps in monthly budgets.

What This Record Means for Your Home and Your Next Steps Forward

When questions come up about property tax notices, the stress often comes from not knowing how far the account has progressed. Notices can build up, dates become more urgent, and it’s hard to tell if a document has already been filed.

At IowaTaxCare, our goal is to help Iowa homeowners facing tax delinquency. We work directly with those at risk of losing their homes to tax auction, offering solutions to pay overdue taxes and avoid further action whenever possible. Contact us now!

Frequently Asked Questions (FAQ) About Property Tax Notices

Are Tax Liens Public Record?

Yes. These liens appear in public databases, and anyone can check for an active lien through the county’s official pages. This helps review unresolved taxes and ongoing actions.

What Should I Do If A Notice Doesn’t Appear In The System?

Confirm that the property address and Parcel ID match the information stored in county records. When the details differ, the notice may have been sent somewhere else. The tax office can review the account and confirm if the notice was issued.

What Risk Exists If I Ignore Property Tax Notices?

If the county detects a lack of response, the next step may be a recorded notice, which can move the account toward a lien. Once filed, the entry becomes part of your public record and may limit options such as refinancing or selling.

How Do I Confirm If A Payment Was Applied To My Account?

Visit your county’s tax portal and open the section that lists prior payments. Many counties include the date, method used, and amount processed. Reviewing this area helps resolve questions when a notice does not match your records.