Living in a fully paid home no longer means financial stability when property taxes and fixed-income seniors meet. Research from the Urban Institute shows that over 30% of households led by older adults spend a good part of their income on housing costs, including property taxes.

This post explains why this tax pressure keeps coming back, how to spot early signs before things get harder, and what options are available to respond in time.

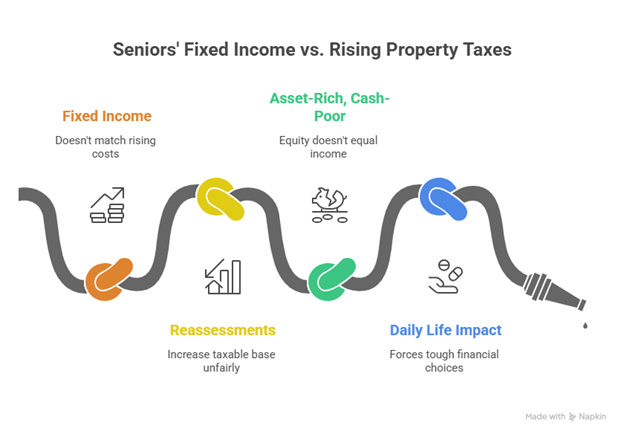

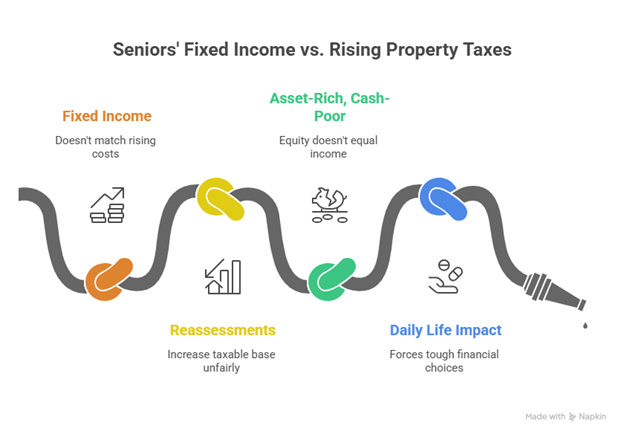

Why Are Property Taxes Becoming Harder For Seniors On Fixed Incomes?

Property taxes are based on a home’s estimated value, not on monthly cash flow. At the same time, many seniors rely on steady incomes that don’t increase as living costs rise. This difference explains why property taxes and fixed-income seniors often clash, gradually putting pressure on household budgets.

What Does Living on a Fixed Income Mean in the U.S.?

For many older adults, income comes from sources such as Social Security or pensions. This predictability helps with planning but offers little flexibility when costs rise.

- Monthly income doesn’t change with local inflation.

- It doesn’t keep pace with rising property values.

- Unexpected costs put immediate pressure on budgets.

How Do Revaluations Work, and Why Do They Raise Property Taxes?

Local governments update property estimates to reflect market conditions. In areas where home prices rise quickly, these reassessments typically translate into higher tax bills, no matter the homeowner’s personal situation.

- Reassessments increase the taxable base.

- The calculation ignores the homeowner’s age.

- Available income is not considered.

What Does Being “Asset-Rich, Cash-Poor” Look Like?

This describes homeowners whose property is valuable on paper, but who have limited cash flow.

- Home equity rises, but doesn’t produce spendable income.

- The tax bill reflects property value, not monthly cash flow.

- The room to cover essential expenses shrinks over time.

This isn’t about poor financial habits. The imbalance arises when tax rules advance faster than income.

How Does This Pressure Show Up In Daily Life?

The impact often appears before any official notice. Property taxes compete with other obligations and force tough choices.

- Less room for medications or basic services.

- Savings redirected to pay the annual tax bill.

- Continuous financial strain, even in homes without a mortgage.

Research from the Center on Budget and Policy Priorities shows that tax preferences for older adults can exceed 3% of total state budgets in nearly one-third of jurisdictions. Looking ahead, projections point to growing fiscal pressure if policies remain unchanged.

👉 Check if your home is an asset or a liability to see how rising property taxes can quietly shift a paid-off home from security to strain.

How to Recognize When Property Taxes Affect Your Finances

When property tax payments compete with health care, utilities, or food, your financial stability is at risk. This doesn’t always come with a notice. Often, it appears through small financial choices made every month.

Early Signs That Property Taxes Are Affecting Your Finances

These signs usually pop up first in the monthly cash flow, even while property taxes are still being paid on time.

- Frequent Payment Delays: What starts as an occasional delay, like postponing a bill or using a credit card, can end up being a habit. When this often happens, your budget is under strain. This shows limited financial room, not poor planning.

- Using Savings for Property Taxes: Money set aside for emergencies begins going toward property taxes. This shift means taxes no longer fit within your monthly income and are draining reserves that are hard to rebuild.

- Trade-Offs in Medical Spending: You may find yourself delaying appointments, spacing out medications, or choosing plans with less coverage. When property taxes force these choices, they impact sensitive areas of your daily life.

Administrative Signs That Property Taxes Are Affecting Your Finances

While financial signs are felt daily, administrative signals often come through official notices that need your attention:

- Notices of Increased Assessed Value: When a county raises a home’s assessed value, your taxable base goes up. Even if this change seems abstract, the effect is clear in the amount owed.

- Adjustments to Local Tax Rates: Local governments update tax rates to fund services. Small percentage changes can mean hundreds of extra dollars each year for households on fixed incomes.

- Loss of Senior Exemptions: Many senior exemptions need renewal or depend on income limits. If these benefits expire without warning, property tax bills can rise sharply and disrupt your household balance.

What Happens When Rising Property Taxes Are Ignored During Retirement?

Ignoring rising property taxes can lead to penalties, tax liens, and even foreclosure. When property taxes increase, and no action is taken, the problem continues to grow. This often happens when finances are already tight.

Tax Consequences Of Ignoring Rising Property Taxes During Retirement

The first effects show up before any legal issues arise. They appear in the amount owed and how the balance increases over time.

- Accumulated interest: Late payments trigger interest that adds to the total owed. Initially, these amounts may seem small. Over time, they grow and make it harder to catch up. Local tax offices explain this process and how interest is calculated.

- Local penalties: Many counties impose automatic fees when property taxes go unpaid past the due date. These fees are added to the principal and show up on the next bill, which may be higher than expected. This adds pressure to household finances.

Legal And Property Risks Tied To Ignoring Rising Property Taxes During Retirement

When unpaid taxes linger, the issue shifts from a tax concern to a legal one, affecting the home directly.

- Tax lien on the property: A local authority can place a lien to secure payment of unpaid taxes. While living in the home is still possible, the lien limits future options and complicates selling the property or managing finances. County governments detail this process and its effects in their public records.

- Loss of financial control: With an active lien, part of future income is tied up. Each new notice adds strain and restricts the ability to plan household expenses calmly.

- Forced sale or unplanned relocation: If the debt stays unpaid, tax foreclosure proceedings can begin. At this point, many feel pushed to sell or relocate sooner than planned, even if the home was fully paid off and meant for long-term retirement.

👉 Learn what delinquent property taxes are and how they quietly grow over time.

When Is It Worth Seeking Help Before Liens Or Penalties Appear?

Support is worth talking about once property tax payments start to create financial strain, not after a legal notice or formal balance is sent. Waiting for an official letter often limits the paths still available.

In many cases, existing assistance works best before taxes fall behind, and extra charges start to appear. Spotting that moment early helps shift the situation from reacting under pressure to adjusting with time.

Programs Available Before The Issue Deepens

There are many options to ease property tax pressure when income is fixed:

- Property tax relief for seniors: State and local programs that lower tax bills based on age and income. These typically apply before any delinquency and require a timely application.

- Senior property tax exemption: Partial exemptions tied to a home’s assessed value. In many counties, failing to renew an exemption results in an automatic increase in the following year, even when income is still the same.

- Tax deferral programs: Options that allow property taxes to be postponed until the home is sold or ownership transfers after death. These programs do not remove the obligation, though they can provide room to breathe when the monthly cash flow feels tight.

Common Mistakes When Waiting Too Long

Most difficulties do not result from mistakes; they often grow from assumptions that delay action:

- Assuming the increase will ease on its own: Many homeowners expect the next bill to work out. When housing values continue to rise, the adjustment stays in place, and unpaid amounts begin to add up.

- Skipping a review of state or county benefits: Rules change widely across states. Missing updates to relief programs or exemptions can leave available support unused and allow financial pressure to grow unnecessarily.

The Strain Does Not Come From The Home, It Comes From The Tax

Property taxes and fixed-income seniors reflect a situation many households experience quietly: tax bills rise while monthly income stays steady, and pressure builds without a formal warning. This pattern is not about personal mistakes. It reflects how the system operates when income has little room to adjust.

We offer guidance to help people approach these situations with more perspective and less stress. Property tax relief programs and local exemptions can offer a practical starting point to review available options early and make more confident decisions about the future of the home.

If rising property taxes are putting a strain on your budget, contact us to explore practical options and avoid difficult decisions later.