Many people struggle to pay their property taxes because of real changes in their financial situation, not due to neglect. An unexpected medical bill, a family member’s illness, a loss, or income that no longer covers everyday expenses often pushes tax payments lower on the priority list.

This pattern is already visible in Cuyahoga County, Ohio. According to Axios, property tax delinquency increased by more than USD 60 million after recent property revaluations, reflecting how financial pressure can lead to missed property tax payments even between homeowners who intend to stay current.

Why Do Many People Have Unpaid Property Taxes

Most property owners do not end up with unpaid property taxes due to disorganization or lack of interest. In many cases, the cause is financial strain that limits their ability to pay during sensitive moments.

These situations often stem from events that disrupt a household’s financial stability. When income becomes uncertain or unexpected expenses arise, tax payments typically take a back seat to more urgent needs. This helps explain why delays occur and why they’re typically tied to real-life challenges rather than negligence.

1. Impact of Unexpected Medical Expenses

Health-related costs are still one of the most frequent causes. A prolonged hospital stay, specialized treatments, or high-cost medications often force households to redirect funds right away. In that context, money originally reserved for taxes is commonly used to cover medical care, which leads to missed property tax payments.

Example

A common situation occurs when someone is admitted on an emergency basis, and the hospital stay extends for several weeks. Even with health insurance, copays, medications outside coverage, and transportation expenses begin to add up quickly.

The monthly budget shifts almost entirely toward those immediate needs, leaving property tax payments pending.

2. Illness Or Death Of A Family Member

A serious illness affecting a family member or a loss introduces strong financial and emotional pressure. Along with direct expenses such as medical care, caregiving, and funeral services, it is common for one household member to cut back working hours or step away from work for a period of time.

Example

A frequent scenario arises when someone needs to pause work responsibilities to care for a relative with an advanced illness. Medical expenses are joined by transportation, in-home support, and, in some cases, unexpected funeral costs.

With reduced income and new obligations, the household budget shifts toward immediate needs, and tax payments are postponed. Over time, this situation can cause back property taxes to accumulate, even when the intention was to stay current.

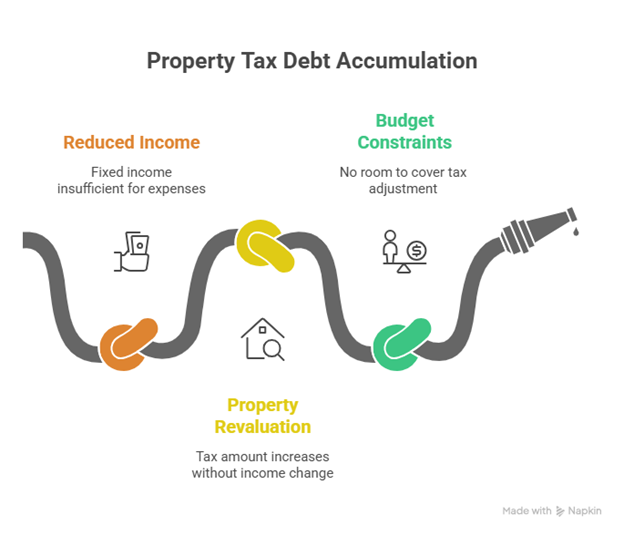

3. Reduced Income Or Insufficient Fixed Salary

Job loss, fewer working hours, or a fixed income that no longer covers rising living expenses often trigger unpaid property taxes, which then accumulate as property tax debt. Property revaluations can add pressure when the amount owed increases without any parallel change in income.

Example

A typical case involves a retired individual living on a fixed monthly income that remains stable for years while basic expenses continue to rise. After a property revaluation, the annual tax increases suddenly and exceeds what the budget can absorb.

With no room to cover that adjustment, payments fall behind, and unpaid property taxes begin to build up as property tax debt, even while other obligations remain up to date.

👉 Check property taxes and fixed income, and how rising tax bills can strain monthly budgets when income stays the same

When Are Property Taxes Considered Late?

Property tax delinquency occurs when property taxes are not paid before the established deadline, and the balance moves into a delinquent status, with additional charges beginning to apply.

When Is A Tax Considered Delinquent?

In many U.S. counties, a tax is considered delinquent once payment is not made before the annual deadline. For example, in Ramsey County, Minnesota, property taxes that remain unpaid after the due date move into delinquent status at the start of the following fiscal year.

According to Ramsey County, once this stage begins, penalties (often around 10% of the outstanding balance) apply, along with interest calculated on the remaining amount of unpaid property taxes. These charges continue to accumulate each month, making the total balance harder to manage over time.

What Happens If You Don’t Deal With Unpaid Property Taxes?

When unpaid property taxes remain unresolved over time, the situation can move toward legal actions such as tax liens, public auctions, or even the loss of the property.

In most cases, this isn’t caused by neglect. It usually follows real financial events that disrupt stability, such as medical expenses, income reduction, or unexpected home repairs.

1. Tax Liens And Legal Limits

One of the first decisions is the placement of a tax lien. This legal claim stays attached to the property until the full balance is resolved. While it is active, everyday financial decisions tied to the home become more restricted.

What Happens?

- A tax lien gives the local tax authority legal priority over other creditors.

- The presence of back property taxes often blocks the sale or refinancing of the home, since the balance must be cleared before any transaction moves forward.

- During periods of financial pressure, this limitation reduces access to cash options when flexibility is most needed.

2. Tax Sales or Public Auctions

If property tax debt continues without resolution for several years, some local governments may begin auction procedures to recover the unpaid balance.

What Happens?

- In many states, the law allows a property to be sold after multiple years of unpaid taxes.

- In California, for example, a property may enter a tax sale after five years of delinquency, although a redemption period exists before the sale becomes final.

- These cases often involve family homes where financial setbacks made it difficult to catch up in time.

3. Long-Term Financial Impact

Even when unpaid property taxes do not appear directly on a credit report, the financial impact can extend well beyond the home itself.

What Happens?

- Losing a property often leads to forced relocation and the loss of accumulated equity.

- Reduced liquidity afterward limits access to future financing and complicates housing-related plans.

- This impact tends to weigh more heavily on households with fixed or reduced income, where restoring financial balance takes longer.

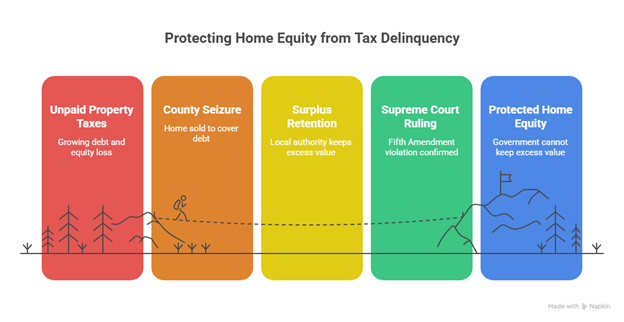

Tyler V. Hennepin County Case

The Tyler v. Hennepin County case shows how unpaid property taxes lead to consequences that fall far beyond the original amount owed, including the loss of accumulated home equity.

What Happened In The Tyler Case?

Geraldine Tyler, a 94-year-old homeowner in Minnesota, fell behind on her property tax payments after facing personal and financial difficulties. The unpaid balance was relatively small when compared with the market value of her home.

The situation developed in the following way:

- The county seized and sold her condominium to recover the property tax debt.

- After taxes, penalties, and fees were covered, the sale produced a surplus.

- The local authority kept that surplus instead of returning it to the homeowner.

The dispute reached the U.S. Supreme Court. In 2023, the Court ruled that keeping the excess value violated the Fifth Amendment of the United States Constitution. The decision clarified that government authorities cannot retain more than the amount strictly owed when collecting unpaid property taxes.

Why Does This Case Matter To Property Owners?

This ruling brought attention to a situation that affects many people dealing with property tax delinquency, usually tied to real-life hardships rather than a refusal to pay. The case offers several clear lessons:

- Tax arrears can add up quickly, even when the initial balance seems manageable.

- Enforcement actions continue without taking personal circumstances into account, such as illness or reduced income.

- Missed property tax payments can put years of accumulated equity at risk.

- Legal protections often take effect once financial damage is already present

👉Check how the 65+ property tax exemption works and why it can ease pressure when unpaid taxes start affecting household stability.

Learn How to Protect Your Home When Property Taxes Fall Behind

Unpaid property taxes usually don’t happen because someone is careless. Most of the time, they come after tough moments, such as losing income, a medical emergency, or unexpected family expenses. When missed property tax payments start to pile up, it can feel like things are getting out of control fast.

If that’s happening to you, take a breath, you’re not alone. It helps to look at the big picture and figure out what options are on the table. In IowaTaxCare, we’re here to support people who feel stuck and need real help to keep their homes. There’s a way forward — and we’re ready to walk it with you.

Frequently Asked Questions (FAQ) About Unpaid Property Taxes

What Is The Difference Between Missed Property Tax Payments And Property Tax Delinquency?

Missed property tax payments refer to individual payments that were not made on their scheduled date. Property tax delinquency appears once the delay continues and the local authority records it as a formal noncompliance.

How Long Is Available Before Losing A Property?

The timeline varies depending on the state. In California, a property may enter a tax sale process after five years of unpaid taxes, with a prior redemption period that allows the balance to be settled. In Maine, the process often moves faster, with property foreclosure tax timelines that begin much earlier.

Is It Possible To Negotiate Or Set Up A Payment Plan?

Many counties offer payment arrangements or temporary relief programs, especially when delays follow illness, income loss, or unexpected home repairs. These options usually appear before back property taxes continue to accumulate and turn into a heavier property tax debt.