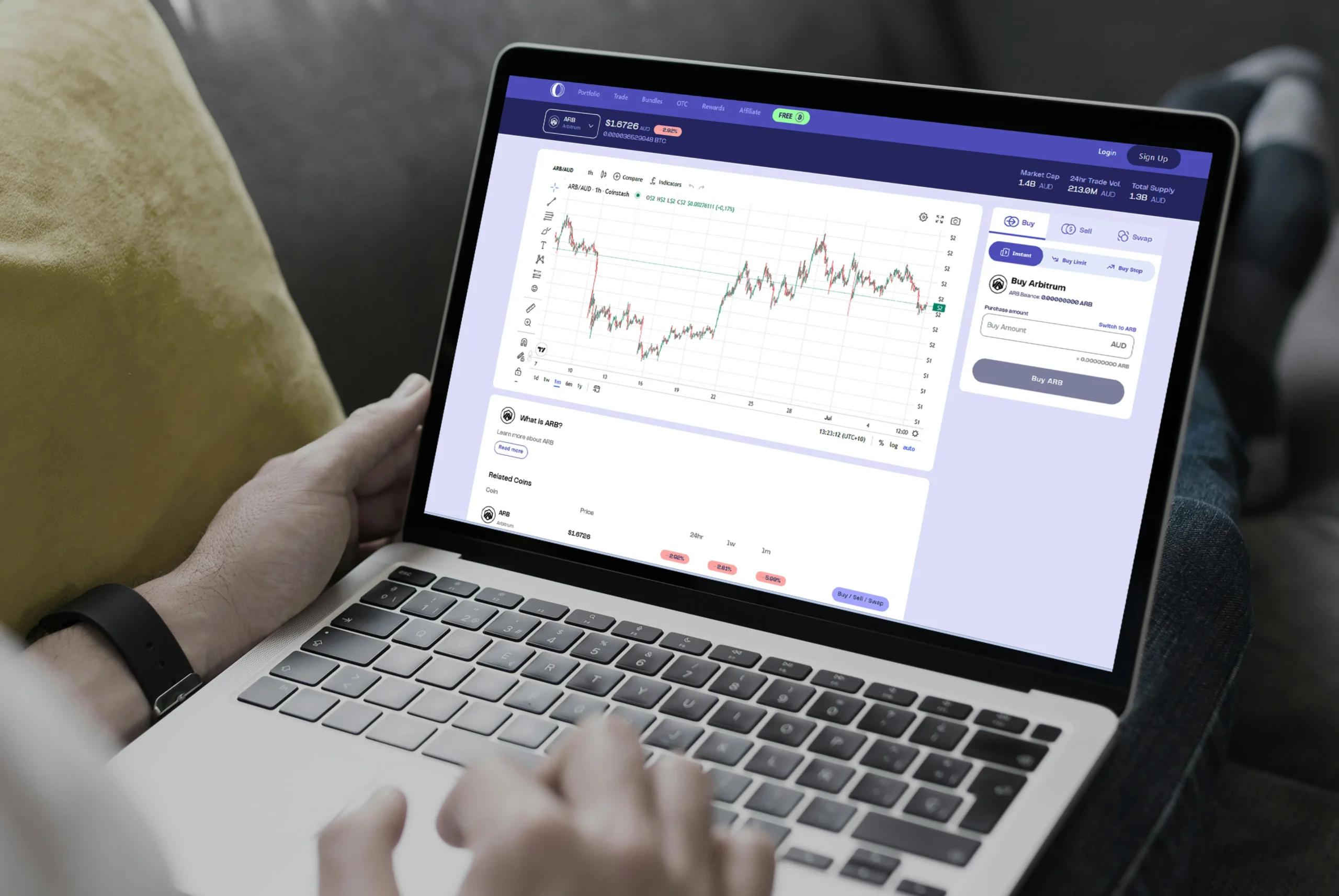

As cryptocurrency platforms or exchanges are widely used to manage financial transactions and store digital assets—which, according to Hacken, host over $40 billion in cryptocurrency—more users are drawn to these platforms. At the same time, cybercriminal threats are increasing, making security audits for exchanges essential.

This process checks that an exchange meets the highest security standards and complies with necessary regulatory frameworks. In this post, we will explore what a security audit involves, why it matters, and how it benefits both users and operators of cryptocurrency platforms.

Need support after a scam? Join our community today.

What Are Security Audits for Exchanges & How Do They Work?

Security audits for exchanges are evaluations designed to verify that the systems handling cryptocurrency transactions meet specific security standards and comply with relevant regulations. The goal of this process is to identify vulnerabilities that could be exploited to compromise the exchange or the digital assets it holds.

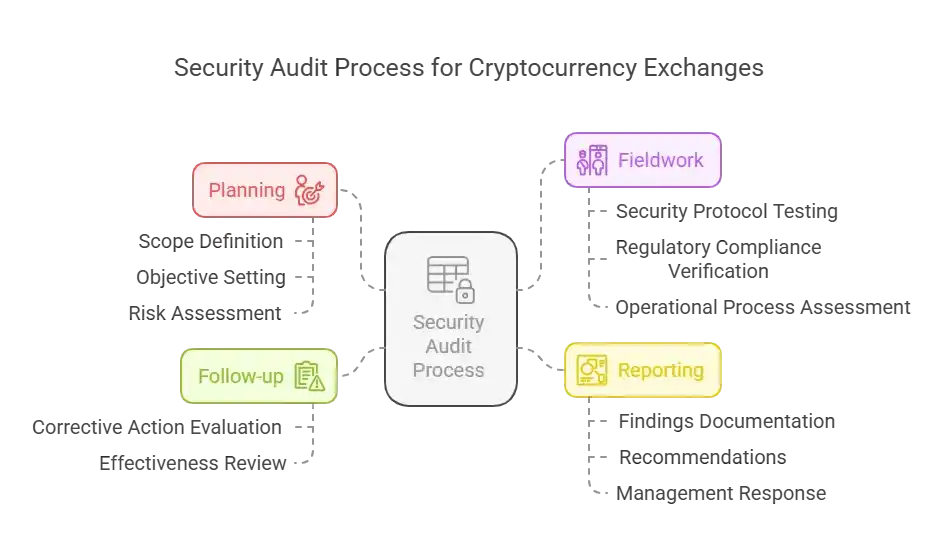

This process is divided into phases:

- Planning: During the planning stage, auditors define the scope of the audit, establish objectives, and prepare a detailed plan that outlines the audit methodology. This phase often includes a risk assessment to prioritize focus areas based on their potential impact on the organization.

- Fieldwork: Fieldwork involves a direct evaluation of security measures and controls within the exchange. This includes testing the effectiveness of security protocols, verifying compliance with regulatory standards, and analyzing the integrity of the operational processes.

- Reporting: Once the fieldwork is completed, the auditors prepare a detailed report that outlines their findings, including any vulnerabilities or non-compliance issues discovered. The report offers recommendations for addressing these issues, and it typically requires a formal response from the exchange’s management.

- Follow-up: The audit concludes with a follow-up phase, where the effectiveness of the corrective actions is reviewed to check that all concerns have been correctly solved.

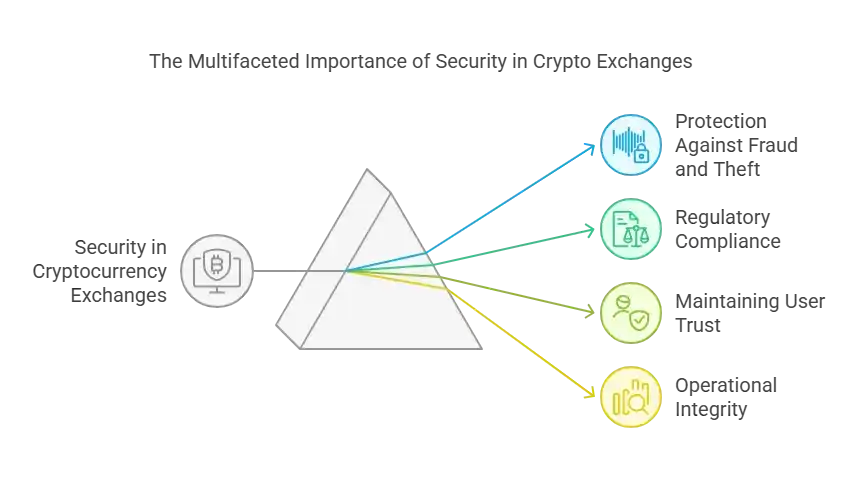

Why Are Security Audits Important in Crypto Exchanges?

As the use of cryptocurrencies becomes ever more popular, adopting stricter security measures in exchanges to protect users and maintain the integrity of the financial systems they support is important. Other reasons why this is necessary include:

1. Protection Against Fraud and Theft

Cryptocurrency exchanges handle a high volume of financial transactions and store a substantial total of digital assets, which makes them attractive targets for cybercriminals. In these cases, effective security measures are important to protect these assets from theft, hacking incidents, and other forms of cybercrime.

2. Regulatory Compliance

Many countries, such as the United States, the United Kingdom, Japan, and Germany, are increasing crypto exchange regulations to prevent money laundering and terrorism financing. Exchanges need robust security protocols to comply with these regulations and to avoid penalties or legal consequences.

3. Maintaining User Trust

Security breaches can lead to major financial losses for users and destroy trust in the platform. Maintaining high-security standards is important for retaining user confidence and making sure the sustainability of the exchange.

4. Operational Integrity

Strong security measures keep cryptocurrency exchanges operating properly, preventing costly breaches that could disrupt trading activities and weaken both the exchange’s stability and user trust.

Have questions about dealing with scams? Contact us for support.

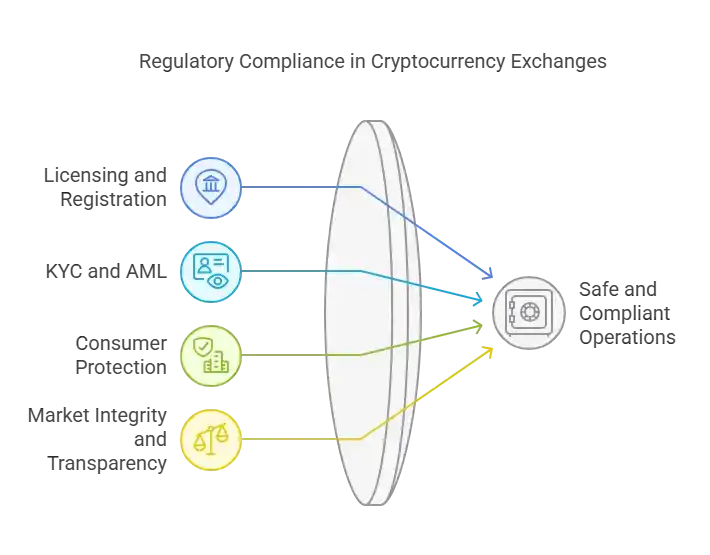

What Regulations Must Cryptocurrency Exchanges Comply With?

Cryptocurrency exchanges must adhere to various regulatory and compliance requirements to maintain the safety and integrity of their operations. These regulations are important for protecting against fraud, keeping markets stable, and following financial laws.

1. Licensing and Registration

Exchanges are often required to register with financial authorities and obtain licenses to operate legally. This includes complying with money transmission laws and obtaining the necessary approvals to handle customer funds.

- Example: In the United States, exchanges must register with the Financial Crimes Enforcement Network (FinCEN) and comply with the Bank Secrecy Act (BSA).

- Example: In the European Union, the Markets in Crypto-Assets (MiCA) Regulation establishes licensing requirements for crypto service providers.

2. Know Your Customer (KYC) and Anti-Money Laundering (AML) Procedures

Exchanges must implement KYC and AML procedures to verify the identity of their customers and monitor transactions for suspicious activities, which helps prevent money laundering and terrorism financing. These procedures align with guidelines and help maintain a transparent financial environment.

- Example: The Fifth Anti-Money Laundering Directive (5AMLD) of the EU requires cryptocurrency exchanges to conduct KYC checks on all users.

- Example: In Japan, exchanges must follow the Act on Prevention of Transfer of Criminal Proceeds, implementing strict KYC and AML policies.

3. Consumer Protection Measures

Keeping consumer funds safe and providing clear, truthful information about investment risks are top priorities. Exchanges are encouraged to implement robust security measures and transparent practices to protect users from theft and fraud.

- Example: In the UK, the Financial Conduct Authority (FCA) mandates that exchanges provide clear risk warnings and segregate customer funds.

- Example: In South Korea, the Financial Services Commission (FSC) requires exchanges to have real-name bank accounts for user deposits to prevent fraud.

4. Market Integrity and Transparency Policies

Regulations often require exchanges to offer fair market conditions free from manipulation. This includes setting and maintaining rules around trading and providing transparent pricing information.

- Example: In the United States, the Securities and Exchange Commission (SEC) investigates and penalizes exchanges involved in price manipulation.

- Example: In Singapore, the Monetary Authority of Singapore (MAS) applies transparency requirements under the Payment Services Act to prevent unfair trading practices.

What are the Benefits of Security Audits for Users and Operators of Exchanges?

Security audits bring numerous benefits to users and operators of cryptocurrency exchanges. Here’s a breakdown of how these audits can be helpful:

1. Increased Security and Trust

Security audits help to identify vulnerabilities within the exchange’s infrastructure, leading to stronger security measures. This protects against potential cyberattacks and thefts, while also building user confidence in their transactions and the storage of digital assets.

2. Regulatory Compliance

Regular security audits help exchanges confirm their compliance with recent crypto exchange regulations. This helps them avoid legal penalties, maintain a good standing with regulatory bodies, and give users confidence that the exchange follows clear guidelines to protect their interests.

3. Market Stability and Integrity

Fraud and illegal activities can destabilize the cryptocurrency market, making it riskier for investors. Security audits identify vulnerabilities that could be exploited. As a result, exchanges create a safer trading environment where justice and transparency take priority.

4. Attraction of New Users and Investment

A well-audited exchange demonstrates a strong commitment to security, making it more attractive to users and investors. When security measures are in place and regularly reviewed, potential customers feel safer choosing that platform for their transactions.

Use Regulated Exchanges and Stay Informed with CDN

Security audits for exchanges help crypto platforms prevent cyber threats. Crypto-related hacks doubled in 2024, with losses reaching $2.2 billion—a 17% increase from the previous year, according to TRM. Given these rising threats, audits must continue strengthening security and regulatory standards to keep user assets safe from fraud and breaches.

For exchange users and operators, knowing how these audits work makes a difference in avoiding risks. If you’ve been scammed or need support, Cryptoscam Defense Network is a place to share experiences and learn how to protect yourself from future threats.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future frauds.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Photos via Freepik.