Trading at an institutional level works very differently from what most people are used to. It includes bigger trades, faster decisions, and tools built specifically for professionals. That’s what institutional trading platforms do.

In this post, you’ll learn about what is institutional trading platform, what makes them different, and why they’re so important for professional traders to make smarter, faster decisions in the market. If you’re curious about how real trading happens behind the scenes, this is a great place to start.

Need support after a scam? Join our community today.

What is an Institutional Trading Platform?

An institutional trading platform is a professional tool used by big financial firms to trade quickly, safely, and at scale. Unlike regular trading platforms or apps, these platforms are built for organizations that move large amounts of money and require advanced tools to do it right.

They’re commonly used by large financial institutions that manage high trade volumes and require robust, customizable tools.

What Makes Them Different?

These platforms are built to support fast decisions, reduce risk, and give professional traders more control over how trades are placed and managed. To understand the difference, here’s a quick comparison:

Retail Platform vs. Institutional Platform

| Feature | Retail Platform | Institutional Platform |

| Order Size | Small to medium | Large, high-frequency |

| Market Access | Through brokers | Direct access to exchanges (DMA) |

| Latency | Moderate | Ultra-low latency |

| Asset Coverage | Mostly limited | Multi-asset (stocks, FX, derivatives, etc.) |

| Risk Management | Basic | Real-time, integrated |

| Customization | Very limited | Flexible and configurable |

| Strategy Support | Manual or semi-automatic | Algorithmic, automated, portfolio-wide |

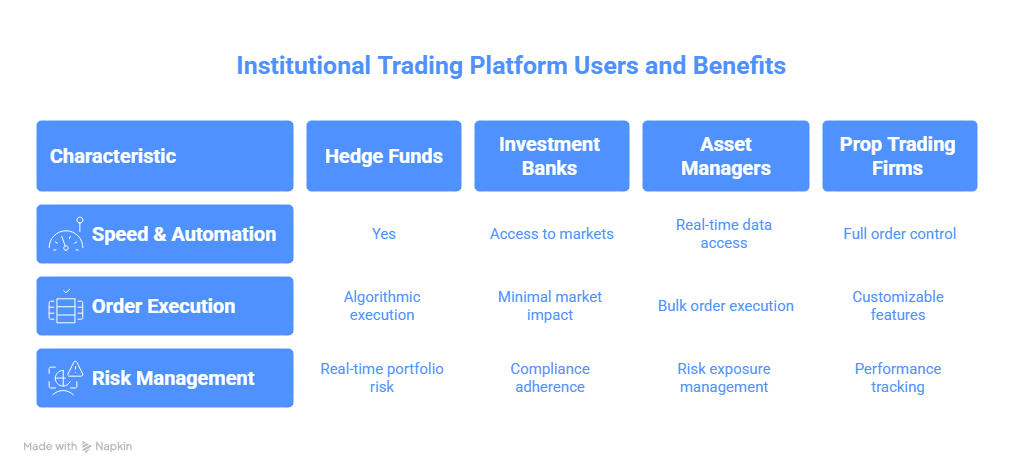

Who Uses Institutional Trading Platforms and Why?

Institutional trading platforms aren’t for everyone; they’re built for firms that need power, precision, and speed at scale. These platforms solve specific problems for different types of professional traders. Let’s look at who uses them and what they get out of them:

1. Hedge Funds

Hedge funds depend on speed, automation, and flexibility. They use institutional platforms to:

- Run high-frequency strategies with low processing time.

- Automate execution using custom algorithms.

- React instantly to news or price movements.

- Manage risk across multiple portfolios in real time.

2. Investment Banks

Banks execute trades for clients and manage their positions. They use these platforms to:

- Access multiple markets and asset classes from one system.

- Execute large orders with minimal market disruption.

- Stay compliant with strict internal controls and regulations.

- Offer advanced execution options to institutional clients.

3. Asset Managers

Asset managers need reliability and control when investing on behalf of others. They use institutional platforms to:

- Access real-time data and market depth.

- Manage risk exposure across multiple funds.

- Execute trades in bulk with order-splitting tools.

- Align trades with investment policies and benchmarks.

4. Proprietary Trading Firms

Prop traders use the firm’s capital and need to act fast. They depend on institutional platforms for:

- Full control over order routing and execution.

- Customizable features to support in-house strategies.

- Detailed performance tracking and analytics.

- Support for algorithmic and discretionary trading.

Have questions about dealing with scams? Contact us for support.

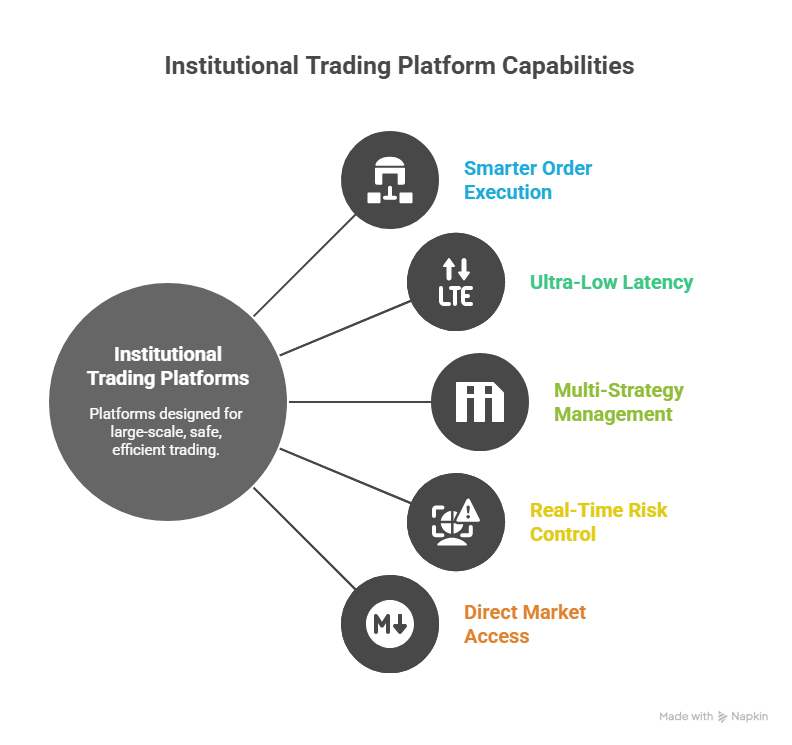

How Institutional Trading Platforms Meet Real Trading Needs?

Institutional traders require systems that solve real operational problems, minute by minute. These platforms are designed for exactly that: to make large-scale trading possible, safe, and efficient.

1. Avoiding Price Impact With Smarter Order Execution

Placing a large order in one go can move the market and work against you. Institutional platforms allow traders to break orders into smaller parts, using smart routing and execution algorithms that reduce visibility and minimize price impact.

2. Reducing Delays In Critical Strategies

In high-frequency trading, a delay of 10 milliseconds can mean losing priority in the order book. Institutional systems are optimized for ultra-low latency, allowing firms to execute at the right price before the market shifts.

3. Managing Multiple Strategies Across Assets

Firms don’t trade one instrument at a time; they run dozens of strategies in parallel, across equities, FX, options, and futures. A robust platform handles all of them from a single interface, syncing data and managing exposure in real time.

4. Real-time Risk Control While Trading

Traders can’t wait for end-of-day reports. These platforms include tools that track position limits, leverage, margin, and exposure live, so decisions are informed and compliant with both internal rules and external regulations.

5. Direct Market Access For Better Control

Routing trades through third parties adds cost and uncertainty. Institutional platforms offer Direct Market Access (DMA), allowing firms to choose where and how orders are sent, with full control over execution timing, venue, and visibility.

How Institutions Trade In Real Market Conditions?

Institutional trading includes a wide range of strategies and operations that are deeply connected to market behavior. These firms trade at a scale and level of complexity that requires precise execution, advanced tools, and strategic planning. Here are some of the most common ways institutions interact with the markets daily:

1. Forex Trading At Scale

Banks and major financial institutions dominate the currency markets. Their trades, often valued in hundreds of millions, are tied to interest rate shifts, global asset exposure, or client hedging.

- Example: A global bank might sell billions in euros to rebalance currency exposure after a central bank policy change, instantly affecting EUR/USD pricing.

2. Fixed-income Investments

Pension funds, insurance companies, and asset managers allocate significant capital to government and corporate bonds. These investments shape credit markets, influence interest rates, and set benchmarks that influence how both countries and companies access funding.

- Example: A public pension fund shifting from corporate bonds to treasuries can push down corporate bond prices and raise yields across that sector.

3. Block Trades and Discreet Execution

When institutions need to trade large volumes without triggering market reactions, they often use block trading. These orders are executed through dark pools or trusted brokers to reduce visibility. Even so, markets sometimes respond once the size and direction of the trade are detected.

- Example: A hedge fund placing a $50 million block order off-exchange might still trigger follow-on trades once the market senses unusual volume on a single asset.

4. Hedging Through Derivatives

Institutional traders don’t just seek profits; they also work to reduce risk. Derivatives like swaps, options, and futures are used to protect portfolios

- Example: A pension fund might use interest rate swaps to lock in returns on long-duration bonds, avoiding losses if rates rise.

5. High-frequency and Algorithmic Trading

Some institutions use fully automated systems to scan markets and execute trades in microseconds. These high-frequency strategies now represent a significant portion of trading volume in equities and forex.

- Example: An algorithm might detect a small price imbalance across exchanges and execute thousands of trades in milliseconds to capture arbitrage — all before a human could react.

Stay Safe from Crypto Scams with Professional Tools

Behind every major market movement, there’s usually an institution making strategic decisions. These firms depend on advanced tools to manage risk, execute trades, and stay competitive. Learning about how they operate opens up a more complete view of how financial markets really work and what factors influence them on a global scale.

At Cryptoscam Defense Network, we’ve seen how institutional platforms are built for precision and scale, but also how important it is to stay alert to fraud risks, especially in markets like crypto. That’s why we continue to provide tools, resources, and support for institutions and anyone who wants to protect themselves against digital asset scams.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Frequently Asked Questions (FAQs) About What is Institutional Trading Platform

Can an Institutional Trading Platform Fall Victim To Crypto Scams?

Yes. While most institutional trading platform have strong risk management protocols, attackers increasingly target institutional systems through compromised APIs, deepfakes, or insider threats. Proper vendor selection and ongoing threat assessment are essential.

What Vulnerabilities Can Institutional Trading Systems Face?

Even highly secure systems can be exposed to risks like third-party integration flaws, compromised credentials, or algorithm manipulation. The complexity of these platforms makes constant monitoring and regular audits essential.

Should Institutions Use Third-Party Platforms Or Build Their Own?

It depends on the firm’s size, strategy, and resources. Custom-built platforms offer full control and flexibility, but require ongoing maintenance. Third-party systems offer speed to market, proven reliability, and support — but come with integration and security considerations.

Photos via Freepik.