Do police investigate credit card theft? Yes, but the response isn’t always simple. When a card is physically stolen, it’s treated differently from credit card fraud (unauthorized use) or identity theft, where someone’s personal information is used to open accounts or commit other crimes.

In 2024, the FTC recorded over 449,000 cases of credit card fraud, a clear sign of how common the problem has become. In this post, we’ll walk you through how law enforcement deals with these cases, how to file a police report for credit card fraud, the penalties involved, and the easy steps to follow if you ever find a lost card.

Need support after a scam? Join our community today.

Do Police Investigate Credit Card Theft?

Yes, police can investigate credit card theft, but not every incident is treated with the same priority. How far an investigation goes depends on factors like the available evidence, the amount of money involved, any signs of repeated activity, and the local laws in place.

When Do Police Actually Investigate?

In many situations, departments file the report just for documentation or insurance purposes. Detectives are usually assigned only if there are clear leads, such as an identified suspect, security footage, or transactions that can be traced locally.

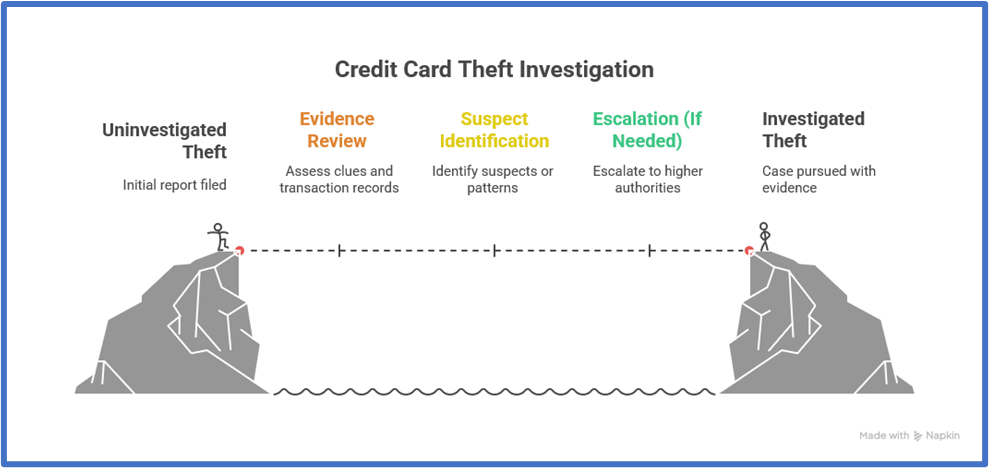

Here’s how police usually handle these reports:

- They follow up when there are suspects, witnesses, video evidence, skimming devices, or local charges made with the card.

- They log the complaint, with no further action, if it’s submitted online and lacks evidence. This is common in counties like Fairfax, Whatcom, and Miami-Dade.

- They coordinate with banks and merchants to access transaction records, which often requires an official report.

- They escalate the case to state or federal authorities when it involves organized fraud or large financial losses.

Once someone files a report, they receive a case number. However, whether it goes further depends on how strong the evidence is and how big the case appears to be.

How To File A Police Report For Credit Card Fraud?

Filing a report for credit card fraud isn’t something you should skip. A case number helps with refunds or chargebacks, supports disputes with your bank, and may allow access to merchant records related to the unauthorized charges.

If you want to know exactly how to file a police report for credit card fraud, here’s what to do:

1. Preparation

Before you file a report, it helps to organize everything tied to your case. Being prepared with specific details speeds up the process and gives your filing more credibility from the very beginning. The goal is for police, your bank, and merchants to have verifiable evidence from the first contact.

Before you go to the police, make sure to:

- Contact your bank to block the card and dispute the charges.

- Gather account statements, screenshots, receipts, and where each transaction took place.

- Keep your ID documents on hand to support your report.

Practical Preparation Example

- You spot three charges you don’t recognize. Contact your bank to request an immediate block, ask for a list of charges, and obtain a reference number for your case.

- Download your latest statement as a PDF, take screenshots of the suspicious transactions, and save any email or SMS alerts.

- Note the date, time, and location of each charge; if there were in-store purchases, write down the store’s address.

- Have your ID ready (and, if possible, proof of address) to attach to your documentation when you file the police report.

With this packet prepared, your report is processed faster, and your bank has what it needs to move the investigation forward and request merchant transaction records when needed.

Where And How To Report?

Filing the report through the proper channels creates a verifiable record and gives you the paperwork, banks and merchants usually ask for. Our recommendation is to cover two fronts: the federal filing to get the FTC Identity Theft Report, and the local police filing to get your case number.

Here are the steps we recommended:

- Federal channel (U.S.): Go to IdentityTheft.gov, complete the form, and generate your FTC Identity Theft Report with a recovery plan. Download the PDF and save your confirmation number.

- Local police: File the report in person or through your city/county portal. Request a physical or digital copy and check that it includes your case number and the date.

- State guides: Use California DOJ or USA.gov to find contacts, see if online filings are available, and confirm any required documents.

Practical Example: How And Where To Report

- You spot two charges you don’t recognize. Visit IdentityTheft.gov, choose the option for credit card fraud, complete your details, and download the FTC Identity Theft Report with the action plan.

- Next, go to your local police portal (or the station). Attach statements and screenshots, and include the FTC Identity Theft Report PDF as supporting documentation. You receive your case number and a copy of the report.

- With both documents (FTC report + case number), contact your bank by chat or phone: request a block, open the dispute, and ask them to use the case number when coordinating with the merchant.

- Store everything in one folder (FTC PDF, police report copy, statements, bank confirmations). If someone calls to verify details, you’ll have what you need ready, so the process moves forward without delays.

2. After You File

Once you file the report, your case number is the reference everyone uses: your bank, merchants, and law enforcement. Keep it close by; it speeds responses, cuts back-and-forth, and helps you plan the next steps.

Use your case number to:

- Share it with your bank or your credit card company to support disputes and block further charges. Ask for written confirmation and an internal reference number.

- Use it to request merchant records tied to the suspicious transactions (receipts, point-of-sale logs, and video when available). Include the date, time, and store name or location.

- Store it with your financial documents like statements, screenshots, and bank emails, in case anyone requests evidence later.

Practical Follow-Up Example

- Call your bank, provide the case number, and ask to block the card, issue a replacement, and open or continue the dispute. They’ll send written confirmation and a reference number.

- Contact the merchant linked to the charge. Share the case number, date, and time, and request a copy of the receipt or terminal log; if it happened in-store, ask if video is available.

- Create a folder with the police report PDF, bank confirmations, statements, and merchant replies. Set a reminder to check back in 7–10 days. If a new charge appears, report it at once and cite the same case number, so everything stays under one file.

🛡️Learn how to report fraud in different agencies and file a complaint.

Is Credit Card Fraud A Felony: Differences Between Federal And State Law

Yes, credit card fraud can be charged as a felony, though it depends on the statute that applies. The type of offense, whether it is a misdemeanor or a felony, affects priority and which authorities get involved.

We recommend keeping these quick definitions in mind to explain the terms:

- Misdemeanor: Lower-level offense; often punished with fines, probation, or up to one year in a local jail.

- Felony: A more serious offense; generally over one year in prison and potential collateral consequences, which can vary by state.

With that context, the table below compares how federal and state law handle these cases: first, the rules and monetary triggers that can turn conduct into a felony; then, who investigates at each level.

Comparative Chart — Federal Vs. State Law (U.S.)

| Aspect | Federal law | State law (examples) |

| Main statute | 18 U.S.C. §1029 (fraud involving “access devices”) and 18 U.S.C. §1028A (aggravated identity theft). Applies when cards, numbers, or related devices are used or possessed to defraud. | Varies by state. NY, TX, and VA apply different rules and monetary triggers. |

| Thresholds/criteria | §1029: obtaining value of $1,000 or more within 12 months, or possessing 15+ unauthorized devices. §1028A: adds 2 mandatory, consecutive years when identity theft occurs during the underlying offense. | New York: stealing a card = Grand Larceny in the Fourth Degree (Class E felony), regardless of amount. Texas: Credit or Debit Card Abuse = state-jail felony by default. Virginia: felony if the aggregate value is $1,000 or more within 6 months; below that, usually a misdemeanor. |

| Who investigates | Local police may open the case. Large-scale schemes can escalate to the U.S. Secret Service or the FBI. | Local or state police and state prosecutors. For higher amounts or recurring activity, they coordinate with federal agencies. |

| Impact on police response | Felony charges and recurring activity tend to draw more resources. An FTC Identity Theft Report can help request records from merchants and payment processors. | In states with monetary triggers (e.g., VA $1,000 / 6 months), lower amounts are often treated as misdemeanors, which can limit immediate resources. |

Have questions about dealing with scams? Contact us for support.

Jail Time For Credit Card Fraud By State: Mini-Reference

If you’re asking, “Do police investigate credit card theft?” the next question is typically how jail terms look across states. Penalties depend on the offense level and the venue, so here’s a concise guide you can scan:

Quick table by state (indicative jail terms)

| State | Indicative jail terms and notes |

| Texas | “State-jail felony”: 180 days–2 years in a state jail. |

| New York | Class E felony: up to 4 years in prison. |

| Virginia | < $1,000 within 6 months: Class 1 misdemeanor (up to 12 months). ≥ $1,000 within 6 months: Class 6 felony (1–5 years). |

| California | Smaller cases (≤ $950 under petty-theft rules): up to 6 months. Felony under 1170(h): 16 months, 2 or 3 years in county jail. |

| Florida | Within 6 months, ≤2 uses or < $100: first-degree misdemeanor (up to 1 year). Above that: third-degree felony (up to 5 years). |

| Illinois | ≤ $300 within 6 months: Class 4 felony (1–3 years). > $300 within 6 months: Class 3 felony (2–5 years). |

What to Do If You Find a Credit Card?

If you come across a card, act with care: do not use it and report it right away. For the cardholder, the Fair Credit Billing Act (FCBA) caps liability for unauthorized charges at $50, which is why calling the bank quickly matters.

Recommended actions

- Do not use the card: Using someone else’s card may be treated as fraud.

- Return it safely: Hand it to the business where you found it or to a nearby bank, or call the number on the back to report it as found through your bank or your credit card company.

- If it’s a wallet: take it to a police station without handling its contents.

Do Police Investigate Credit Card Theft: Request Help Now

Yes, the police can investigate credit card theft, but priority depends on the evidence and the jurisdiction. Your quick route is simple: block the card with your bank, file a report at IdentityTheft.gov (FTC), and submit a report to your local police. Then prepare statements, receipts, and screenshots to support your case.

At Cryptoscam Defense Network, we stay with you from start to finish. We help you organize evidence, prepare reports for FTC/FBI/IC3, set up bank disputes, AI crypto prediction, and report fraud cases. Need support today? Contact us and we’ll guide each step.

✅ Download our free toolkit to easily collect, organize, and report scam cases — with dropdowns for scam types, payment methods, platforms, and direct links to agencies like the FTC, FBI IC3, CFPB, BBB, and more.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.