Millions of people get suspicious text messages every day, and many wonder if they’re real or not. In 2024, the FTC logged over 378,000 reports of text fraud, and now even names like Apple Intelligence get used in phishing attempts, with scammers sending fake alerts pretending to be linked to this tool, making it harder.

With so many tactics out there, learning how to tell if a text is a scam helps you avoid losses and keep your personal information safe. In this post, we’ll go around the most common warning signs, real cases, what can happen if you reply, how to report these texts, and the best ways to stay protected.

Need support after a scam? Join our community today.

What Does It Mean When A Text Message Is A Scam?

A scam text, also called SMS smishing, is a scheme where someone pretends to be a trusted company or person to trick you. The goal is to steal passwords, capture financial details, or confirm that your phone number is active.

Learning how to tell if a text is a scam matters because these tactics keep changing and getting more convincing. To avoid mixing them up with regular spam, here’s the difference:

Scam or Smishing vs. Spam or Promotions: Comparative Table

| Type of message | Main characteristics | Risk involved | Groups most affected |

| Scam or smishing | Pretend to be banks, delivery services, relatives, or employers; often includes fake links or urgent requests. | Identity theft, malware infections, and financial loss. | Older adults, digital banking users, and employees |

| Spam or promotions | Mass texts with offers, discounts, or reminders are sent without consent. | Inbox overload, annoyance, no direct risk if ignored. | Frequent online shoppers and social media users |

The size of the problem is clear: Pew Research reports that 61% of U.S. adults receive scam texts at least once a week, and the FTC confirms that 11% of SMS scam cases lead to financial loss.

How To Tell If A Text Is A Scam?

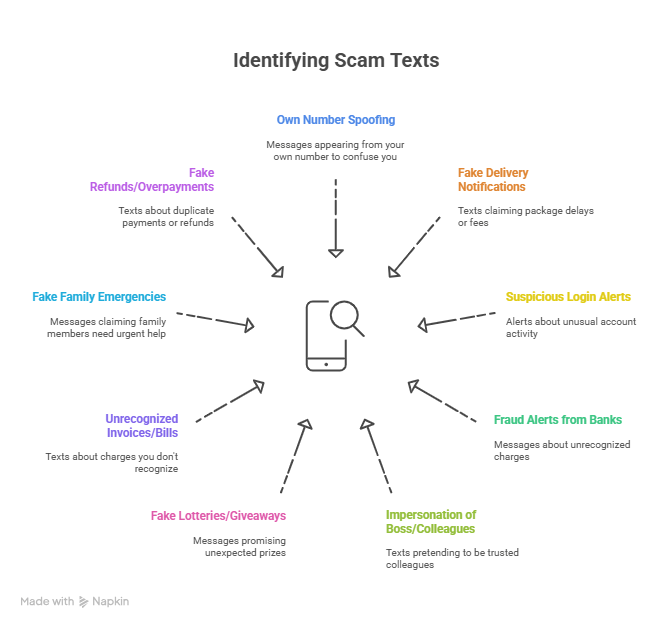

When it comes to fake texts, the warning signs of a scam often repeat. Spotting them early can keep you from falling for a scheme and help protect your personal information. Here are some of the most common cases, with real examples of how they usually look:

1. Messages That Appear To Come From Your Own Number

A growing trick is receiving a text that looks like it was sent from your own phone number. This practice, known as spoofing, is designed to confuse you. Seeing your number as the sender might make it seem like a notice from your carrier or a service you use.

- Real example: “Attention: your number needs verification. Click this link to confirm your account.”

Legitimate providers never text you from your own number. If one shows in your inbox without you sending it, the safest option is to ignore it, avoid clicking links, and block the number.

2. Fake Package Delivery Notifications

With the growth of online shopping, scammers send fake delivery texts to make you believe a package is delayed or requires a small payment. Their tactic is simple: they create urgency so you’ll click before checking.

- Real example: “Your package could not be delivered. Click here to pay a $2.99 pending fee.”

Courier companies don’t charge extra fees by text or ask for confirmation through shortened links. If you get a message like this, check directly on the courier’s official website using your tracking number.

3. Suspicious Login Alerts

These messages pretend to be security alerts, claiming that someone tried to access your account from another device or location. The idea is to scare you into clicking a link and giving away your login details.

- Real example: “Unusual activity was detected on your email account. Verify it now here: [link].”

Email and social media platforms may notify you of unusual activity, but they don’t send verification links via SMS. If you receive a text like this, go directly to the app or website to confirm if there’s a real issue.

4. Alleged Fraud Alerts From Your Bank

Scammers also pose as banks to create panic. They send texts that look like official notices about unrecognized charges or suspicious access to your account. Their goal is to push you into sharing personal or financial details through a fake link.

- Real example: “Bank XYZ: we detected an unrecognized charge. Confirm your identity using this link.”

Banks advise against sharing passwords or card details by text. If you receive a message like this, contact your bank directly through their app or the customer service number on your card.

5. Messages Claiming To Be From Your Boss Or Colleagues

One frequent scheme is when scammers impersonate trusted people at work. They send a text pretending to be your boss or a coworker, using a sense of urgency to push you into acting quickly.

- Real example: “I’m your boss, I need you to send the payment list right away. Use this link to share it.”

These texts exploit workplace leadership or professional trust to pressure you. If you ever doubt a request, confirm it with that person through a direct call or your company’s internal channels before doing anything.

6. Fake Lotteries, Raffles, And Giveaways

Getting a text that promises an unexpected prize is another warning sign. Scammers send messages claiming you won a contest or lottery you never joined. The idea is to trick you into clicking a link or paying a small fee to “claim” your prize.

- Real example: “Congratulations! You won an iPhone 15. Claim it by paying the shipping cost here.”

Learning how to tell if a text is a scam helps you recognize these traps: no legitimate contest will ever ask for private details or payments over SMS. If you receive a message about a prize you never entered for, the safest step is to ignore and delete it.

7. Invoices Or Bills You Don’t Recognize

In this scam text, scammers send messages that look like invoices or charges for services you never used. Their tactic is to create urgency so you feel pressured to act immediately.

- Real example: “Pending bill: $499 for premium service. Cancel here if you don’t recognize the charge.”

This method plays on the fear of losing money. The right move is to review your statements in your bank’s official app or on the service’s website, never through links sent by text.

8. Fake Family Emergencies

These scams appeal to your emotions. Criminals pretend to be a relative or close friend in trouble, trying to get you to act without checking first.

- Real example: “I’m your cousin. I was robbed and need money urgently. Please transfer to this account.”

It’s a pressure tactic built on fear and concern. If you receive a message like this, reach out to that person directly using another method before sending money or personal details.

9. Fake Refunds Or Overpayments

Here, scammers claim you’re owed a refund or that you made a duplicate payment. They want you to click a link to “get your money back,” when their real goal is to steal your banking data.

- Real example: “A duplicate charge was detected on your card. Click here to receive your refund.”

Legitimate companies never request financial details by SMS. If you think there’s an issue with a charge, check directly in your bank’s app or call customer service.

Have questions about dealing with scams? Contact us for support.

Patterns That Reveal a Scam Text Message

Even though the content changes, most scams share the same tactics. Recognizing them makes it easier to spot fraud, no matter how it’s disguised.

- Extreme urgency: messages designed to make you act without thinking, such as “act now or lose your account.”

- Spelling and grammar mistakes: often intentional, used to filter for people more likely to respond.

- Shortened URLs or strange domains: links that look real at first glance but lead to fake sites.

- Requests for private details: asking for passwords, card numbers, or personal data is never how real companies communicate.

🛡️Check warning signs of a Gemini scam before it’s too late, so you don’t run into traps that target your accounts.

What Happens If You Open Or Reply To A Fake Text?

Opening or replying to a scam text might feel harmless, but it can expose you to serious risks. Even one tap on an unsafe link can put your personal and financial information at risk. Here’s what can happen:

- Identity theft: scammers may steal passwords, card numbers, or other private details.

- Malware installation: the link could place malicious software on your device without you noticing.

- Financial loss: entering data on fake websites can lead to charges you never approved.

- Number confirmed as active: replying shows that your phone line is in use, which often triggers more scam attempts.

- More scam texts: once your number is validated, you’re likely to keep receiving similar fraudulent messages.

Remembering how to tell if a text is a scam helps you recognize these traps early and keep your accounts safe.

How To Report Fake Text Messages

When a suspicious SMS appears, acting quickly can reduce the chances of receiving more. There are official channels you can use to report these scam text messages and help carriers and consumer agencies block them.

- Forward the message to 7726 (SPAM), a free service available through most carriers.

- Use the “Report” option included in some messaging apps to flag the fake text directly.

- Submit a case to the FTC at ReportFraud.ftc.gov with details or screenshots.

- Block unfamiliar numbers on your device to cut down repeat attempts from the same sender.

How To Protect Yourself From Scammers And Hackers Through SMS

The safest way to deal with a scam text is to stop it before it causes trouble. Adding small habits to your daily routine online makes it harder for attackers to succeed.

- Here are a few to keep in mind:

- Avoid clicking on suspicious links, even if the sender seems familiar, as it could be a case of phishing.

- Never share sensitive data such as banking details or passwords over SMS.

- Turn on two-factor authentication for stronger account security.

- Install spam-blocking apps, which are widely available on most devices.

- Keep your operating system updated to close known security gaps.

- Always confirm through official sources, like verified websites or mobile apps, before taking action.

How to tell if a text is a scam: protect your accounts with simple steps

Knowing how to tell if a text is a scam makes it easier to spot when a message could put your security at risk. Scams like fake giveaways, false banking alerts, or fraudulent delivery notices show up every day — but catching them early can help you avoid losing money or sharing personal information.

At Cryptoscam Defense Network, we work side by side with you to face digital fraud of all kinds. We guide you through cases such as fake refunds, fake profiles, or scams on LinkedIn. Share this guide and help more people learn how to respond.

✅ Download our Fraud Report Toolkit to easily collect, organize, and report scam cases, with dropdowns for scam types, payment methods, platforms, and direct links to agencies like the FTC, FBI IC3, CFPB, BBB, and more.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.