Digital payment platforms are indispensable, but sadly, more and more are targeted by cybercriminals. PayPal, one of the world’s largest online payment systems, processes billions of transactions every year, making it a constant subject of public concern when it comes to data safety and privacy.

In this post, we’ll answer a common question users ask: Has PayPal ever had a data breach? You’ll also learn how its security has evolved over the years, what types of data have been affected, and the simple steps you can take to protect your account.

Need support after a scam? Join our community today.

Has PayPal Ever Had a Data Breach?

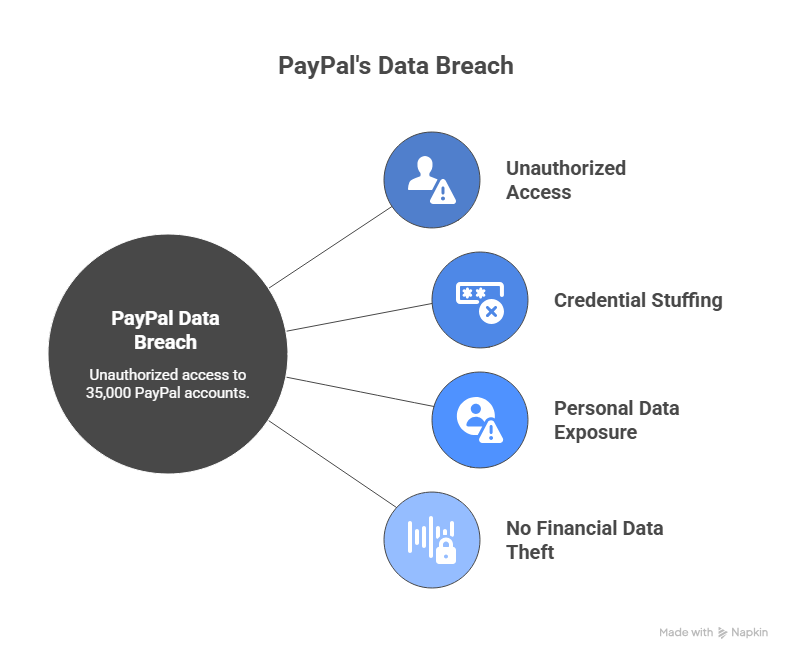

Yes, PayPal experienced a confirmed data breach when cybercriminals used stolen login credentials from other websites to access approximately 35,000 accounts. This method is known as credential stuffing, a type of cyberattack where hackers reuse leaked usernames and passwords from other platforms to gain unauthorized access to accounts.

What Happened Exactly

In an incident in December 2022, according to Forbes, around 35,000 PayPal user accounts were compromised by unauthorized access linked to credential stuffing. While no financial information was stolen, different types of personal data were exposed, including:

- Full names and postal addresses

- Dates of birth

- Social Security Numbers (SSNs) and tax identification numbers (ITINs)

How PayPal Responded

PayPal took immediate action after the incident:

- Forced password resets

- Contacted affected users directly

- Confirmed that payment systems were not compromised

- Updated its monitoring tools

- Expanded the use of two-factor authentication (2FA) to prevent future intrusions

PayPal stated that there was no evidence of unauthorized transactions or internal system compromise. Still, it offered two years of free credit monitoring and identity protection to affected users and invited everyone to enable two-factor authentication (2FA).

Regulatory impact

According to PhishingTackle, the New York State Department of Financial Services (NYDFS) fined PayPal $2 million for insufficient cybersecurity measures at the time of the breach. This regulatory pressure pushed the company to upgrade its defense systems and make two-factor authentication mandatory for U.S.-based accounts.

Check this complete list of the most common PayPal chargeback scams for more examples and prevention tips.

What Was The Real-World Impact of Exposed PayPal Data Information

Even small amounts of personal information can have serious consequences when PayPal accounts are hacked. That incident invited important questions like: has PayPal ever had a data breach, and what can users expect in terms of protection?

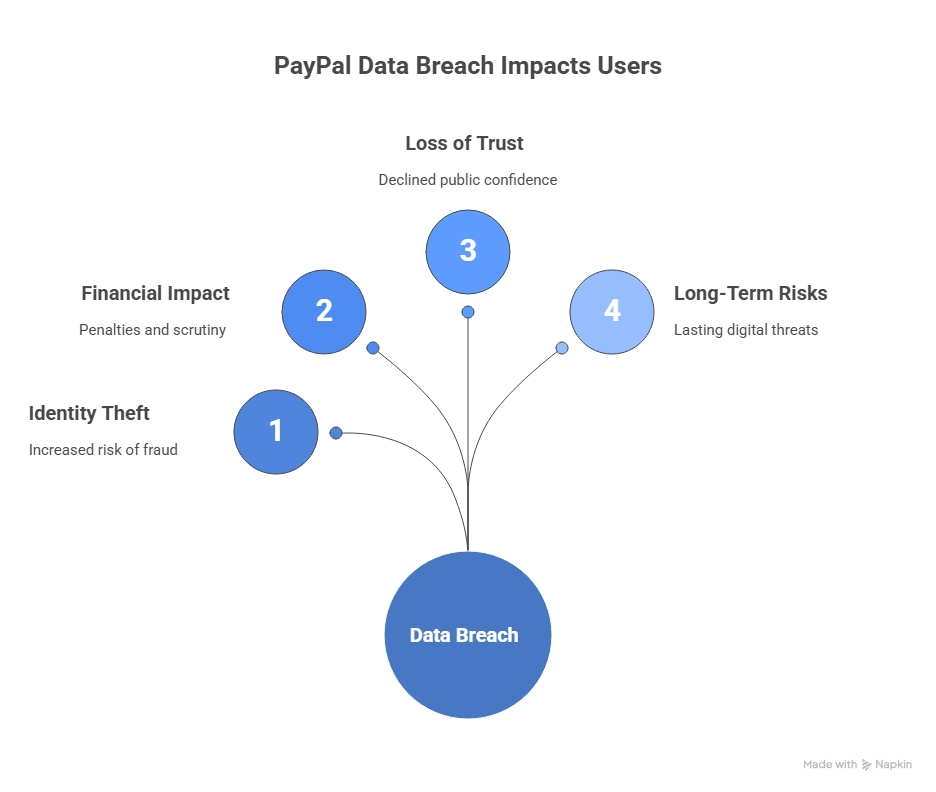

Here are the real consequences of a PayPal data breach:

- Risk of Identity Theft: The leaked information increased the risk of identity theft and fraud. Many users had to reset their passwords, enable multifactor authentication, and monitor their accounts for unusual activity.

- Financial and Regulatory Impact: PayPal faced financial penalties and closer regulatory scrutiny after the incident. These consequences pushed the company to improve its cybersecurity standards and internal controls.

- Loss of User Trust: Public confidence in PayPal’s security declined after the breach. Users became more cautious about sharing personal data and demanded stronger protections for their accounts.

- Long-Term Consequences: Even without reports of direct money theft, the exposure of personal data created lasting risks. The incident served as a reminder of how reused passwords and weak security practices can lead to serious digital threats.

Have questions about dealing with scams? Contact us for support.

How to Stay Safe When Using PayPal

PayPal is one of the most trusted payment platforms, but like any online service, it can be targeted by scammers and hackers. Since PayPal had a data breach, it is a real and valid concern to take proactive steps to protect your account. Here are key safety tips every user should follow:

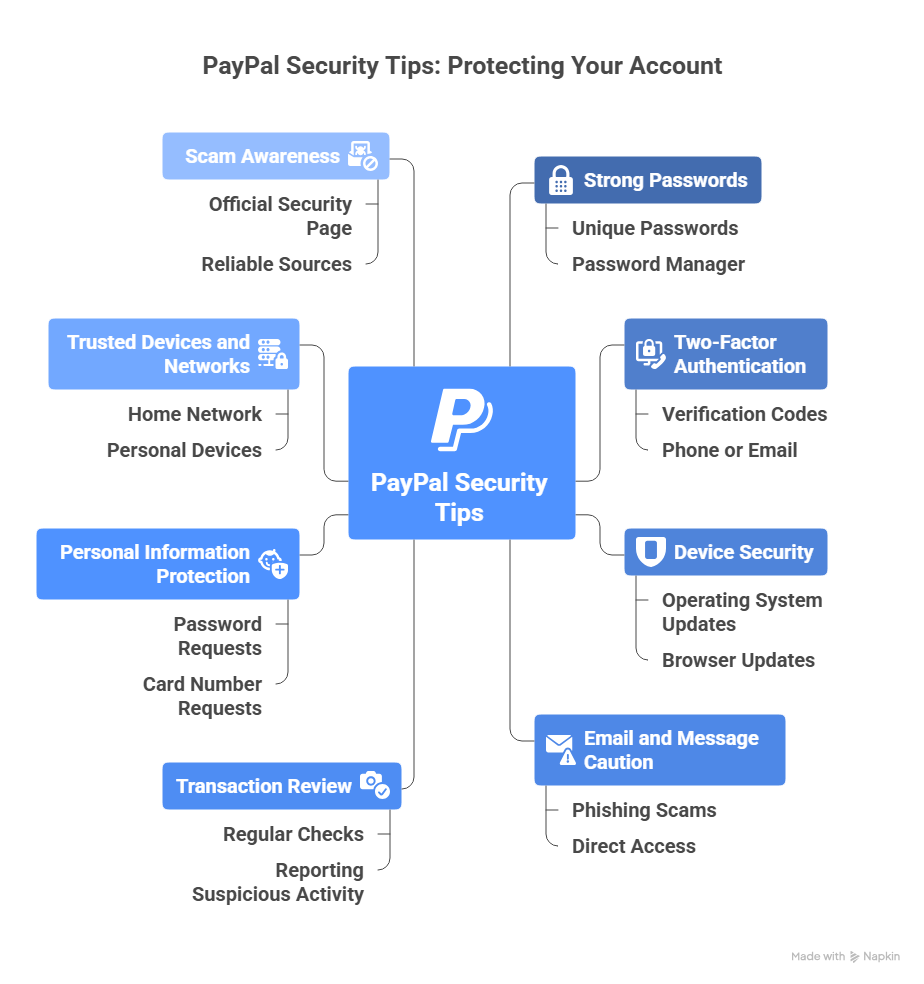

1. Use Strong, Unique Passwords

Avoid reusing passwords from other sites. Create a unique one that includes a mix of letters, numbers, and symbols. Consider using a reliable password manager to generate and store complex passwords safely.

2. Enable Two-Factor Authentication (2FA)

Activate 2FA in your PayPal settings. This extra layer of protection sends a verification code to your phone or email whenever someone tries to log in, making it much harder for hackers to access your account.

3. Keep Your Devices Secure

Always update your operating system, browser, and PayPal app. Security updates fix vulnerabilities that attackers could exploit. Avoid logging in from public Wi-Fi or shared devices.

4. Be Careful with Emails and Messages

Phishing scams often look like real PayPal notifications. Never click links or download attachments from emails claiming to be from PayPal unless you’re sure they’re legitimate. Access your account directly by typing paypal.com in your browser instead.

5. Review Transactions Regularly

Check your PayPal activity regularly to spot unauthorized payments early. If you notice something suspicious, report it immediately through the “Resolution Center” on your PayPal account.

6. Don’t Share Personal Information

PayPal will never ask for your full password, card number, or Social Security number via email or text. Fraudsters typically imitate official PayPal emails or messages to trick users into revealing personal details. These scams may look convincing, but they’re designed to steal your login credentials or financial data.

7. Use Trusted Devices and Networks

Whenever possible, make transactions only from your own devices and secure home network. Avoid accessing PayPal from internet cafés, shared computers, or unknown networks.

8. Stay Informed About Scams

Cybercriminals are always finding new ways to trick users. To stay one step ahead, check PayPal’s official security page or reliable sources like Cryptoscam Defense Network, where you can learn about the latest threats and how to protect yourself online.

News Report: Hackers Claim Massive 2025 PayPal Leak, but PayPal Says It’s Old Data

In August 2025, new reports claimed that PayPal user data was circulating on dark web forums. Hackers alleged they had leaked a dataset of 15.8 million PayPal accounts, containing email addresses and plaintext passwords.

Key Details

- Date: Data allegedly stolen in May 2025

- Scope: Around 15.8 million user records (unverified)

- Data Type: Emails, passwords, and linked URLs

- Potential Risk: Could fuel credential-stuffing or phishing attempts

PayPal’s Response

PayPal publicly denied any new breach, clarifying that the dataset was not from a recent hack. The company linked it to the 2022 credential-stuffing incident, when attackers used stolen data and passwords from other sites to access a limited number of PayPal accounts.

According to Unión Rayo, PayPal emphasized that there is no evidence of a new intrusion, and that selling old or reused credentials on the dark web is a common tactic among cybercriminals to attract attention or profit from outdated data.

Why It Matters to Users

Even though the 2025 leak was never confirmed, it shows how old information can reappear online and still create risks. This reminder underlines why every user should keep strong, unique passwords and use two-factor authentication to reduce the chance of future account attacks.

Stay Safe from a Data Breach With Cryptoscam Defense Network

While PayPal has since upgraded its defenses, the best protection still depends on your personal actions: using strong credentials, activating multifactor authentication, and staying informed about the latest online threats.

For helpful guidance on how to identify scams and protect your financial data, at Cryptoscam Defense Network, we share with you trusted resources for crypto fraud detection and online security awareness to keep your data and financials safe.

✅ Download our Fraud Report Toolkit to easily collect, organize, and report scam cases, with dropdowns for scam types, payment methods, platforms, and direct links to agencies like the FTC, FBI IC3, CFPB, BBB, and more.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Frequently Asked Questions (FAQs) About Has PayPal Ever Had a Data Breach

How Can I Know If the 2022 PayPal Breach Affected My Account?

PayPal directly contacted all users whose data was exposed. If you didn’t receive a notification email from the company in early 2023, your account was most likely not affected. Still, it’s a good idea to reset your password, enable two-factor authentication, and regularly review your account activity for extra safety.

Is My Credit Card Information Safe On PayPal?

Yes. PayPal encrypts and stores financial data securely. The 2022 breach did not expose credit card or bank account information, but users should still monitor transactions and report any unauthorized activity immediately.

Is PayPal Still Safe To Use After These Breaches?

Yes. PayPal has reinforced its cybersecurity systems, implemented stronger authentication controls, and now requires two-factor authentication (2FA) for U.S. accounts. It’s still considered one of the safest payment platforms when users follow basic security steps.

How Often Should I Change My PayPal Password?

It’s recommended to change your PayPal password every 3 to 6 months, or immediately if you suspect any suspicious login activity. Use a strong combination of uppercase, lowercase, numbers, and symbols.

Photos via Freepik.