When someone falls behind on property taxes, the worry of losing their home rises fast and creates a weight that’s hard to ignore. Moving toward how to stop property tax foreclosure starts with taking action in the next few days, before fees grow and the county schedules a sale that limits your options.

The National Tax Lien Association reports more than $22 billion in delinquent property taxes in a single year, a sign of how many families face similar pressure. In this post, we explain what happens in a what is a tax foreclosure is, how far behind in property taxes before foreclosure, and the options that can slow the process.

Need support after a scam? Join our community today.

How To Stop Property Tax Foreclosure

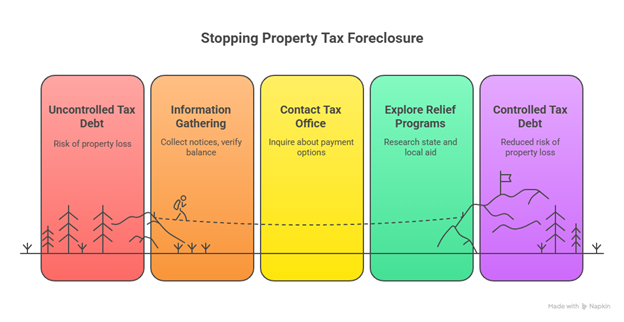

To move forward with how to stop property tax foreclosure, a homeowner needs a full picture of the balance, a sense of the deadlines in their state, contact with the tax office, and awareness of the relief programs designed for past-due accounts.

When someone already has past-due taxes, the first goal is to regain control before the county schedules a sale without warning. A simple structure helps organize the information and lowers the chance of surprises while the case moves through the system.

Immediate Checklist

- Gather every notice and letter the county has sent.

- Verify the full balance owed: taxes, interest, penalties, and legal fees.

- Check if a tax sale date or lawsuit has already been posted.

- Call the tax office and ask about their payment options.

- Explore state or local relief programs that support homeowners with past-due taxes.

- Keep everything in a digital or physical folder to move forward with structure.

This checklist gives you a starting point and prevents the case from progressing unnoticed.

Step-By-Step Plan To Stop The Process Before The Tax Sale

Once the initial information is organized, the next stage involves actions tailored to how your state handles property taxes. Each state follows its own approach, so moving in stages helps you react with calm instead of pressure, especially when you’ve already wondered what happens if you don’t pay property taxes.

- Confirm if your state uses a tax lien or tax deed system: This difference shapes the timeline and the real alternatives available to slow the process. If you’re unsure how each system works, the National Consumer Law Center (NCLC) offers guidance for homeowners and policymakers.

- Request a written, updated statement: Ask the county for a document that shows the full balance, accumulated penalties, interest, legal fees, and the date through which the amount is valid.

- Review the county’s payment plans: Ask specifically about the length of the plan, the first payment required, penalties, or interest that may continue.

- Explore state assistance programs: The Homeowner Assistance Fund (HAF) allocated USD 9.961 billion to support households with past-due housing costs, including delinquent property taxes, according to the U.S. Department of the Treasury.

- Consider a regulated property tax loan: This may help when the county does not offer flexible terms and a tax sale is close on the calendar. Before committing, confirm that the lender is authorized and compare the total cost with the county’s plan.

- Seek legal guidance when there are broader debts: If there are mortgage delays or other financial obligations, an attorney may recommend reviewing Chapter 13 to pause the process. NCLC has mentioned that early support and accessible payment structures help reduce foreclosures nationwide.

What If There’s Already A Tax Sale Date On The Calendar

When the county has already scheduled a tax sale, the window to act is shorter, though there are still paths to consider.

- Some states offer a redemption period that allows the homeowner to recover the property once the balance is paid. This applies in places such as Texas, Illinois, Georgia, Indiana, Michigan, and Minnesota, where the law gives the owner a window to settle the debt after the sale has been scheduled or completed.

- Negotiation becomes harder, though certain counties may consider arrangements when the homeowner shows intent to resolve the debt.

- At this stage, it is common to speak with a foreclosure or bankruptcy attorney to review the remaining options.

Each week matters. The goal is to prevent the process from moving ahead without a chance to respond.

👉 When handling a property tax issue, keeping your personal data secure matters. Learn how to check if my data was breached: simple steps & tools to review any sign of exposure.

States That Offer A Redemption Period After A Tax Sale

These states are among the most documented examples where a homeowner may recover a property after a tax sale. Even so, redemption rules depend on the type of sale, the county, and the homeowner’s situation. Laws may change, and some procedures apply differently across local jurisdictions.

For this reason, it helps to confirm the current deadlines with the local tax office or speak with an attorney familiar with how far behind in property taxes before foreclosure issues in your state. This ensures that any step you take reflects your specific situation and the most recent legal guidance.

States that offer a redemption period after a tax sale

| State | Redemption available? | How it works |

| Texas | Yes | Homestead and agricultural properties have a two-year redemption window. Other properties have six months. |

| Georgia | Yes | Homeowners have one year to pay the balance and keep the property after a tax deed sale. |

| South Carolina | Yes | The state uses a redeemable tax deed system that allows a set redemption window. |

| Tennessee | Yes | Uses redeemable tax deeds that give time to address the balance before the title transfers. |

| Alabama | Yes | In tax lien cases, homeowners may have up to three years to redeem the property. |

| Indiana | Yes | Some counties allow redemption based on timelines set in state law. |

| Iowa | Yes | Redemption timelines vary by county and depend on the type of property involved. |

| Oregon | Yes | Certain procedures offer redemption opportunities based on the tax sale structure. |

| South Dakota | Yes | Redemption windows depend on county rules and the type of sale. |

Have questions about dealing with scams? Contact us for support.

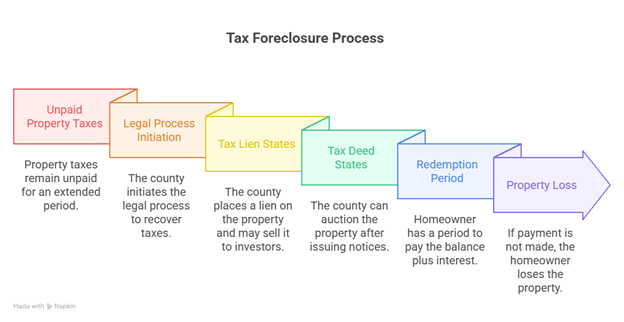

What Is a Tax Foreclosure and How Does It Work

A tax foreclosure is a legal process used when property taxes remain unpaid for an extended period. If the balance is not covered within the deadlines set in state law, the case may advance to a sale, and the homeowner can lose the title.

When someone wants to understand what a tax foreclosure is, it is normal to find terms that feel unfamiliar. In practice, counties follow a sequence created to recover taxes that have stayed overdue for months.

Tax Lien vs. Tax Deed States

The way a tax foreclosure unfolds depends on the system used in the state. Some states operate under tax lien rules, while others use tax deed procedures, and this difference often leads to completely different outcomes for homeowners with similar levels of delinquency.

- In tax lien states, the county places a lien on the property and may sell it to investors. The homeowner keeps the house during this stage, but must pay the overdue balance plus interest within the redemption period. If that payment is not made on time, the property may be lost once the period ends.

- In tax deed states, the county can auction the property after issuing the required notices. This shortens the time the owner has to resolve the balance, even when the amount owed is relatively small.

Because each system follows its own rules, it is helpful to review how the process works where the homeowner lives before making financial or legal decisions.

Stages Of A Tax Foreclosure

While terms and deadlines vary among states, most tax foreclosure cases follow a similar sequence. These are the stages most homeowners encounter:

- Initial delinquency, taxes reach their due date and remain unpaid.

- Interest, penalties, and notices are sent by the county as the balance grows.

- Publication of legal notices, tax lien sale, or announcement of a tax deed auction.

- Redemption period in many states allows the owner to pay the balance and retain the property.

- Transfer of title when the amount is not paid within the required timeframe.

👉 If you receive suspicious messages mentioning your taxes or your property, take a moment to review them before responding. Check how to report a deepfake to understand how these tactics work.

Real case: Tyler vs. Hennepin County

The Tyler v. Hennepin County case offers a clear example of why so many homeowners want to understand how to stop property tax foreclosure before things escalate.

Geraldine Tyler, a 94-year-old woman, had accumulated close to 15,000 dollars in unpaid property taxes. The county later sold her condo for 40,000 dollars and kept every dollar left after covering the debt. In 2023, the U.S. Supreme Court ruled that keeping that excess violates the Takings Clause of the Fifth Amendment.

To understand how the case unfolded, here’s the sequence:

- Debt owed: around 15,000 dollars in taxes and added charges.

- County action: the condo was sold for 40,000 dollars.

- Extra equity kept: the remaining 25,000 dollars stayed with the county.

- Supreme Court ruling: the excess belongs to the homeowner, not the government.

This case matters for anyone trying to learn what a tax foreclosure is or wondering how far behind in property taxes before foreclosure a situation can go. It highlights how fast equity can disappear if no one reviews what the state does with leftover funds.

If You’re Afraid Of Losing What You Built, Change The Direction

The Tyler v. Hennepin County case makes clear that how to stop the property tax foreclosure process involves much more than bringing the balance up to date. It requires learning how your state handles timeframes, how surplus equity is treated, and the steps a county may take when unpaid taxes remain open.

At Cryptoscam Defense Network, we share resources designed to help you plan your next moves with more calm and direction. And if you want to compare how required dates work in another context, our guide on when property taxes are due in Iowa offers a helpful breakdown of deadlines and fees.

✅ Download our Fraud Report Toolkit to easily collect, organize, and report scam cases, with dropdowns for scam types, payment methods, platforms, and direct links to agencies like the FTC, FBI, IC3, CFPB, BBB, and more.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.