When reviewing your property tax bill, it’s normal to feel confused by some terms used. Many homeowners share this concern, especially since recent data from the Tax Foundation shows that property taxes change rapidly and can reach high amounts depending on the state.

This Tax and Property Terms Glossary was created to help you understand the most common concepts found in tax valuations, notices, adjustments, and appeal procedures. These definitions will make it easier to read your tax bill and make informed decisions as a homeowner.

Property Tax Glossary for Everyday Homeowners

Here’s a simple glossary of common property tax terms you’ll likely see in your bills, letters, or tax-related paperwork. Each definition comes with a simple explanation of why it matters, so you can manage your property with confidence.

🔤 A

Ad Valorem Tax

A tax based on the value assigned to your home during the yearly inspection. This number appears on your next bill and can shift when market conditions change.

- Why it matters: It can increase or lower your bill automatically, even if no review was requested.

Annual Reassessment

A yearly review that updates your property’s taxable value based on market activity or changes in your area. Even if the property hasn’t changed, this new value will still affect your future bills.

- Why it matters: It sets the base used to calculate your property tax.

Appraisal

An estimate of your home’s current market value, prepared by a certified appraiser. It’s useful when selling, refinancing, or appealing your tax value.

- Why it matters: It helps determine if your assessed value reflects your home’s actual worth.

Assessment Notice

An official letter that shows the new taxable value assigned to your property. It comes with a deadline to appeal and gives you a chance to catch errors early. Reviewing it on time helps you compare the updated value with your home’s real condition.

- Why it matters: It’s your chance to fix issues before the bill is finalized.

🔤 B

Billing Cycle

The schedule that tells you when tax notices, bills, and reminders are sent. It helps you stay on top of your payments with notifications of when to review charges, get ready to pay, and make sure everything looks right. Each area has its own schedule, which can be confusing if you’ve recently moved.

- Why it matters: It helps you anticipate deadlines and avoid delays.

Board of Review

A local panel that looks at appeals from homeowners who believe their property’s assessed value doesn’t match its actual condition. The board reviews documents, listens to your arguments, and compares your property to similar ones. This process gives you a real chance to fix numbers that could be raising your tax bill unfairly.

- Why it matters: It gives you a way to challenge incorrect values and potentially lower your taxes.

🔤 C

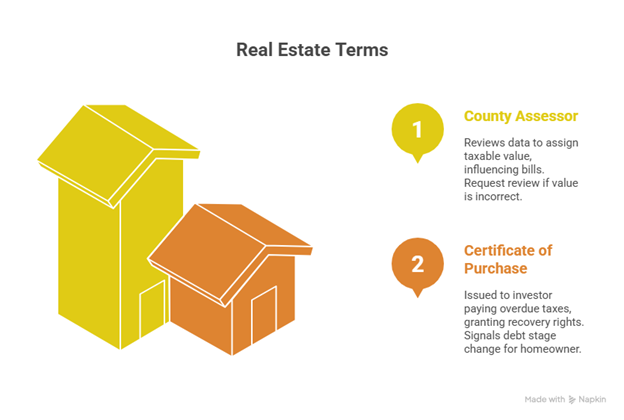

County Assessor

An official who reviews market data, property details, and trends in your neighborhood to decide the taxable value of your home. Their assessment affects every tax bill you get during the fiscal year. If the value seems off, you can ask for a formal review.

- Why it matters: Their estimate directly affects how much tax you’ll pay each year.

Certificate of Purchase

A document given to an investor who pays someone’s unpaid property taxes at a tax sale. It gives that investor the right to recover what they paid—plus interest—during a set time called the redemption period. For the homeowner, it means the tax debt has moved into a new phase.

- Why it matters: It shows that someone else now holds your tax debt and could gain more rights over time.

Have questions about dealing with scams? Contact us for support.

🔤 D

Delinquency Notice

A letter you receive when your property taxes haven’t been paid by the deadline. It lets you know your account has moved into a new phase and may now include extra charges. For many people, this is the first formal reminder that something needs to be done

- Why it matters: It warns you early, giving you a chance to act before late fees or legal actions begin.

Delinquent Taxes

Taxes that haven’t been paid on time and are now officially overdue, based on your county or state’s rules. Once you reach this stage, the local authority may start more aggressive collection efforts.

- Why it matters: Unpaid taxes can lead to automatic penalties or collection steps.

Disability Exemption

A tax break for homeowners who have a certified disability. It helps lower their yearly property tax, easing the burden for those who have ongoing medical expenses or tighter budgets. Each area has its own paperwork requirements, but the goal is the same: reduce what you owe.

- Why it matters: It gives financial relief to people facing extra challenges.

🔤 E

Escrow Account

An account managed by your lender where part of your monthly mortgage payment is set aside to cover property taxes and insurance. This way, you don’t have to worry about handling separate due dates. Many homeowners rely on it to stay on track with their yearly tax obligations.

- Why it matters: It helps you avoid falling behind on taxes by spreading out the payments.

👉Check what happens if you don’t pay property taxes to learn how missed payments can affect your home and budget.

🔤 H

Homestead Exemption

A benefit that reduces the taxable value of your primary residence. It’s designed for homeowners who meet certain residency requirements and can lead to noticeable savings, especially when property values rise quickly. Many states have their own version of this exemption.

- Why it matters: It lowers the amount of your home’s value that’s taxed, which can reduce your yearly bill.

🔤 I

Installment Plan (Payment Plan)

An agreement that allows homeowners to pay overdue property taxes in scheduled installments when a full payment isn’t possible. Interest usually applies, but the plan gives you time to handle the debt without immediate legal pressure.

- Why it matters: It pauses legal measures while you work on the balance.

🔤 L

Lien (Property Tax Lien)

A legal hold placed on your property when taxes go unpaid. It’s recorded with the county and shows up in any action related to the home. While the lien is active, it blocks things like selling, transferring, or refinancing until the full amount is paid.

- Why it matters: It limits what you can do with the property until the debt is cleared.

🔤 P

Penalty & Interest

Extra charges that are added when your property tax payment is late. These amounts grow with each billing cycle and are typically shown as percentages that increase the balance.

- Why it matters: Late fees start right away and can make your balance grow faster than expected.

Property Tax Bill

The yearly document that lists the full amount tied to your property. It includes deadlines, a breakdown of each charge, and available payment options.

- Why it matters: It tells you exactly how much you need to pay and by when.

Property Tax Relief Program

A program designed to help homeowners who qualify under certain criteria, like income level, age, disability, or financial hardship. These programs aim to reduce the yearly tax burden for eligible households.

- Why it matters: It gives you some flexibility when your financial situation is tight.

🔤 R

Redemption Period

The amount of time the law gives you to reclaim your property after a tax sale. During this period, you can pay back the overdue taxes, plus interest and any added costs, to keep your home.

- Why it matters: It gives you one last chance to keep your property before the transfer becomes permanent.

Right of Redemption

The legal right that allows you to take back ownership of your property during the redemption period. It gives you some time and protection before losing your home for good.

- Why it matters: It can stop the property from being transferred immediately to someone else.

🔤 S

Senior Exemption

A tax benefit for homeowners who meet certain age and residency requirements. It’s meant to help people on a fixed income or retirement budget manage their yearly tax expenses. Each state decides how much of your home’s value is exempt.

- Why it matters: It offers tax relief for households living on a limited monthly income.

Special Assessment

An extra charge used to fund local projects like sidewalks, lighting, or drainage improvements. It’s separate from your regular property tax and only applies for the time set by your local government.

- Why it matters: It shows up when your area is scheduled for infrastructure upgrades.

👉Check how to stop property tax foreclosure to see the steps that guide you through each stage.

🔤 T

Tax Deed

A document that transfers property ownership after a tax sale. It means the previous owner lost their rights because of unpaid taxes, and the new buyer now holds legal title.

- Why it matters: It confirms the official loss of ownership following a tax sale.

Tax Foreclosure

A process where the local government sells a property to recover unpaid taxes. Once it reaches this stage, the home is put up for auction, and the owner no longer controls what happens next.

- Why it matters: Marks the most severe consequence of prolonged nonpayment.

Tax Lien Certificate

A certificate issued to an investor who pays off unpaid property taxes for someone else. The investor earns interest until the homeowner repays the debt.

- Why it matters: Your debt is now held by someone who expects repayment with interest.

Tax Rate Hearing

A public meeting where proposed property tax rates are reviewed and discussed. Residents can give feedback, but final decisions are made by the local board.

- Why it matters: The verdict decides future tax rates on your bill.

🔤 V

Veterans Exemption

A property tax reduction available to eligible veterans or surviving spouses. Requirements vary by state, but the goal is to provide financial relief for households after military service.

- Why it matters: It honors service by reducing the yearly tax burden.

Now That You Know the Terms, What Comes Next

While the rules and procedures may change depending on the state you live in, the core concepts behind property taxes are still the same. Understanding these terms is the first step to making informed decisions and building a plan that protects your home.

Resources like Can You Buy a House If You Owe Taxes can help you connect what you owe with your next steps—without adding pressure to your finances.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.