Having a delinquent tax does not just mean you owe money; it can affect other parts of your finances as well. Many households face lower credit scores, accumulated payments, and no more lending alternatives.

This helps explain why tax issues often show up during loan reviews, and why people ask: Can you buy a house if you owe taxes? In this post, we’ll explore how tax delays can lead to financial pressure, what can happen when someone is delinquent on property taxes, and which steps can help get things back on track.

Need support after a scam? Join our community today.

What Is A Delinquent Tax?

A delinquent tax happens when a tax deadline passes, and the payment has not been made. Once that occurs, extra charges, interest, and collection steps begin to follow.

When the delay includes delinquent property taxes, the situation becomes more serious. The county may send formal notices, start a tax sale process, or even take steps toward seizing the property if no payment plan or agreement is in place.

Here is a simple example:

A homeowner who owes $3,000 in property taxes may face:

- Formal notices after roughly 60 days

- Monthly interest rates above 1%, depending on the jurisdiction

- Placement on tax sale lists after a few unpaid billing cycles

In simple terms, a delinquent tax means more than just an overdue balance. It shows that the tax authority has already started the collection process and may take further steps to recover what is owed.

What Happens When You Have a Delinquent Tax?

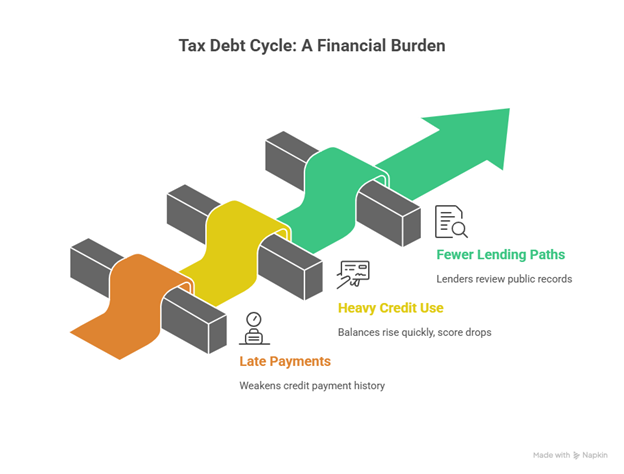

A delinquent tax adds pressure that affects how other bills are paid each month. That pressure often increases debt and reduces the ability to stay current.

Even though tax liens no longer appear in credit files, their indirect effects still influence how a loan officer reviews your application. FICO reports that 35% of a credit score depends on payment history.

These are some common effects when taxes fall behind:

1. Stressed Budget

A budget is in a stressed phase when the monthly income no longer covers all regular payments. With a delinquent tax, added interest and fees compete with expenses that were already planned.

- Example: A family that normally pays all bills at the start of the month receives a notice about interest from a past-due tax. The money they had set aside for utilities or transportation now goes to cover that tax. As a result, two other bills are paid late.

2. Late Payments on Other Accounts

Missed payments often begin when people shift money to cover overdue taxes. Since payment history is the largest portion of a credit score, even one late payment weakens the record. When someone changes their bill schedule to cover tax debt, gaps appear, and lenders notice them.

- Example: Someone who normally pays a credit card on the fifth gets an unexpected tax interest charge. To pay for that, they delay the card payment. A few days later, the delay shows up as a late payment and raises questions during their next loan application.

3. Heavy Credit Card Use

When money is tight, many people turn to credit cards to cover routine expenses, and balances rise quickly. Experian suggests keeping card usage under 30%, and scores tend to respond better when the percentage stays even lower. As the balance grows closer to the limit, the score tends to drop.

- Example: Someone who usually keeps credit use at 20 percent begins using their card for gas, groceries, and other basics after a tax bill arrives. Within weeks, usage hits 75%. Even with minimum payments, the high balance lowers their score and makes it harder to get new credit.

4. Fewer Lending Paths

A delinquent tax may not appear in a credit file, but many lenders check public records during the review. If they find unpaid taxes with no agreement in place, they might reduce the loan amount, raise interest rates, or ask for more paperwork.

- Example: A person applies for a personal loan with a good score. The lender checks public records and sees a recent tax delay without a resolution. They offer a smaller loan and ask for more documents before approving it.

👉 Check what happens if you don’t pay property taxes and how counties move when a balance stays open.

Have questions about dealing with scams? Contact us for support.

Difference Between Delinquent Tax And Tax Lien

Sometimes these terms get mixed up because they often appear in the same kind of situation, even though each one refers to a different stage in the process. A delinquent tax is the unpaid amount, while a tax lien is the legal claim recorded to secure that amount until it is resolved:

Comparison: Delinquent Tax vs. Tax Lien

| Concept | Delinquent Tax | Tax Lien |

| What is it? | Unpaid tax past its deadline. | Legal claim against a property to secure an overdue tax. |

| When does it occur? | As soon as the due date passes without payment. | When the authority records its right to collect using the property as collateral. |

| Consequences | Interest, notices, pressure on the budget, and administrative limits. | Public records that can affect property sales and allow stronger actions. |

| Does it include property taxes? | Yes, it includes delinquent property taxes. | Yes, a lien can be placed on a property due to unpaid taxes. |

| Final risk | Growing charges and ongoing collection steps. | The property may be sold in a tax sale if the balance isn’t resolved. |

What Do Lenders Review When There Is An Active Delinquent Tax?

When a lender sees a delinquent tax, their focus shifts to signs of financial stability. They need to be sure that the applicant can handle future payments without added strain. That review becomes even stricter when delinquent on property taxes appears in public records, as it often implies an unresolved issue.

Lenders look for consistency: steady income, reasonable obligations, and documents that match the information provided. These are the key areas they review:

1. Debt-to-Income Ratio (DTI)

This is usually one of the first figures they consider. If someone is repaying a delinquent tax through a monthly plan, that payment is added to their other debts. As the DTI increases, the available margin shrinks, and lenders adjust their expectations about the applicant’s ability to manage new credit.

2. Public Records

Although tax liens no longer appear in credit reports, lenders still review public records. If they find entries tied to delinquent property taxes, they may view it as a sign of risk. This does not affect the credit score directly, but it shapes how reliable the applicant appears.

3. Tax Return Status

If a tax return is missing or unfilled, most lenders pause the process. They need to confirm income and verify that the applicant’s tax history is current. An unfilled return raises doubts about undisclosed amounts.

Example Comparison

Here’s a simple way to picture how lenders respond:

- Profile A: Has an active payment plan, six months of on-time history, and updated documents → the review usually progresses without major delays.

- Profile B: Has ignored notices, late filings, and a public record showing delinquent on property taxes → the most common response is a denial or a request for extensive documentation before reconsidering.

If Debt Keeps You On Edge, There’s Still Room To Recover

A delinquent tax affects your credit, limits your loan options, and makes it harder to keep up with regular expenses. When delinquent property taxes are not paid, the stress can increase quickly, especially without a clear plan to move forward.

At Cryptoscam Defense Network, we provide guidance to help you handle these situations with more clarity and confidence. If your case feels more complex, our guide on how to stop property tax foreclosure explains common scenarios and steps you can take to move forward.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.