Financial fraud can have severe consequences, but are financial frauds criminal or civil cases? The answer depends on the nature of the fraud, the intent behind it, and the damages caused. Understanding these differences is important for identifying the right legal action and protecting your investment.

This fraud isn’t always treated the same way. In this post, we’ll talk about the differences between criminal and civil cases and whether financial fraud is a criminal or civil offense. Also, we’ll show you how to report financial fraud to protect yourself and take the right legal steps.

Need support after a scam? Join our community today.

What Are Criminal and Civil Cases?

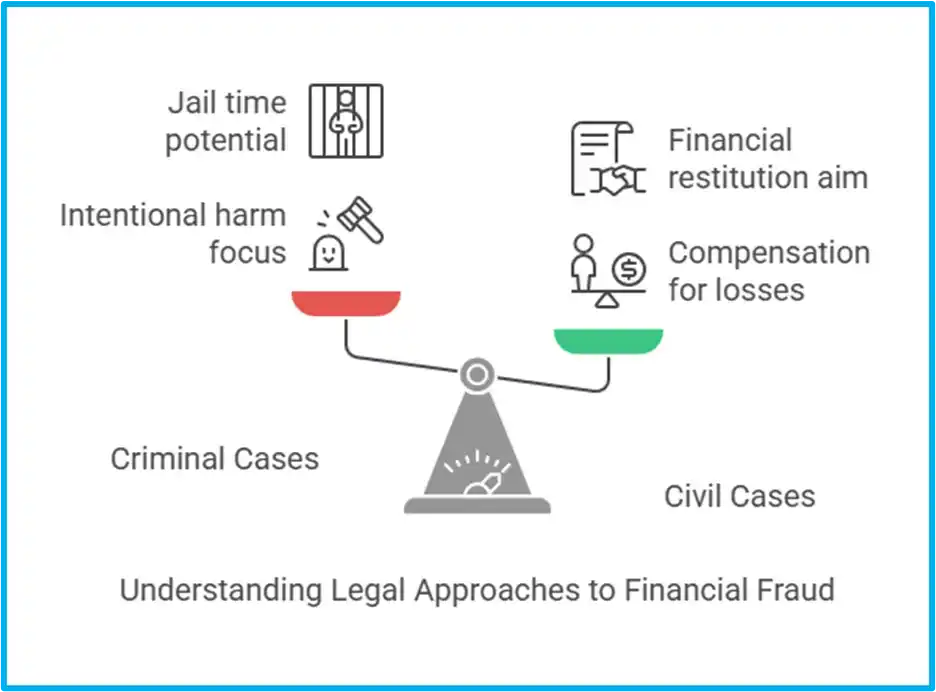

When looking at financial fraud, the difference between criminal and civil cases matters. How fraud is prosecuted depends on several factors, including intent, harm caused, and legal action taken. Here’s what criminal and civil cases are:

What Are Criminal Cases?

Criminal cases are legal actions taken by the government against an individual or entity accused of breaking the law. These cases focus on punishing illegal behavior and preventing future offenses.

Key Aspects of Criminal Cases:

- Government-Initiated: Prosecutors bring charges against the accused, referred to as the defendant.

- Objective: The goal is to impose penalties, such as imprisonment, fines, or probation.

- Burden of Proof: The prosecution must prove the defendant’s guilt beyond a reasonable doubt, which is the highest legal standard.

Examples: Financial fraud cases prosecuted as criminal offenses include embezzlement, insider trading, identity theft, bank fraud, tax evasion, money laundering, wire fraud, and securities fraud.

What Are Civil Cases?

Civil cases are legal disputes in which individuals, businesses, or organizations seek compensation for damages caused by fraud. Unlike criminal cases, these disputes involve lawsuits between private parties rather than government prosecution.

Key Aspects of Civil Cases:

- Private Disputes: A plaintiff sues the accused party for financial compensation.

- Objective: The goal is to provide a remedy to the injured party, often in the form of monetary damages.

- Burden of Proof: The plaintiff must prove the case by a preponderance of the evidence, meaning it is more likely than not that fraud occurred.

Examples: Common civil fraud cases include breach of contract, misrepresentation, negligence claims, fraudulent misrepresentation, mobile deposit check scams, false advertising, securities fraud, real estate fraud, and investment fraud.

Are Financial Frauds Criminal or Civil Cases?

Financial fraud can be prosecuted as both a criminal and civil case, depending on the circumstances. The severity of the offense, the intent behind the fraud, and the damages caused all play a role in determining the legal approach.

- Criminal financial fraud occurs when fraud is committed intentionally and causes important harm. Cases such as identity theft, check-washing fraud, bank fraud, tax fraud, and securities fraud often lead to criminal charges.

- Civil financial fraud involves disputes where one party seeks compensation for financial losses due to illegal practices. Cases such as false advertising, negligent misrepresentation, and breach of fiduciary duty are usually handled in civil court.

In some cases, financial fraud results in both criminal charges and civil lawsuits. For example, a fraudster convicted of securities fraud may spend jail time while also being sued by investors seeking to recover their losses.

What are the Differences Between Criminal and Civil Cases?

After experiencing financial fraud, knowing the right course of action depends on whether the case falls under civil or criminal law. The distinction matters as it defines how the fraud is prosecuted and what legal remedies are available.

In fact, according to Alloy, in 2024, 25% of financial institutions lost over $1M to fraud, while consumer losses topped $10B. Here’s how civil and criminal cases differ:

1. Initiation of Proceedings

- Criminal cases: begin when government prosecutors file charges against an individual or entity accused of violating the law. These cases are typically investigated by law enforcement agencies before formal charges are brought.

- Civil cases: initiated by private individuals or businesses seeking compensation for damages caused by another party. The plaintiff must file a lawsuit, present evidence, and prove that the defendant is responsible for the harm suffered.

2. Objectives

- Criminal cases: focus on punishing unlawful conduct and preventing future offenses. The defendant may face legal penalties such as imprisonment or fines. The primary goal is to protect society and promote public order by holding offenders accountable.

- Civil cases: seek to compensate the victim for financial losses or damages rather than punishing the offender. The goal is to restore the injured party as much as possible. Courts may also issue injunctions or specific performance orders to prevent future harm or enforce agreements.

3. Outcomes

- Criminal cases: a criminal conviction can end up in prison time, fines, probation, or community service. The severity of the punishment depends on the crime committed.

- Civil cases: a civil judgment typically ends in monetary compensation or court-ordered actions like specific performance, asking the defendant to commit to a contractual obligation.

4. Burden of Proof

- Criminal cases: require proof beyond a reasonable doubt, the highest standard in the legal system. This means there must be no reasonable uncertainty about the defendant’s guilt.

- Civil cases: require proof by a preponderance of the evidence, meaning it is more likely than not that the defendant is responsible. This is a lower burden of proof than in criminal cases.

What Is Financial Fraud?

Financial fraud is when someone lies, tricks, or hides important information to take money or assets they shouldn’t. It’s a way of cheating for financial gain, whether by a person or a company. Some common forms of financial fraud include:

- Identity theft – Using someone else’s personal information for financial transactions.

- Mortgage Fraud – Mortgage fraud is committed when someone lies or fakes information to get a home loan or better terms. It can involve buyers, sellers, or lenders.

- Credit card fraud – Unauthorized use of credit or debit cards.

- Investment fraud – Illicit schemes that promise high returns with little risk.

Examples of Criminal vs. Civil Cases in Financial Fraud

- Criminal Case: Identity Theft – someone steals your personal information, like your Social Security number or credit card details, to open accounts or make purchases in your name. If caught, they could receive serious penalties, including jail time.

- Civil Case: Investment Fraud – a company promises you high returns on an investment but falsely informs you about the risks or never actually invests your money. You can sue them to recover your losses, but instead of jail time, the consequence is financial compensation.

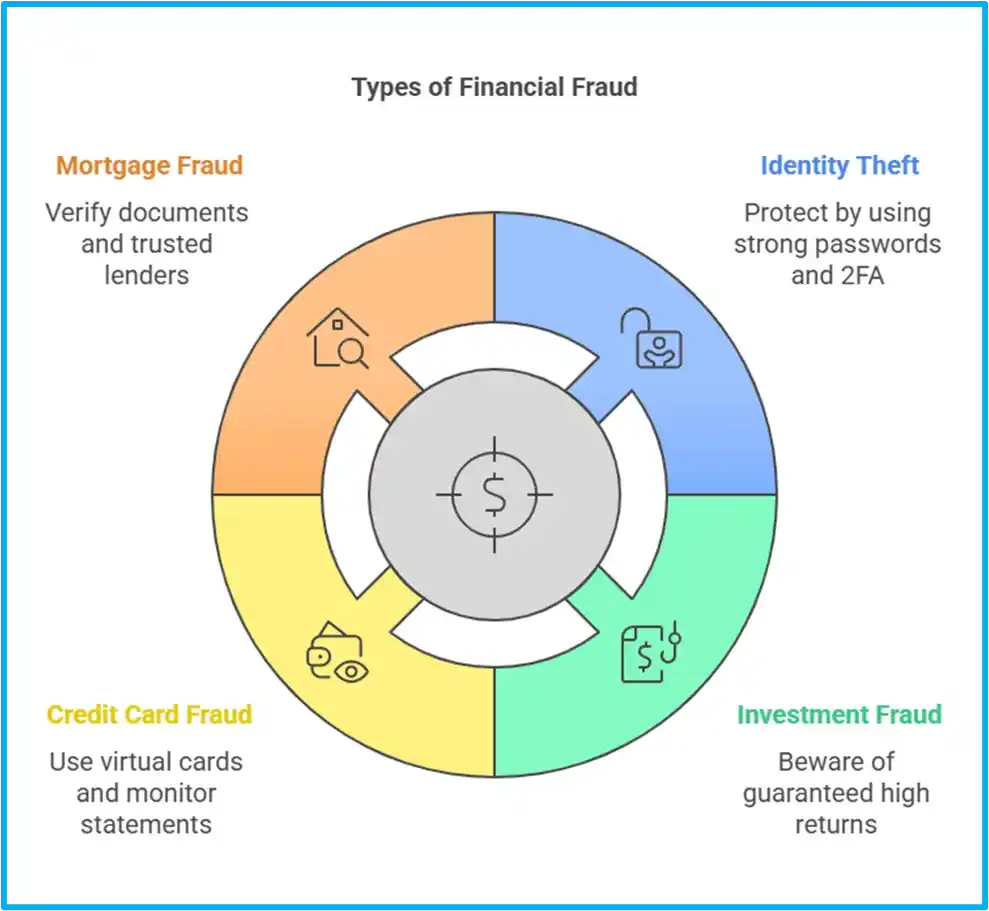

What are the Common Types of Financial Fraud?

Financial fraud can take many forms, affecting citizens, businesses, and financial institutions. Are financial frauds criminal or civil cases? The type of fraud and the legal action taken determine whether it falls under criminal or civil law.

Here are some of the most common types of financial fraud and how you can avoid them:

1. Identity Theft

Identity theft is when someone steals personal information, such as Social Security numbers, bank account details, or credit card information, to commit fraud. Victims may face unauthorized transactions, damaged credit scores, and legal disputes caused by fraudulent activities in their name.

How to Protect Yourself from Identity Theft?

- Use strong, unique passwords for online accounts.

- Monitor bank statements and credit reports regularly.

- Enable two-factor authentication (2FA) for extra security.

- Avoid sharing personal information over the phone or email unless necessary.

2. Investment Fraud

Investment fraud is when scammers use deceptive schemes that promise high returns with little or no risk. Common scams include Ponzi schemes, where money from new investors is used to pay earlier investors rather than generating real profits.

How to Protect Yourself from Investment Fraud?

- Be cautious of “guaranteed” high returns with little risk.

- Verify whether the investment is registered with financial authorities.

- Research the company and check for complaints or lawsuits.

- Never rush into an investment due to pressure tactics.

3. Credit Card Fraud

Credit card fraud is when stolen or unauthorized card details are used to make purchases or withdraw money. Criminals may obtain information through data breaches, skimming devices, or phishing scams.

How to Protect Yourself from Credit Card Fraud?

- Regularly review credit card statements for suspicious transactions.

- Use virtual credit cards for online purchases.

- Never share your card details via email or phone.

- Report lost or stolen cards immediately to the bank.

4. Mortgage Fraud

Mortgage fraud is when misrepresentation or deception occurs during the loan application process. Fraudsters may provide false income details, inflate property values, or use stolen identities to secure loans illegally.

How to Protect Yourself from Mortgage Fraud?

- Verify all loan documents and financial statements before signing.

- Work with trusted lenders and real estate professionals.

- Be cautious of unlicensed brokers offering “too-good-to-be-true” deals.

- Report suspicious loan offers or requests for upfront payments.

Have questions about dealing with scams? Contact us for support.

How to Report Financial Fraud?

Reporting financial fraud is key to stopping further damage, holding scammers accountable, and protecting others from being tricked. If no one speaks up, they can keep scamming and cause even bigger financial losses.

Here’s how you can report fraud and protect your money:

1. Take Immediate Actions

- Notify your bank or credit card provider of any unauthorized transactions. Many financial institutions offer fraud protection and may help recover lost funds.

- Request a fraud alert on your credit report from major credit bureaus. This makes it harder for fraudsters to open accounts in your name.

- Freeze your credit if needed to prevent further fraudulent activity.

- Change passwords and security settings for your financial accounts to block unauthorized access.

2. Report to the Authorities

File a report with your local law enforcement authorities. This helps create an official record and may be necessary for legal action. Report the fraud to federal agencies, such as:

- Federal Trade Commission (FTC) – Handles consumer fraud complaints.

- Securities and Exchange Commission (SEC) – Investigates investment fraud and market manipulation.

- Internal Revenue Service (IRS) – Addresses tax-related fraud and identity theft.

- Consumer Financial Protection Bureau (CFPB) – Assists victims of credit fraud and financial scams.

3. Seek Legal Advice

- Seek legal advice to understand your rights and available options. A lawyer can help determine whether you should file a civil lawsuit or pursue criminal charges.

- Consider joining a class-action lawsuit if multiple victims were affected by the same fraud scheme.

- Keep records of all communications with banks, law enforcement, and agencies to support your case.

Report Fraud the Right Way: Criminal or Civil Case?

Are financial frauds criminal or civil cases? The answer depends on factors such as intent, damages, and legal proceedings. Some cases lead to criminal charges, while others end in civil lawsuits—and in many cases, both.

If you can spot different types of fraud, report them, and get legal help, you have a better chance of recovering your money and avoiding new scams. At Cryptoscam Defense Network, we give you the information you need to protect your finances and take action in time. Join our community and keep your money safe!

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future frauds.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Frequently Asked Questions (FAQs) about Financial Fraud as Criminal or Civil Cases

Can a Same Act of Fraud Lead to Both Criminal and Civil Cases?

A single act of fraud can lead to both criminal and civil cases. In criminal cases, prosecutors may charge the perpetrator if they find evidence of intentional deception for personal gain. At the same time, the victim can initiate a civil case to seek compensation for what they’ve suffered due to the fraud.

In both types of cases, the elements include the intentional misrepresentation of important facts, the fraudster’s knowledge that these facts were false, and the victim’s reliance on these false claims, leading to some form of harm or loss.

Which Types of Fraud are More Likely to be Treated as Criminal Rather than Civil?

Some types of fraud are more likely to be treated as criminal offenses rather than civil cases, particularly when they include deception with the intent to gain financially or harm others. Examples of fraud that commonly result in criminal charges include:

- Mail and wire fraud: These crimes involve using postal services or electronic communication (such as phone or email) to carry out fraudulent activities.

- Identity theft: This happens when someone illegally obtains another person’s personal information to commit fraud, often resulting in financial harm.

- Securities fraud: Fraud related to falsifying stock or investment values, such as insider trading or “pump and dump” schemes.

- Credit card fraud: Using someone else’s credit card information without permission to make purchases or for financial gain.