If you’re asking, “Can you buy a house if you owe taxes?” the short answer is yes in some situations. A recent report from Nasdaq notes that nearly 23% of Americans say they owe back taxes, which helps explain how common this concern is.

Here, we walk through what lenders review, how tax debt shapes a mortgage request, and the steps that often help people move forward with more confidence. I also include a quick note on what happens if you don’t pay property taxes, since many borrowers ask about both when planning their next move.

Need support after a scam? Join our community today.

Can You Buy A House If You Owe Taxes

In many cases, you can still move forward with a mortgage as long as the tax balance is documented, managed, and supported through an active payment plan.

Lenders look for steady behavior rather than perfection, and their main focus is confirming that your tax payments will not interfere with your ability to cover a home loan month after month.

Why This Situation Appears More Often Than People Expect

Unpaid taxes show up frequently in mortgage reviews. IRS data indicates that the agency handles substantial volumes of overdue collections every year, which explains why this topic comes up so often during loan evaluations.

How To Interpret The Question In Practice

Answering “Can you buy a house if you owe taxes?” means looking at several factors together: the type of debt, the presence of a payment agreement, any active lien, and how these elements shape your monthly budget.

When your records are organized, and the debt is handled through a structured plan, many lenders remain open to reviewing the application without ruling it out at the beginning

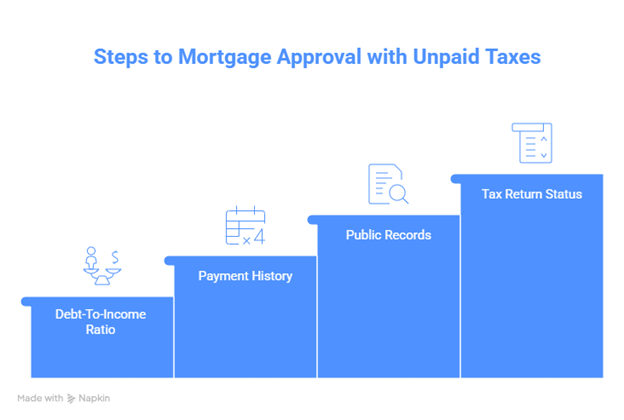

What Do Lenders Review When You Owe Taxes

When you move forward with a mortgage while carrying unpaid taxes, a lender looks past the amount you owe. Their focus is on how that balance is being handled and how it fits into your broader financial habits. This helps them see if a new mortgage can fit into your monthly budget without putting the rest of your commitments at risk:

1. Debt-To-Income Ratio (DTI)

Your debt-to-income ratio, or DTI, shows how much of your monthly income is already tied to other payments. It gives the lender a sense of whether a mortgage can sit comfortably alongside your existing responsibilities.

If you have an IRS payment plan, the monthly installment is added to the rest of your active obligations.

What Lenders Review

- The monthly amount assigned to your IRS plan

- The share of your income that the installment represents

- Your margin to cover both the tax payment and a mortgage without extra strain

2. Payment History

Your recent payment pattern shows how consistently you’ve followed your IRS agreement. Lenders often look at this to gauge stability, especially when your payments show a predictable rhythm.

Some programs request proof of three or more consecutive on-time payments, as this helps them feel more comfortable moving forward.

What Lenders Check In Your Payment History

- How often were payments made on time

- Whether the amounts match your IRS agreement

- Continuity in your payment pattern

- Alignment with statements or official IRS records

3. Public Records

Public records include accessible files that list events such as a lien, civil actions, or other entries that may shape how a lender reads your financial background. IRS debt does not always affect your score, yet it can appear in these records and prompt a more careful review.

What Lenders Usually Examine

- Movements in your score and shifts that may need context

- Any lien or similar entry that requires clarification

- How a new mortgage would work with your usual financial habits

4. Tax Return Status

A tax return is the document sent to the IRS to report income, deductions, and any balance that remains pending. Lenders use these filings to verify the financial data you share during the mortgage review.

If a return is missing, the lender has no dependable way to confirm income, which pauses the evaluation even when the pending amount is small. Without that record, it becomes harder to measure your stability as an applicant.

What lenders check in this stage

- Filed returns for the years they request, as any gap interrupts the review

- Consistency between the income you report and the documents you provide, since mismatches can trigger more questions

Comparative Example

To make everything easier to picture, here are two scenarios with the same tax balance but very different outcomes:

- Profile A: taxpayer with $8,000 in unpaid taxes, an active plan, six consecutive payments, and a 38% DTI → often workable

- Profile B: same balance, missing returns, and no agreement with the IRS → high chance of denial

👉Learn what a fraudulent deed is and why it can affect a home purchase when tax debt is involved; understanding this risk helps you avoid extra issues as you move forward.

How Do Tax Debt, Credit Reports, And Data Breaches Affect Your Homebuying Plans

During a home purchase, the question you can buy a house if you owe taxes usually comes up, and the answer depends on more than the balance you still need to pay. Your data protection, your credit record, and the way a lender reviews your information all shape how the evaluation moves forward.

If someone misuses your information or a data breach exposes your records, the review may slow down because lenders rely on documentation that needs to stay consistent at every step.

Factors That May Influence Your Homebuying Plans If You Already Owe Taxes

- Altered credit records: Unusual activity can lead the lender to request more documentation.

- Compromised tax transcripts: Unauthorized access may lead the IRS to question inconsistencies, creating delays in your review.

- Identity concerns: Alerts triggered after a breach can cause the lender to pause the evaluation.

- Impact on your monthly budget: Fraud may add unauthorized charges that modify how your financial profile is interpreted.

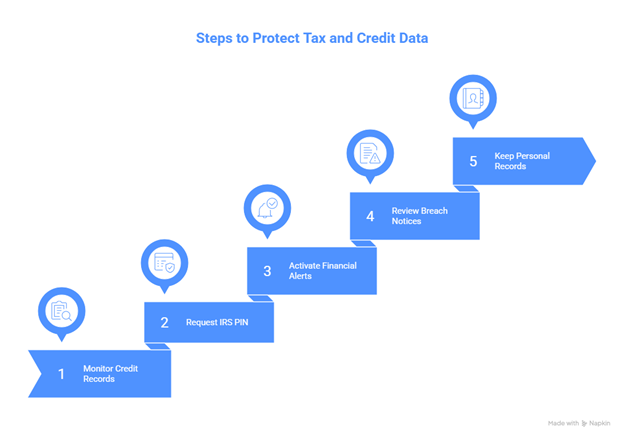

Practical Steps To Protect Your Tax And Credit Data

Taking early action helps keep your information stable while you address your tax balance and move toward a home purchase. Specialists in security and credit management often recommend:

- Monitoring your credit records through official tools to detect unusual activity.

- Requesting an IRS Identity Protection PIN to add extra security when filing returns.

- Activating alerts in your financial accounts, especially if you use automatic payments or have an installment agreement with the IRS.

- Reviewing notices about compromised accounts, especially from companies that experienced a breach.

- Keeping a personal record of any changes, since lenders appreciate clear documentation during their review.

Have questions about dealing with scams? Contact us for support.

How Can You Turn What Feels Like A Limit Into A Plan That Supports Your Home Purchase

Asking if you can buy a house if you owe taxes often creates uncertainty, yet progress is feasible when your returns are updated, your payment plan is active, and your DTI aligns with what a lender expects. These actions help you look at your situation with more order.

At Cryptoscam Defense Network, we share resources that strengthen your financial security and help you make decisions with more confidence, even when you need to explore related topics, such as when property taxes are due in Iowa.

✅ Download our Fraud Report Toolkit to easily collect, organize, and report scam cases, with dropdowns for scam types, payment methods, platforms, and direct links to agencies like the FTC, FBI, IC3, CFPB, BBB, and more.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Frequently Asked Questions About Can You Buy A House If You Owe Taxes

Does A Federal Tax Lien Prevent Someone From Buying A Home?

A federal tax lien is a legal claim the IRS places on your assets when a balance remains unresolved. Since it appears in public records, lenders treat it as a priority obligation and usually pause any home purchase until the debt is addressed through a payment plan or full resolution.

Can I qualify for an FHA loan if I owe back taxes?

An FHA loan, backed by the Federal Housing Administration, offers flexible terms for applicants who need accessible financing. Even so, you must have your tax returns filed and an active payment agreement with the IRS if there is an outstanding balance.

Do lenders review IRS tax transcripts during the mortgage process?

Yes. Lenders use IRS tax transcripts to confirm your income and check that the details in your application match what has been filed. This review becomes even more relevant when tax debt exists, since the lender must verify that your financial documents remain consistent and reliable enough to move forward.