Crypto hedge funds can look like an easy way into digital investing, especially if you don’t want to trade on your own. However, behind the attractive websites and big promises, not all of them are trustworthy. Some are well-managed and legit, others are nothing more than clever scams.

In this post, you’ll learn how these funds work, what strategies they use, how they make money, and, most importantly, how to spot red flags and make smarter, safer decisions with your crypto investment fund.

Need support after a scam? Join our community today.

What Are Crypto Hedge Funds?

Crypto hedge funds are professionally managed groups that invest exclusively in cryptocurrencies. They offer a way for you to get exposure to crypto without having to manage every trade yourself.

Who Manages These Funds?

These funds are run by teams or individuals with experience in crypto and finance. They’re in charge of making all the trading decisions, analyzing trends, evaluating risks, and adjusting positions when needed.

How Do They Handle Your Investment?

Here’s what usually happens:

- You (and other investors) put money into the fund.

- The fund combines all contributions.

- The manager decides how that money is used.

- Profits or losses are shared based on how much each person invested.

⚠️ Why You Should Understand This

Some funds are built on real strategy, others are set up to take advantage of beginners. By understanding how they work, you’ll be better positioned to protect yourself from bad players in the industry.

What Types of Crypto Investment Funds Exist?

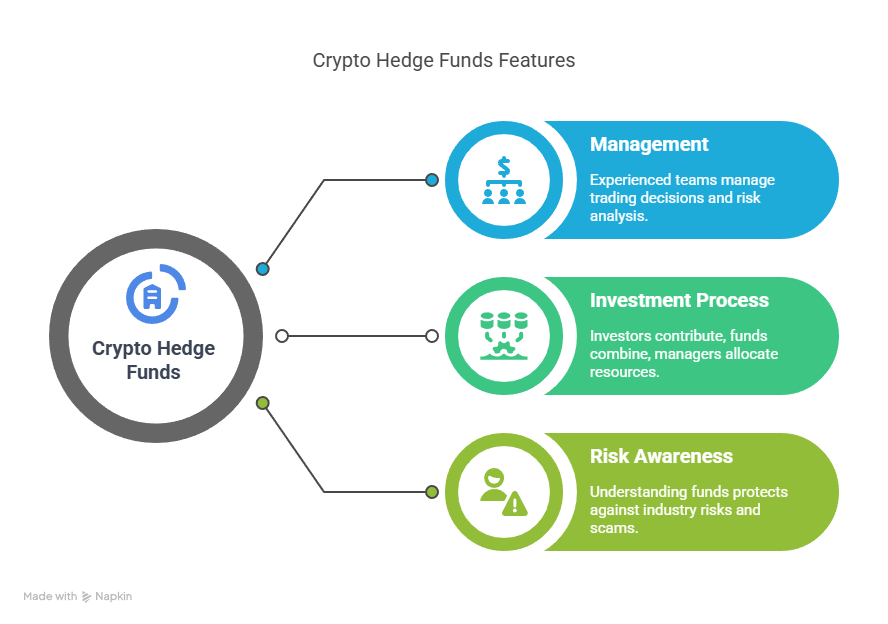

Not all crypto hedge funds follow the same strategy. Some take a simple buy-and-hold approach, while others use more advanced tactics to try to make money regardless of what the market is doing. Being aware of the differences can help you pick a fund that fits your goals and level of comfort:

1. Long-Only Funds

These funds follow a simple strategy: buy and hold. They invest in well-known cryptocurrencies like Bitcoin or Ethereum, and wait for their value to increase over time.

💰How Do They Work?

- Focus on coins like Bitcoin and Ethereum.

- Hold positions for the long term.

- Analyze blockchain projects for long-term value.

They tend to carry lower risk and are easier to understand. But their growth depends entirely on the market going up.

2. Market-Neutral Crypto Funds

These funds are structured to generate returns regardless of market movements. They take both long and short positions to reduce exposure to volatility.

💰How Do They Work?

- Go long on undervalued assets.

- Go short on overpriced ones.

- Target price gaps instead of overall trends.

🔎What To Consider?

They can mitigate risk during unstable markets, but the strategies are complex and require in-depth experience to manage effectively.

3. Quantitative Trading Funds

These funds use algorithms and data to trade automatically. The focus is on speed, precision, and reacting instantly to market signals.

💰How Do They Work?

- Use models to predict short-term price movements.

- Run automated systems for high-frequency trades.

- Base decisions entirely on data, not human instinct.

🔎What To Consider?

They can execute trades faster than humans ever could, but you’ll need to trust that the tech behind them is solid and tested.

Have questions about dealing with scams? Contact us for support.

How Crypto Hedge Funds Generate Returns?

A crypto hedge fund isn’t just holding coins and waiting, they use active strategies to try to grow your money. Depending on the fund, the methods may vary, but they usually fall into one of these three approaches.

1. Taking Advantage of Price Gaps Across Exchanges

One of the most common tactics is arbitrage. The fund spots differences in the price of a coin between two exchanges and trades accordingly.

Example

If Bitcoin is selling for $30,000 on Exchange A and $30,150 on Exchange B, the fund buys on A, sells on B, and keeps the $150 difference. It sounds simple, but doing this consistently takes advanced software and fast execution. Timing matters, and fees can quickly turn into gains if not managed properly.

2. Making Markets to Earn Small but Frequent Returns

Some funds act as market makers, placing buy and sell orders constantly to keep trading activity flowing. They profit from the tiny difference between the two prices.

Example

A fund might place a buy order for Ethereum at $1,850 and a sell order at $1,855. When traders match those orders, the fund earns the $5 spread, over and over again throughout the day. This model depends on high volume and stable systems. It’s not attractive, but when done well, it brings in steady returns.

3. Earning Yield Through Decentralized Finance

More aggressive funds explore decentralized platforms to earn passive income. They don’t trade directly, they put their crypto to work by lending it or staking it.

Example

A fund might lend stablecoins through a decentralized protocol and earn 5–8% interest annually. Others may stake tokens in a blockchain network to receive rewards, or provide liquidity to automated trading systems in exchange for a share of the transaction fees. These strategies can offer attractive returns, but they carry higher risk.

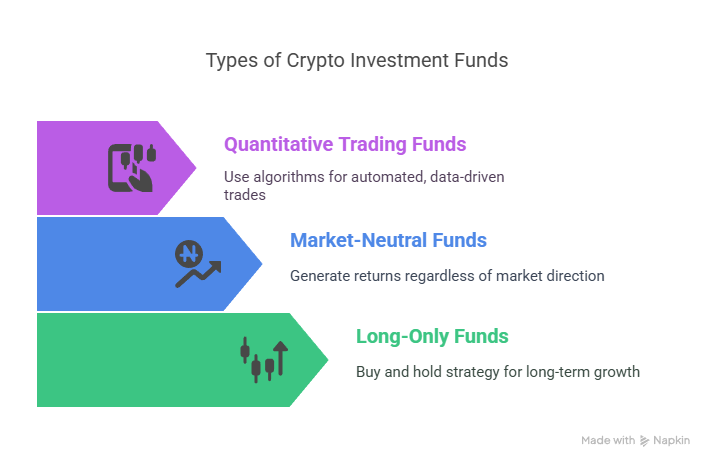

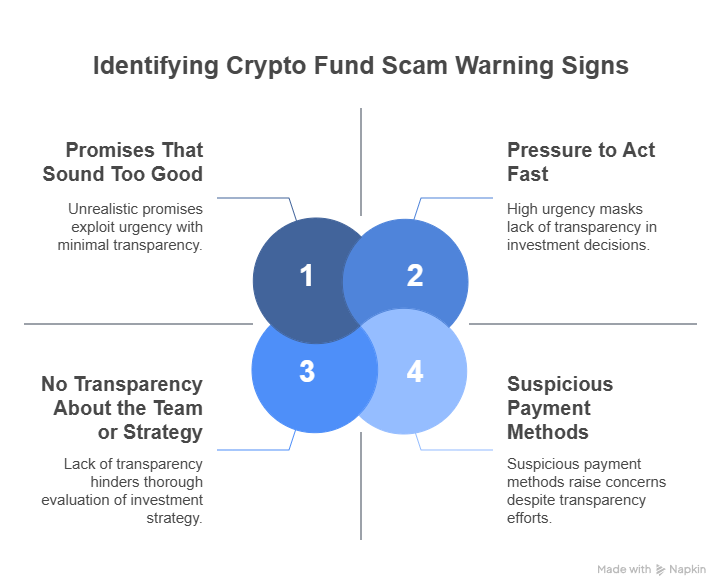

How to Avoid Crypto Fund Scams?

There’s a real opportunity in crypto hedge funds, but there are also bad actors waiting to take advantage of anyone who doesn’t ask enough questions. Scams can look professional and convincing, so being cautious isn’t about fear; it’s about protecting what’s yours.

These are the warning signs to keep in mind before handing over your money:

1. Promises That Sound Too Good

If a fund claims it can deliver high profits with zero risk, that’s a serious red flag. No real investment works that way. Watch for:

- Guaranteed monthly returns.

- Claims of “no risk” or “safe profits”.

- Unrealistic growth projections (20%+ per month).

2. No Transparency About the Team or Strategy

A fund should clearly explain who’s managing it, what experience they have, and how they plan to invest. Watch for:

- No visible team or unverifiable identities.

- Vague or generic explanations of the investment approach.

- Lack of access to audited performance data.

- No signs of regulatory supervision.

3. Pressure to Act Fast

Scammers often push for quick decisions to stop you from doing proper research. Watch for:

- Messages like “only a few spots left”.

- Deadlines that create false urgency.

- Pressure to invest before asking questions.

4. Suspicious Payment Methods

A legitimate fund should offer secure, documented, and traceable ways to invest. Anything outside of that is a risk. Watch for:

- Requests to pay only in crypto.

- Wallet addresses that aren’t tied to the business.

- No written agreement or official paperwork.

How to Research a Crypto Fund Before Investing?

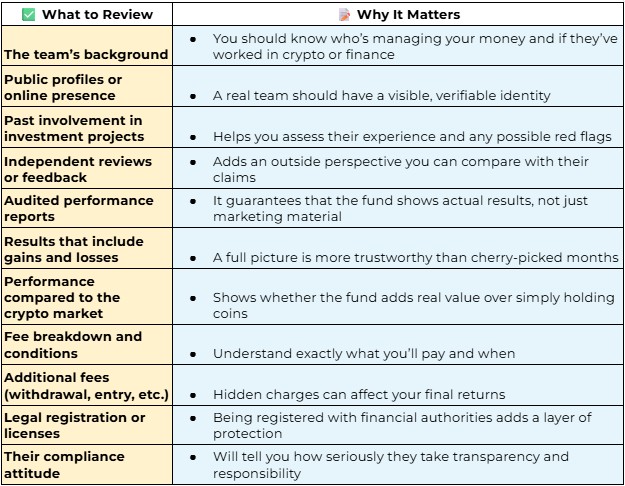

Doing your homework before putting money into any crypto hedge fund is the smartest thing you can do. Even if a fund looks professional, you need to confirm that what they promise matches what they’ve done. Use this checklist to guide your crypto fund research:

How to Research a Crypto Fund Before Investing

What Are Smart Ways to Start Investing in Crypto Hedge Funds?

Getting started with crypto hedge funds doesn’t mean taking big risks from day one. If you move carefully and stay informed, you can explore the space without putting your financial stability at stake.

- Start small and diversify: You don’t need a large investment to begin. Starting with less gives you space to learn without pressure. Limit your crypto hedge fund exposure to around 5–10% of your portfolio.

- Understand your risk limits: Every investor has a different tolerance for volatility. Knowing yours can help you make decisions that match your comfort level. You may see sudden ups and downs, are you okay with that?.

- Stay Informed as You Go: The crypto space moves quickly, but staying updated doesn’t have to be overwhelming. Follow a few reliable crypto news outlets and be aware of the tax rules and legal conditions in your area.

Check investment opportunities near you and compare strategies before deciding.

Lessons from Real Crypto Hedge Fund Fraud Cases

Even when a crypto hedge fund looks professional on the surface, that doesn’t mean it’s operating honestly behind the scenes. These two high-profile cases show how easily trust can be abused—and why doing your research matters.

Alameda Research and the FTX Collapse

In one of the most talked-about fraud cases in crypto history, Sam Bankman-Fried, founder of the FTX exchange and its related hedge fund Alameda Research, was convicted in 2024 for misusing more than $11 billion in customer funds.

FTX presented itself as a trusted platform, backed by big names and major investors. But behind the scenes, Alameda used client assets for risky trades without permission. The fallout affected thousands of users and shook confidence across the entire crypto industry.

HyperVerse: Fraudulent Crypto Hedge Fund with Nonexistent CEO

Another major fraud case involved HyperVerse, previously known as HyperFund. Marketed as an exclusive investment opportunity in the crypto space, it collapsed in 2024, resulting in over $1.3 billion in losses.

The project claimed to have a professional team and futuristic vision, but investigations revealed that its supposed executive director, Steven Reece Lewis, wasn’t real. His profile, including education and experience, was completely fabricated to mislead investors. This case shows how some scams use false representations to appear legitimate.

Make Informed Choices with Cryptoscam Defense Network

Investing in crypto hedge funds can open the door to the digital asset world, but it’s up to you to move wisely. Stay curious, question everything, and always protect your capital. The more informed you are, the better your chances of choosing a fund that truly fits your goals.

At Cryptoscam Defense Network, we’re here to help you protect your investments through reliable crypto fraud detection and prevention. We provide guidance and trusted resources so you can spot threats early and make safer choices in today’s digital economy.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Frequently Asked Questions (FAQs) About Crypto Hedge Funds

Are Crypto Hedge Funds Regulated?

Some crypto hedge funds are regulated, but many operate in partially regulated environments. Always verify if the fund complies with local financial laws.

Do I Need A Lot Of Money To Invest In Crypto Hedge Funds?

Minimums vary. Some crypto hedge funds require bigger amounts, while others are more flexible. Always ask before making any commitments.

Can Crypto Hedge Funds Guarantee Profits?

No. Any claim of guaranteed returns is a red flag. Legitimate funds are upfront about risks and market volatility.

Photos via Freepik.