Receiving a data breach alert means that your personal information could have been exposed. According to the Identity Theft Resource Center, over 1.35 billion breach notifications were sent in the United States in 2024, a number that shows just how common these incidents are now.

In this post, we’ll walk you through what to do right after receiving an alert, how to tell if your data was corrupted, and the most effective ways to protect yourself. That way, you can control the impact of the breach and remove your data from the internet as soon as possible.

Need support after a scam? Join our community today.

What Is A Data Breach Alert?

A data breach alert is an official notice that your personal data has been accessed or exposed by someone without permission. Put simply, your information is no longer completely secure and could be used in ways you never approved.

Why Do These Alerts Happen?

Companies are required by law to send these alerts, which can result from different situations, such as:

- Cyberattacks or ransomware incidents

- Security configuration mistakes

- Data leaks involving third-party providers

- Internal negligence or stolen devices containing sensitive information

According to Secureframe, more than 53 % of all data breaches use personally identifiable information (PII), a sign of how complex this problem is. Organizations send these alerts to:

- Comply with data-protection and privacy regulations

- Avoid legal penalties and loss of customer trust

- Keep communication transparent with clients and employees

- Help affected users act fast and reduce possible damage

Example

Imagine an online platform discovers that one of its service providers accidentally exposed user credentials. The company would then notify affected users and recommend immediate actions such as:

- Changing passwords

- Setting up fraud alerts

- Monitoring recent transactions for unusual activity

How Common Are Data Breach Alerts?

Data breach alerts are becoming more frequent, affecting millions of people across the world. According to Infosecurity Magazine, the number of Americans affected by breaches increased by 26 % during the first quarter of 2025. This rise is mainly linked to:

- A higher number of attacks on mid-sized and large companies

- The growth of remote work, which exposes more weak points

- Inefficient cybersecurity practices in many organizations

This pattern shows that anyone with a digital footprint can receive such an alert, even without sharing sensitive data directly.

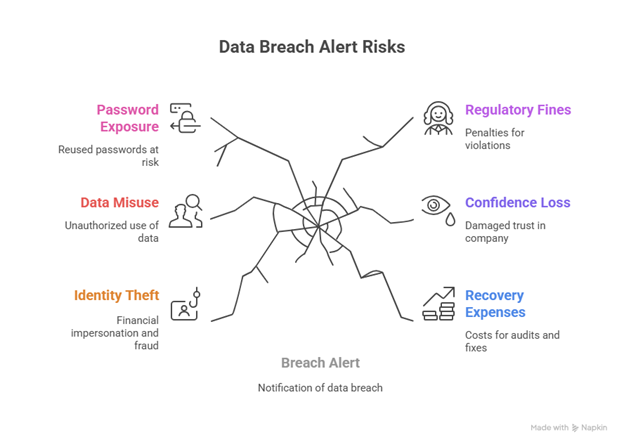

What Are the Risks of a Data Breach?

Receiving this type of notification carries risks for both individuals and companies.

1. Risks for Individuals

- Identity theft or impersonation in financial processes

- Misuse of personal data for fraud or unauthorized purchases

- Exposure of reused passwords across multiple accounts

2. Risks for Companies

- Fines and penalties for regulatory violations

- Loss of confidence from customers and business partners

- High recovery expenses from audits, technical fixes, and compensation efforts

It’s common for people who receive a notice like this to later detect unauthorized transactions or accounts opened under their name. Taking action quickly can stop things from getting worse and keep your information from being misused again.

Have questions about dealing with scams? Contact us for support.

What Steps Should You Take After A Data Breach Alert?

Receiving a data breach alert can feel scary, but the best response is to act fast and stay organized. Every minute matters when it comes to reducing the risk of identity theft or financial loss.

Here’s how to take control and protect your information:

1. Change Your Passwords and PINs

Start by updating every password and PIN linked to the affected account. Focus on your email, online banking, social media, and anywhere you’ve reused the same login details.

Use long, unique passwords that are hard to guess. If you use a password manager, make sure the stored data is also refreshed.

- Example: If you’re told your email was compromised, change that password first. Then check if you’ve reused it for other accounts, like your bank or social profiles. Updating all of them prevents attackers from jumping between platforms.

2. Monitor Your Bank Accounts

In the weeks after a data breach alert, review your bank accounts regularly. Watch for small or suspicious charges, like $1 test transactions, unexpected password reset attempts, or new devices linked to your profile.

If you notice anything suspicious, report it right away. You can also turn on instant alerts in your banking app to track activity in real time.

- Example: An early alert once helped a user notice a small unauthorized charge before larger ones followed. Acting quickly helped stop potential losses before they escalated.

3. Use Identity Monitoring Services

After a breach, some companies offer free identity monitoring for a year. These services track your data across the dark web and notify you if your information is being sold or used to open new accounts.

If the company responsible for the breach doesn’t provide this, explore safe paid options or free tools from credit agencies.

- Example: A customer accepted a year of free identity monitoring after a breach. The service later spotted his email listed on a data-trading site, allowing him to secure his accounts before any fraud occurred.

🛡️ Check the warning signs of a fake text before signing up for a scam that steals your information.

How To Know If A Data Breach Alert Really Affects You?

After getting a data breach alert, it’s normal to wonder if your personal information was exposed or if the message is simply a precaution. The best thing you can do is read it carefully, understand what it says, and take action based on the details provided.

1. Check What The Alert Covers

Start by reviewing the message or letter you received. A legitimate breach notice should clearly state:

- The type of data exposed: email addresses, ID numbers, passwords, or financial records.

- The time frame of the incident: when it happened and how long the breach remained active.

- Who sent the alert: the company or institution responsible for storing your data.

Example: If the alert mentions only your email address, the risk is usually low. But if it lists your Social Security number or banking details, act immediately and follow the recommended protection steps.

2. Determine Which Data Was Compromised

Not every breach carries the same level of risk. Knowing what kind of data was affected helps you decide how urgent your response should be.

- If only your name and email address were exposed, you may face more phishing attempts.

- If your Social Security number, banking information, or health records were involved, take action right away: change your passwords, call your bank, and consider freezing your credit.

Example: A company notified its clients that banking records had been leaked. One customer reacted the same day by requesting a credit freeze. That quick decision prevented criminals from applying for loans in his name.

How to Respond If the Company Stays Silent After a Data Breach Alert?

If the company that sent the data breach alert isn’t being clear or refuses to explain what happened, don’t worry: you still have rights. In the U.S., breach notification laws vary by state, but all require companies to communicate directly and honestly with anyone affected.

Start by checking your state’s specific data breach law. In many cases, companies are legally required to:

- Disclose what type of data was exposed

- Indicate when the breach occurred and how long it lasted

- Provide clear contact information for follow-up

Some states demand very detailed explanations, while others allow different interpretations of what must be reported. The table below shows how major U.S. jurisdictions handle these cases:

Comparison Table of Data Breach Alert Requirements in the U.S.

| Jurisdiction | Required details in the notice | Time frame to notify users | Supervising authority or reporting channel |

| California (CCPA) | Must include the type of data affected, the date of the incident, and contact details for further inquiries | Without unreasonable delay | California Privacy Protection Agency (CPPA) |

| New York (NY SHIELD Act) | Must specify the categories of data exposed and the security measures taken afterward | As soon as possible, once exposure is confirmed | New York State Attorney General |

| Texas | Must describe the nature of the breach and the estimated number of affected residents | Within 60 days of discovery | Texas Attorney General’s Office |

| Florida | Requires a written notice that includes the type of data, the date, and actions offered to protect users | Within 30 days of discovery | Florida Department of Legal Affairs |

| HIPAA (Healthcare sector) | Must explain which medical information was compromised and what actions were taken to reduce harm | Within 60 days of discovery | U.S. Department of Health and Human Services (HHS) |

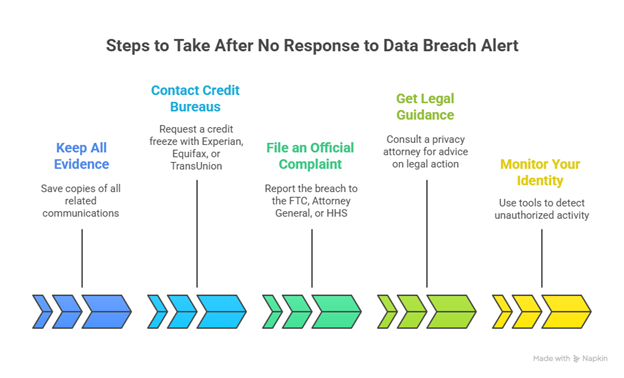

What To Do Next If The Company Still Doesn’t Respond

If the organization keeps ignoring requests or continues to withhold details, there are still more steps you can take:

- Keep all evidence: Save copies of every email, letter, or message related to the data breach alert. These documents may support an investigation later.

- Contact credit bureaus: If financial information was exposed, request a temporary credit freeze with Experian, Equifax, or TransUnion.

- File an official complaint: You can report the case to the Federal Trade Commission (FTC), your state’s Attorney General, or the HHS for breaches involving medical data.

- Get legal guidance: If you suspect negligence or financial harm, a privacy attorney can advise you on filing a civil claim.

- Monitor your identity: Use identity monitoring or fraud alert tools to detect unauthorized activity linked to your personal information.

Don’t Ignore a Data Breach Alert — Your Next Steps Define Your Safety

Acting fast is the best way to protect your information. Every minute matters after a data breach alert, especially if financial details or logins could have been exposed. Update your passwords, monitor your accounts closely, and use trusted tools to catch unusual activity early — before anyone else does.

At Cryptoscam Defense Network, we’ve seen how quick action can change the results of a breach. If you want to improve your company’s defenses, read how to protect confidential company information from hackers, where we share practical ways to stay in control of your sensitive data.

✅ Download our Fraud Report Toolkit to easily collect, organize, and report scam cases, with dropdowns for scam types, payment methods, platforms, and direct links to agencies like the FTC, FBI, IC3, CFPB, BBB, and more.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Frequently Asked Questions (FAQs) About Data Breaches Alert

Should I Cancel My Credit Card If It Was Included in the Breach?

Yes. If your card details were exposed or if you notice any unusual charges, contact your bank immediately. Ask them to cancel the card and issue a new one. It’s also a good idea to turn on purchase alerts so you can track every transaction in real time.

Which Types of Data Are the Most Dangerous When a Breach Happens?

The most sensitive information includes your Social Security Number (SSN), banking records, and login credentials for personal or work accounts. Criminals can use these details to commit identity theft or apply for credit under your name.

Is Paying for an Identity Monitoring Service Worth It?

It depends on how much of your personal information was exposed. When a breach involves financial or medical data, a monitoring service can offer extra protection. Some companies provide this service for free for up to a year after the incident, so review their offer before choosing a paid plan.