Can you imagine waking up one day only to find out that someone else is listed as the owner of your home? That’s the nightmare hundreds of people experience due to a fraudulent deed — a scam that allows criminals to take over someone’s property without consent.

According to NoteServicingCenter, the FBI reported that between 2019 and 2023, over 58,000 victims filed complaints about real estate scams, with losses totaling $1.3 billion. In this post, we will explore how a fraudulent deed works, who may be at risk, and what steps can help safeguard your property.

Need support after a scam? Join our community today.

What Is a Fraudulent Deed?

A fraudulent deed is a forged or altered legal document used to transfer property ownership without the real owner’s knowledge or consent. This type of scam allows someone to take over a home by faking the legal paperwork involved in the property title process.

How Does Deed Fraud Work?

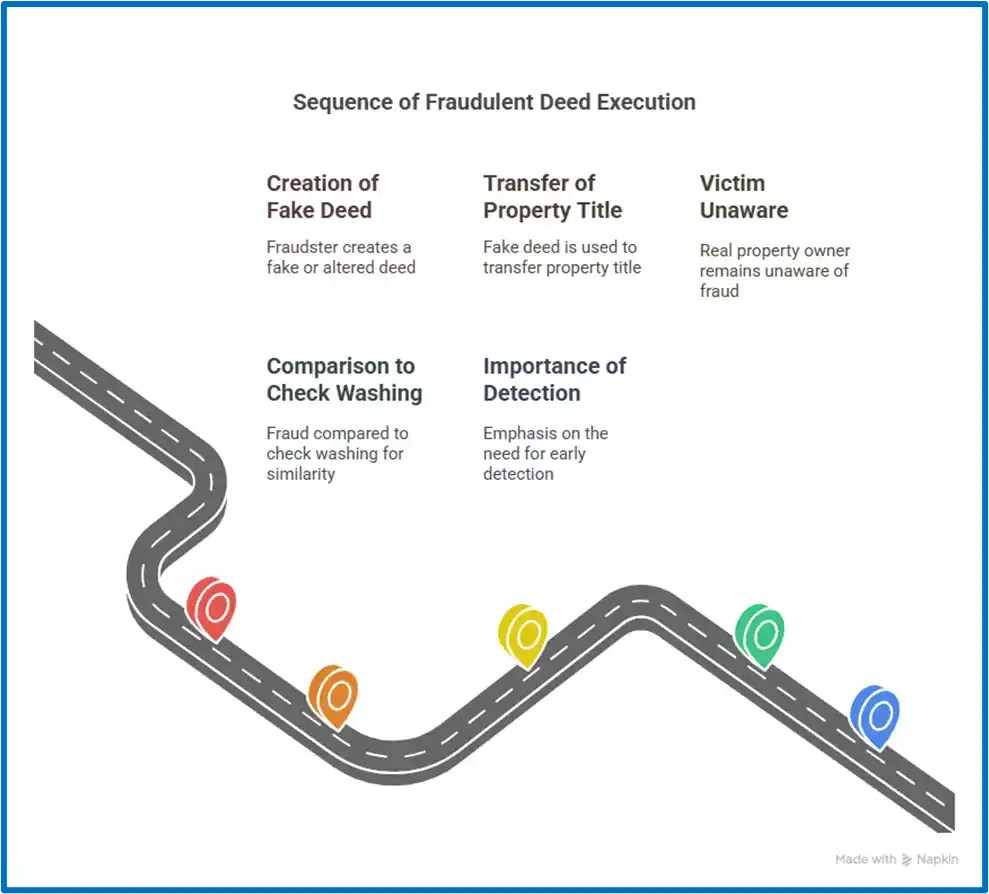

Criminals manipulate official documents to make it appear as if they legally own the property. Here’s how the fraud typically starts:

- Gathering Personal Information: Scammers collect details about the property and its owner, often from public records or online sources.

- Forging the Deed: Using the collected information, they create a fraudulent deed with falsified signatures, sometimes employing fake notary seals to prove authenticity.

- Recording the Fake Deed: The forged document is submitted to the local recorder’s office, where, if accepted, it updates public records to reflect the scammer as the new owner.

This type of fraud shares similarities with check washing, where criminals steal checks from the mail and use chemicals to erase the ink, allowing them to rewrite the payee and amount. Both schemes rely on document manipulation and unauthorized alterations to misappropriate assets.

Who Is at Risk of Deed Theft?

Deed theft can affect any property owner, regardless of experience or property value. What makes it especially dangerous is how silently it happens—many victims only realize it once serious damage has already occurred.

Unexpected letters, notices from the bank, or strangers claiming ownership of the home are often the first warning signs. This type of scam shares similarities with constructive fraud, where the harm is caused by deception through omission or abuse of trust rather than an obvious lie.

Most Vulnerable Property Profiles

Certain types of owners and properties are more likely to be targeted by scammers:

1. Older or absentee homeowners

Seniors, especially those who’ve already paid off their homes, are common targets. If they live alone, aren’t comfortable with online systems, or spend long periods away, it becomes easier for someone to act behind their back.

2. Vacant or inherited properties

A house that’s been empty for a while can quickly catch a scammer’s eye. These places usually go unnoticed, so there’s no one watching or reporting anything. That quiet window gives fraudsters space to fake paperwork without drawing attention.

3. Mortgage-free homes

Once a property is fully paid off, there’s no bank watching over title activity. From a scammer’s perspective, that’s a perfect setup. Without a financial institution reviewing ownership changes, a fraudulent deed can sit on record for months without anyone noticing.

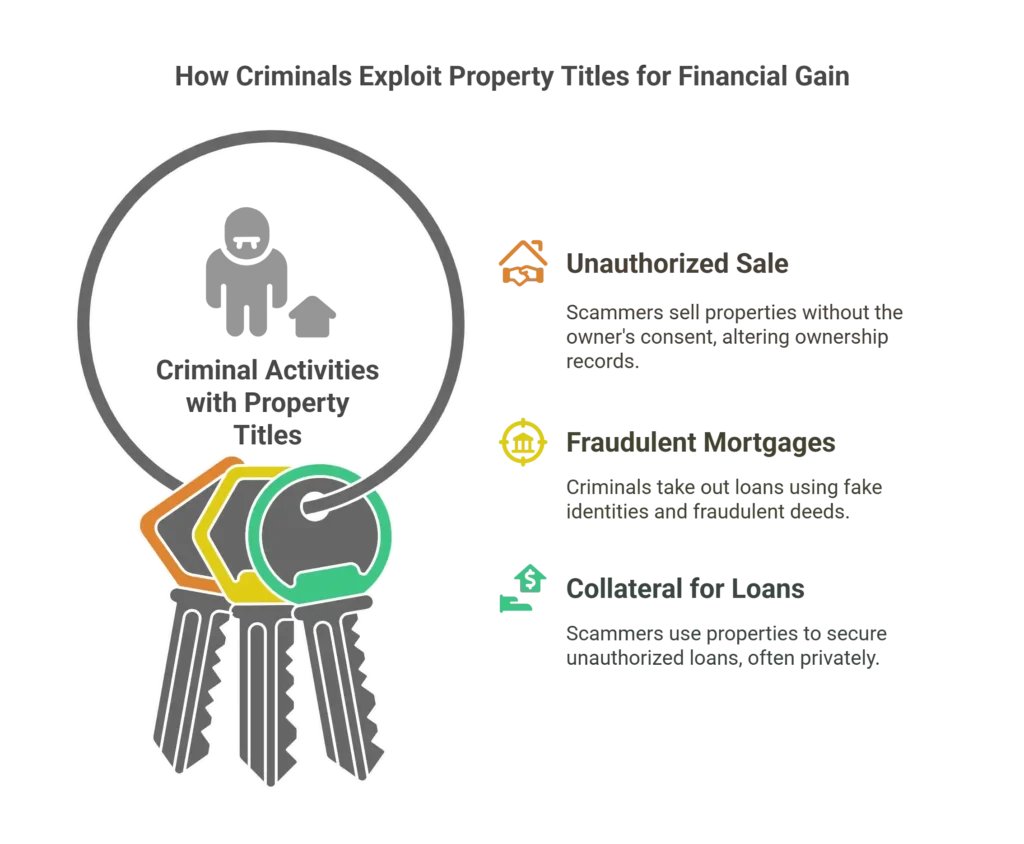

What Can Criminals Do With Your Property Title?

Once a fraudulent deed is officially recorded, scammers gain legal control over the property—even if the real owner has no idea. With that control, they can make decisions that directly affect the true owner’s assets. Here are the most common things they tend to do:

1. Sell the Property Without Consent

The scammer uses the necessary documents to appear as the rightful owner. Once the title is in their name, they list the home for sale and complete the paperwork as if they were the rightful owners, often before the real owner even realizes the property has changed hands.

2. Take Out a Mortgage Under a False Identity

This move is more discreet but just as harmful. Using the fake deed, the scammer applies for a home loan. Since the title shows them as the legal owner, the bank processes the loan without red flags, allowing the criminal to collect the money while the debt remains tied to the property.

3. Use the Property as Collateral for Other Loans

In addition to mortgages, scammers might use the property to secure quick or private loans. These deals typically occur without traditional banks, making the fraud harder to detect and leaving the property tied to debts the real owner never authorized.

How to Verify the Authenticity of a Deed?

Checking the authenticity of a deed can help prevent serious issues, especially when there’s a chance it might involve a fraudulent deed. Here are some simple steps to confirm that everything is in order:

- Compare it with Official County Records: Public records are usually available online or in person at your local office. Make sure the owner’s name, property address, and other key details match the information on your physical document exactly.

- Review Signatures, Stamps, and Notarization: Signatures should be clear and consistent. It’s important to confirm that the notary is officially registered and that their seal is valid. Some forged deeds may include generic stamps or copied signatures that don’t belong to a licensed notary.

- Speak Directly with the County Recorder’s Office: Staff at the local office can explain how to spot common mistakes, altered details, or anything that looks suspicious. If something feels strange, professional legal help is always a smart next step.

- Use Digital Tools or Certified Notarial Services: Some platforms help verify the legitimacy of documents and signatures. These tools can be helpful if you suspect your deed was changed without your permission.

How to Prevent a Fraudulent Deed: Tips for Homeowners

Catching a fraudulent deed early can save you months of legal trouble. Even if it sounds unreal, more and more homeowners are falling victim to this type of fraud without realizing it. The good news is that there are practical ways to lower the risk:

1. Sign Up For Local Government Alerts

Many counties in the U.S. offer free systems that notify you if someone tries to record a document in your name or tied to your property. Signing up only takes a few minutes and gives you a heads-up if anything unusual happens.

2. Get Title Insurance

This type of policy can help if a claim ever comes up regarding your ownership. It’s especially useful if you inherited the property, bought it years ago, or aren’t sure about its legal history. While it won’t stop the fraud from happening, it can give you legal and financial support if it does.

3. Check Public Records Once A Year

You don’t need to be a lawyer to do this. Most counties have an online portal where you can look up your property and confirm that everything looks the same. A quick review once a year is enough to spot anything out of place before it gets worse.

4. Protect Your Personal and Legal Information

Most scams start with leaked or stolen data. Avoid sharing copies of deeds, ID documents, or personal numbers through email, messaging apps, or unsecured services. Be especially careful with familiar-looking messages, as clone phishing is a tactic where scammers copy legitimate emails to trick you into clicking fake links.

Have questions about dealing with scams? Contact us for support.

What to Do If You’re a Victim of a Fraudulent Deed?

Finding out that your property has been transferred without your permission can be stressful. But there’s a path you can take to reclaim your home and protect your rights. If you’re dealing with a fraudulent deed, these steps can help you get back control:

- File a Formal Report with the Police: This is one of the first things you should do. Bring any documents that prove you’re the rightful owner—your original deed, payment records, ID, or any suspicious correspondence. Filing an official report sets the legal process in motion.

- Notify Your Local Property Records Office: Go to the office where your property is registered and explain what happened. Ask them to place a warning or restriction on the title to stop any further changes while the situation is being reviewed.

- Talk to a Real Estate Attorney with Experience in Deed Fraud: A qualified lawyer can guide you through the legal process and help gather the documentation you’ll need. They can assist in filing a claim to reverse the transfer, stop future activity, or even request compensation if appropriate.

- Look into Legal and Community Support Resources: Many local governments and nonprofit groups offer step-by-step guides, free legal aid, or support programs for victims of real estate fraud. Check what’s available in your area that can support you through this process.

Your Property, Your Rules: Don’t Let a Fraudulent Deed Take It From You

A fraudulent deed can put years of investment at risk without you even noticing, as this kind of scam rarely comes with obvious warnings. It’s part of a bigger pattern seen in other scams, such as invoice fraud, where fraudsters send fake billing requests to trick businesses into paying for services they never requested.

At Cryptoscam Defense Network, we’re here to help protect your business or home from these silent threats. Want to avoid uncomfortable surprises tied to your property title? Let’s talk.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future frauds.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.