The rapid growth of decentralized finance (DeFi) has opened the door to new forms of fraud: DeFi wallet scams. According to the CertiK Hack3d Q2+H1 Report, losses across the crypto space reached $688.1 million in Q2 2024, with phishing scams alone causing $433.7 million in damage.

These scams exploit vulnerabilities in wallets and smart contracts, allowing fraudsters to steal assets, often without the victims realizing it until it’s too late. In this post, you’ll learn about DeFi wallet scams, how they work, and practical tips to avoid them.

Need support after a scam? Join our community today.

What Are DeFi Wallet Scams?

A DeFi wallet scam is a fraudulent scheme designed to trick users into giving up access to their crypto assets or confidential information, such as private keys. Scammers typically use tactics like malicious smart contracts or phishing attacks, leading to significant financial losses for victims.

One example of this is when attackers create fake DeFi tokens with manipulated smart contracts. This type of funds transfer fraud can work in the following ways:

- High Transaction Fees: The scammer programs the token to charge excessive fees for every transaction, extracting funds from victims with every interaction.

- Restricted Token Sales: The smart contract may block investors from selling or transferring the token, trapping their funds in a worthless asset.

- Hidden Details: Scammers include malicious code that allows them to withdraw funds without the victim’s consent.

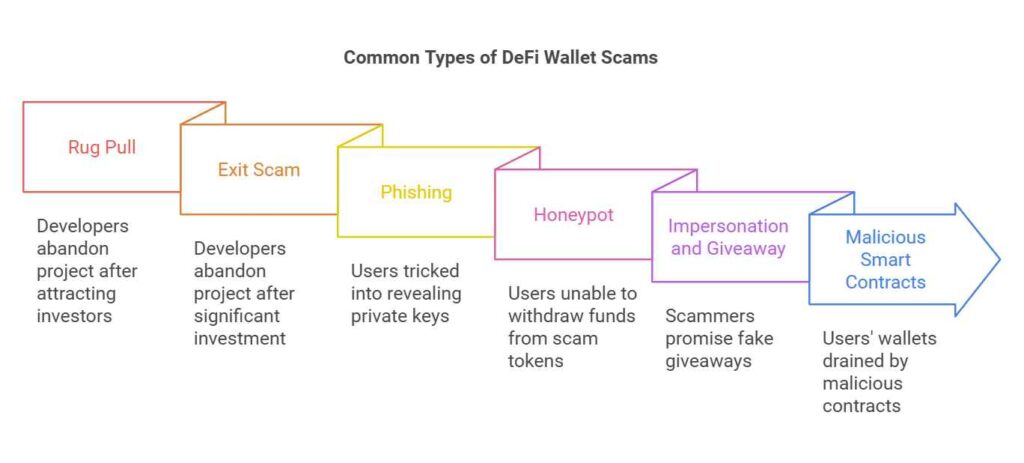

What Are the Common Types of DeFi Wallet Scams?

DeFi scams affect millions of users because they can manipulate tokens, smart contracts, and decentralized financial platforms. Here are the most common types of fraud, their methods, and real examples:

1. Rug Pull Scam

A rug pull means when developers promote a promising DeFi project, attract investors, and then withdraw all the funds while abandoning the project. This scheme leaves investors without their assets or any explanation, as the project vanishes entirely.

Example of Rug Pull Scam

In October 2021, developers launched the AnubisDAO project with little more than a website and an X (formerly known as Twitter) account. Less than 20 hours later, they withdrew the liquidity pool, stealing $58 million from investors.

2. Exit Scam

An exit scam occurs when developers create a legitimate-looking project, collect expensive investments, and then abandon the platform, taking all the funds. Unlike rug pull scams, these are often disguised as project “failures” or sudden closures.

Example of Exit Scam

In June 2021, the StableMagnet project included malicious code in its smart contract.

This allowed attackers to drain funds when users granted permissions, resulting in $27 million in losses.

3. Phishing DeFi Platforms

Phishing scams trick users into revealing their private keys or seed phrases through fake emails or websites that replicate real DeFi platforms. The goal is to gain control of the user’s wallet and drain their funds.

Example of Phishing DeFi platforms

A user might receive an email claiming to be from a platform like Uniswap or MakerDAO, warning them of a compromised account. Clicking the link and submitting private information allows scammers to take over the wallet.

4. Honeypot

A honeypot scam involves fraudulent tokens promising high returns but preventing users from selling or withdrawing their investments. The smart contract is manipulated to benefit only the scammer:

Example of Honeypot

In February 2023, the blockchain security firm CertiK recognized a scammer who created 200 malicious tokens in four months. These tokens included a hidden “lock” that stopped investors from withdrawing their funds, stealing $3.2 million.

5. Impersonation and Giveaway Scam

Scammers impersonate well-known figures or crypto projects on social media, offering fake giveaways. Victims are asked to send funds to a specific address, with the promise of higher returns that never materialize.

Example of Impersonation and Giveaway Scam

During the launch of Celestia’s TIA token, a fake X account appeared, claiming to give away 10 million tokens. The scammers asked for Ethereum wallet addresses, despite TIA not being Ethereum-based, exposing the scam on Twitter.

6. Malicious Smart Contracts

Some scammers create malicious smart contracts that automatically drain users’ wallets upon interaction. These traps often present themselves as legitimate tokens or platforms.

Example of Malicious Smart Contracts

In December 2021, Grim Finance lost $30 million to a reentrancy attack. A malicious contract exploited a weakness in the safeTransferFrom function, triggering multiple deposits before state updates, and allowing the attacker to claim excessive rewards each time.

Have questions about dealing with scams? Contact us for support.

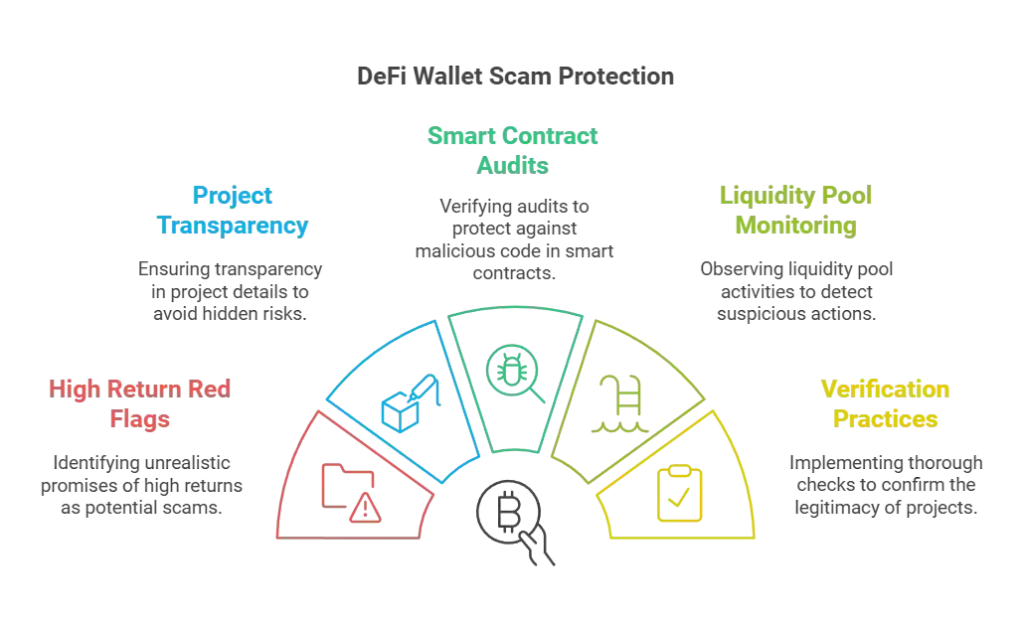

How Can You Spot and Avoid DeFi Wallet Scams?

Identifying scams in the DeFi space can be challenging as scammers constantly improve their techniques. However, there are clear warning signs and tools that can help you protect your investments and avoid fraudulent wallets or tokens. Here are key signs to watch for:

1. Unrealistic Promises of High Returns

If an investment claims to offer extremely high returns with minimal or no risk, it is most likely a scam. Scammers rely on hype to attract victims quickly before disappearing with the funds. Remember: if it sounds too good to be true, it probably is.

2. Lack of Transparency in the Project

Legitimate DeFi projects are transparent about their team, code, and token mechanics. Scammers, on the other hand, often remain anonymous and hide key details. If you notice missing developer information or unclear token lock-up periods, it’s a warning sign. Tools like Token Sniffer or De.fi Scanner can help you detect vulnerabilities.

3. Smart Contracts Without Audits

Trusted security firms audit legitimate smart contracts to confirm their safety and identify malicious code. Projects without audits are higher risk and prone to rug pulls or honeypot scams. Tools like UNCX can help identify vulnerabilities, including restrictions on selling tokens.

4. Suspicious Activity in the Liquidity Pool

Scammers often manipulate liquidity pools to trap investors and steal funds. Warning signs include unlocked liquidity or large withdrawals right after a launch. Tools like DEXtools can monitor buy/sell activity for red flags, while UNCX checks liquidity status.

5. Double-Check Everything

Scammers create fake websites or emails mimicking legitimate crypto platforms. Always verify URLs, email addresses, and project details. If anything feels off, avoid the project and take extra precautions.

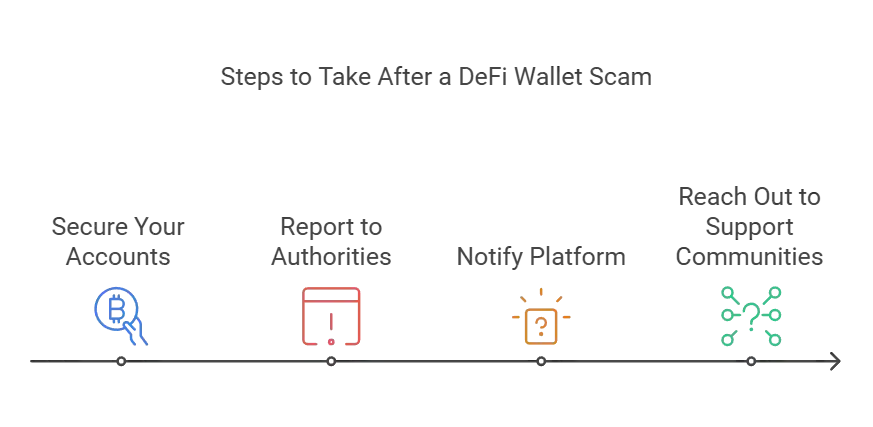

What You Should Do After a DeFi Wallet Scam?

If you’ve fallen victim to a DeFi wallet scam, follow these immediate steps to minimize further risks and increase your chances of recovery.

1. Secure Your Accounts

Disconnect your wallet from the platform or app used by the scammers and change your password immediately. If your bank account is linked, freeze your cards and update associated passwords to prevent further access.

2. Report the Scam to Authorities

File a report with the Federal Trade Commission (FTC) or call 877-382-4357. If you’re outside the U.S., contact your local financial crime agency. A detailed police report may help authorities trace the scammers.

3. Notify the Platform Involved

Report the scam to the platform where it occurred. Provide details such as the scammer’s username, wallet address, and any communication records. For example, Binance Support welcomes victims to file detailed scam reports for further investigation.

4. Reach Out to Support Communities

Communities such as the Cryptoscam Defense Network offer resources and guidance for scam victims. We can provide recovery tips and help you avoid similar crypto scams in the future.

Stay Safe from DeFi Wallet Scams with CDN

The rise of DeFi wallet scams is a serious threat to crypto users, with notable financial consequences. According to the CertiK Hack3d Q2+H1 Report, in H1 2024 alone, total losses reached $1.19 billion from 408 incidents, with private key thefts accounting for $408.9 million.

At Cryptoscam Defense Network (CDN), we teach people to protect themselves against these scams by sharing actionable tips, prevention strategies, and recovery resources. If you’ve experienced fraud, you’re not alone. Join our community to share your story, connect with others, and learn how to secure your investments in the DeFi space.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future frauds.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Frequently Asked Questions (FAQs) About DeFi Wallet Scams

What are Wallet Permissions, and How do Scammers Exploit Them?

Wallet permissions let smart contracts access your funds, but scammers misuse them to steal assets. Always review and limit permissions when connecting your wallet to any DeFi platform to avoid vulnerabilities.

Can I Identify a Scam by Looking at Liquidity Pools?

Yes, tools like DEXtools help monitor liquidity activity for suspicious patterns. For example, unlocked liquidity allows developers to withdraw funds anytime, making it a major red flag for potential crypto scams.

Can I Recover My Funds if I Fall Victim to a DeFi Wallet Scam?

Recovering stolen funds is challenging, but quick action improves your chances. Report the incident to platforms like Binance Support or local authorities. You can also seek assistance from fraud recovery communities such as Cryptoscam Defense Network (CDN) for insights and resources.

Photo via Pexels.