Only 10–15% of daily crypto traders manage to stay consistently profitable, while nearly 80% lose money within their first year, according to Business Money. A big part of the problem is that many investors act on gut feeling or what’s trending online, without real guidance.

That’s where AI crypto prediction tools start to make sense. These systems offer new ways to read the market and respond faster, using data instead of guesswork. In this post, we’ll go over what this technology is, how it works, and how it can support your trading strategy.

Need support after a scam? Join our community today.

What Is AI Crypto Prediction?

AI crypto prediction is a strategy that uses artificial intelligence to analyze crypto market data and anticipate price shifts. These models adjust in real time, making them faster and more flexible. They’re also useful for detecting suspicious trends early, like unusual patterns that could point to a Bitcoin scam.

What makes this especially useful is its ability to process a wide range of signs:

- Price history during different market cycles

- Trading volume during periods of high or low market activity

- Headlines from financial news or major global events

- Emotional trends across platforms like Twitter or Reddit

While these tools help you make better decisions, they don’t take away the uncertainty. According to Bitget, only around 10–20% of traders maintain steady gains, which shows how difficult it is to keep up without the right support.

How Does AI Crypto Prediction Work?

AI crypto prediction relies on real-time, diverse data to generate useful forecasts. In the crypto space, that means going beyond simple charts or price histories. These systems combine signals from a wide range of sources to form a more detailed view of what’s happening in the market.

Here’s where the information comes from:

- Past pricing trends and trading activity.

- Global headlines and economic developments.

- Sentiment tracked across forums and social media platforms.

The model processes this variety of inputs to generate insights that help anticipate potential shifts in asset behavior, which traditional analysis tools often do not consider.

AI Crypto Prediction: Models You’ll See Most Often

What drives any AI crypto prediction system is its core model, the engine that makes sense of the data. These tools take massive datasets and convert them into patterns you can use when making decisions.

Each model functions differently and adjusts its output as market conditions shift. To understand how these systems work, here are the types most often used in the best AI crypto prediction tools:

- Statistical regression: Examines how variables interact to estimate where prices could head next.

- Recurrent neural networks (RNNs): Handle sequences like time series, helping detect recurring price patterns.

- Deep learning models: Work across many layers to spot complex behaviors, refining their output as new data is introduced.

What Is AI Crypto Prediction Used For?

AI crypto prediction is designed to spot market patterns, support safer and reliable trading platforms, and automate key actions in real time. Here’s how it’s commonly used:

- Spot early signs of volatility: It helps pick up potential price swings before they happen, giving you a chance to rethink your strategy faster, something especially useful in crypto.

- Support timing on trades: Rather than reacting emotionally, you can rely on data-driven signals to decide when to buy or sell. This brings more consistency to how you operate.

- Run trades automatically, even offline: Orders can be triggered instantly without waiting for your input, which keeps your strategy going around the clock, even when you’re not watching the screen.

- Catch unexpected activity as it happens: Some models can pick up signs of price manipulation or irregular trading in seconds. That’s especially helpful when trading on low-liquidity platforms.

- Plan for the long term: By reviewing past cycles and assessing future scenarios, this tech gives you an edge if you’re thinking ahead, not just reacting day to day.

- Keep risk exposure under control: These tools can adjust trade size or apply limits automatically, helping protect your capital without having to stay online all the time.

Example

Let’s say an automated system picks up a sudden shift in Ethereum’s price trend after a negative headline. Instead of waiting for you to step in, the model updates your orders, scales back exposure, or activates stop-loss measures to reduce possible losses.

What Is Algorithmic Trading?

Algorithmic trading is a technique that uses pre-programmed instructions based on mathematical rules to carry out transactions in financial markets, including crypto. Through AI crypto prediction, these systems apply artificial intelligence to process data, detect patterns, and respond in just seconds.

How Does It Work with AI?

Instead of relying only on static code, algorithmic trading powered by AI adapts to changing market conditions. It can automate trades and also learn from past behavior to improve over time. When combined with real-time insights, this makes trading more responsive and data-driven.

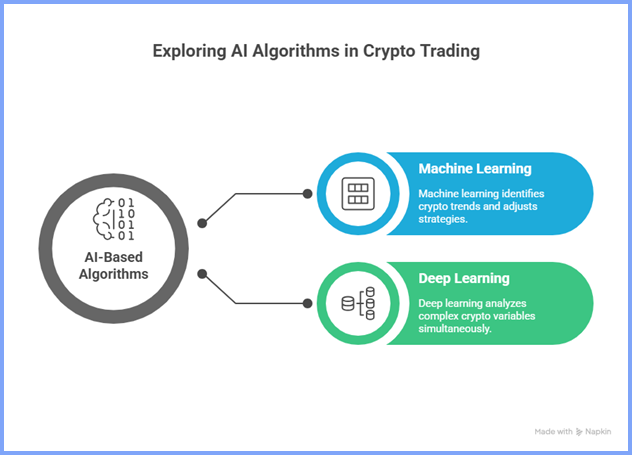

Examples of AI-Based Algorithms

Artificial intelligence has changed how traders interact with crypto markets. Instead of relying solely on rigid instructions, today’s tools incorporate learning systems that adjust as new data comes in. This flexibility allows for quicker reactions and more personalized strategies:

1. Machine Learning

Machine learning is a branch of artificial intelligence where systems learn from historical data without being manually programmed step by step. In crypto prediction, it helps identify behavioral trends, adjust variables on the fly, and build models that improve with ongoing input.

This approach allows platforms to refine their logic over time, especially when facing unusual volatility. Although not flawless, it offers a faster way to spot shifts that could impact short-term decisions. It’s widely used to project pricing behavior.

2. Deep Learning

Deep learning is a more advanced approach that replicates how the human brain processes information. It uses multi-layered neural networks to analyze relationships among thousands of variables.

In AI crypto prediction, it makes it possible to interpret factors like market sentiment, liquidity shifts, transaction speed, and real-time news all at once, something a human analyst could not manage at that scale.

Have questions about dealing with scams? Contact us for support.

Differences Between AI-Based Algorithms and Traditional Bots

While both tools automate trading tasks, traditional bots and AI-powered algorithms work in very different ways. The first follows predefined rules without variation, while AI-based systems learn and adjust on the fly. The next table shows the main differences between them:

Traditional Bots vs AI-Powered Algorithms in Crypto Trading

| Feature | Traditional Bots | AI-Powered Algorithms (AI Trading) |

| Logic type | Fixed, rule-based | Data-driven learning |

| Adaptability | Do not adjust to changing conditions | Update continuously with live input |

| Decision-making | Run simple instructions | Spot patterns and adjust strategies accordingly |

| Use of external variables | Limited or absent | Incorporate news, sentiment, and volatility |

| Performance over time | Stays static | Learns and refines accuracy over time |

| Use in crypto prediction | Works in fixed scenarios | Helps anticipate shifts and respond more quickly |

Pros and Cons of AI Crypto Prediction

AI crypto prediction has made progress in trading thanks to its speed and ability to process huge amounts of data. But like any technology, it comes with cons. Here’s a clear look at what it offers, and where it falls short:

Pros of AI Crypto Prediction

- Better timing through adaptive learning: AI models update themselves as new data flows in. That makes it easier to keep strategies aligned with sudden market shifts, without waiting for human input.

- Non-stop performance: With crypto markets running all day, every day, AI tools can keep up, offering insights and actions without delays.

- Hands-free execution: Bots linked to prediction models can place or adjust trades automatically, even when you’re not at your desk.

Cons of AI Crypto Prediction

- Overfitting to past data: Some systems become too narrowly trained, which limits their ability to respond to unfamiliar events.

- Struggles under market pressure: As Sergey Ryzhavin points out, AI doesn’t foresee the future; it just reacts to past patterns. During chaotic periods, that’s not always enough.

- Risk of chain reactions: Without proper oversight, some AI tools may overreact and make choices that worsen instability.

Is AI Crypto Prediction Safe to Use? Here’s What Experts Say

Using artificial intelligence to forecast crypto market behavior keeps gaining ground, though it still raises valid concerns. While many platforms claim greater precision, there’s an ongoing debate around how wise it is to hand over full control to an algorithm.

To look at this more closely, let’s consider the views of experts who have worked with AI in finance and digital assets for years:

- Dr. Lorena Nessi, crypto expert and CCN contributor, says no AI system can fully predict the crypto market, especially during emotional or unexpected events. She warns about risks like overfitting, data gaps, and system errors. AI can scan real-time data, but human judgment is still essential.

- Paul Singer, billionaire investor and founder of Elliott Management, is skeptical about the hype around AI and crypto. He believes their usefulness and valuations are heavily overestimated. Singer suggests caution when relying on AI for financial predictions.

- Ari Juels, professor at Cornell Tech, warns that combining AI agents with crypto can create serious vulnerabilities. He explains that autonomous agents can be tricked into creating malicious smart contracts. This introduces a new layer of risk to the crypto ecosystem.

From a professional point of view, using AI crypto prediction can speed up your decisions and spot trends faster. But trusting it blindly is risky. With more fraud cases in crypto, automated tools can expose you if you don’t stay in control.

The best approach is to treat these tools as part of a larger strategy, one where human oversight and risk management still carry the most weight. Technology adds support, but experience continues to matter

Practical Tips for Using AI in Crypto Trading

You can use AI crypto prediction as part of your trading approach, but that doesn’t mean you should step aside completely. Here are some helpful tips to keep in mind:

- Double-check the source: Only use bots developed by reputable platforms with solid user reviews. A poorly built tool can distort the data, or worse, put your capital at risk.

- Keep your hands on the wheel: Automated systems built on the best AI crypto prediction can be efficient, but they shouldn’t run solo. Take time to define your settings and make informed choices at every stage.

- Keep monitoring everything: Watch how your strategy performs, adjust as needed, and stay alert to news. AI moves fast, but crypto markets can still take unexpected turns.

Is It Worth Including AI Crypto Prediction in Your Strategy?

AI crypto prediction can help you break down data in seconds and respond quickly to market changes. It helps spot hidden patterns and automate repetitive tasks, but it doesn’t do the job on its own. No model gets it right every time. The best approach is to use it as support while reviewing every decision on your own.

At Cryptoscam Defense Network, we help people spot crypto-related fraud and build stronger protection for their assets. If you’ve been promised guaranteed returns, feel unsure about a suspicious bot, or you’re wondering “how to remove my data from the internet,” we can guide you through each step.