Every week, thousands of people lose money by using trading platforms that appear legitimate but operate without regulatory supervision. A report cited by Fxstreet says that between 74% and 89% of retail traders lose money when trading contracts for difference or forex instruments.

Trading platforms are part of the tools & trends in 2025, attracting users of all levels. But experience means little if the platform lacks transparency. In this post, we’ll explain how to identify reliable trading platforms, who regulates them, and which platforms are most widely used.

Need support after a scam? Join our community today.

What Is a Trading Platform?

A trading platform is a digital system that lets you place trades in assets such as stocks, currencies, or cryptocurrencies from any device with internet access. These systems allow you to place and manage orders, view interactive charts, set alerts, and monitor real-time news related to financial markets.

The structure and features of these platforms change depending on the target user. Some are built for newcomers and focus on simplicity, while others offer advanced features designed for those with a technical approach to trading.

Trading Platforms, Brokers, and Exchanges: The Differences

A common point of confusion is about the roles of trading platforms, brokers, and exchanges. While all of them give access to financial markets, each one plays a different role in how transactions are executed and how assets are held or transferred.

Here are the main differences between these concepts:

Differences between Trading Platforms, Brokers & Exchanges

| Element | What is it? | What is it used for? |

| Trading Platform | It is the interface or software where you execute your trades. | To place orders, view charts, analyze data, and track your assets. |

| Broker | It is the intermediary between you and the market. | Responsible for processing your orders through the platform. |

| Exchange | It is a place (centralized or not) where digital assets are traded. | To buy and sell cryptocurrencies or other assets directly between peers. |

While brokers are regulated, many exchanges operate without oversight. That’s why it’s important to check whether a trading platform connects to a trusted broker or works independently. The security of centralized exchanges is important too; they are usually under stricter control and offer better protection for your funds.

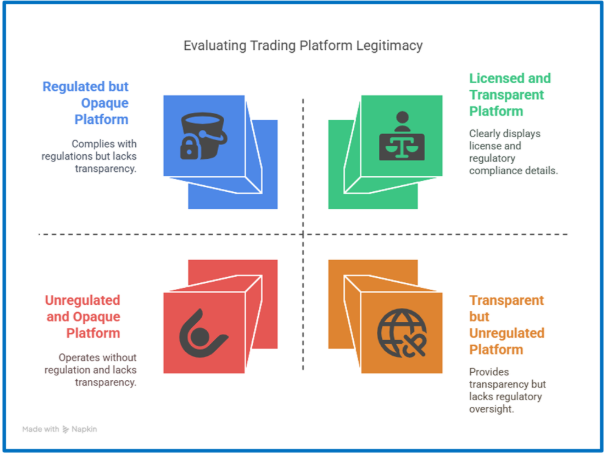

What Defines a Secure and Legitimate Trading Platform?

Before committing funds, check if the platform works transparently. Reputable services are regulated, show legal details clearly, and make terms easy to review. If access is limited or the setup looks like a high-risk wallet, it’s worth thinking twice before moving forward.

Here are 7 elements that define a legitimate trading platform:

1. License Number and Regulatory Authority Clearly Stated

A legitimate trading platform should be under official supervision. This usually means holding a license issued by a recognized body such as Spain’s CNMV, the UK’s FCA, or the U.S. SEC.

This license number is typically found in the website’s footer or sections like “Legal Notice” or “Regulatory Information.” If it’s not there or if it references a different company, it may be worth investigating further. You can always confirm the license number directly on the regulator’s official website.

2. Legal Section Accessible from the Main Menu

Well-established platforms are transparent about their policies. They make documents such as terms and conditions, privacy policies, risk disclosures, and legal statements easy to access.

Beyond meeting regulatory requirements, this gives users a clearer picture of how their data is used, how funds are managed, and under what terms they can operate.

If this information is incomplete, poorly translated, or difficult to find, it’s worth considering other alternatives.

3. Information About Fund Custody and Account Segregation

Account segregation refers to the practice of keeping client funds separate from a company’s operational accounts. This measure is required in many countries to protect users from abuse of their capital.

It’s also helpful to know which bank or financial institution is in charge of holding the funds. Reliable platforms usually say this information clearly, offering greater confidence about where your money is kept and who oversees its custody.

4. Clear Fee Structure and Transparent Pricing

A trustworthy trading service is open about how it charges for its operations. You should be able to see, without effort, what you’ll pay for opening a position, keeping your account active, or requesting a withdrawal. This often includes per-trade charges, spreads on assets like foreign currencies, and inactivity penalties.

If these details are hidden or difficult to access, it is a warning sign. Some services with poor reputations use unclear pricing as a tactic to delay withdrawals or justify unexpected account restrictions.

5. Demo Access Without Payment Information

Reputable services often let demo accounts without asking for a credit card or banking details. This allows you to get familiar with the interface, test trading features, and explore functionalities, without risking any funds.

When no upfront payment is required, it shows the provider is more interested in giving people a real opportunity to explore the service rather than pushing for immediate deposits.

6. Active and Accessible Support Channels

A visible, responsive support team is a sign that the service values its users. Reliable providers typically give multiple contact options, such as live chat, email, phone support, or contact forms built into the site.

Many also include updated help centers with practical guides and FAQ sections. If you send a question and receive no meaningful response within a day or two, or if replies feel automated and unhelpful, it may be time to reconsider whether the service is operating responsibly.

7. Legal Presence That Can Be Verified

Legitimate services make their legal identity clear. When visiting a website, look for the full company name, business registration number, tax address, and the regulatory agency overseeing their activity.

Some suspicious providers operate under unclear names or list addresses that can’t be matched with any official business records. To double-check this, you can consult national registries such as the CNMV in Spain or the FCA in the UK to confirm whether the information is valid and up to date.

8. Independent Reviews That Reflect Real Experiences

Along with what the service says about itself, it helps to read what users are sharing on trusted third-party sites. Platforms like Trustpilot, Google Reviews, or Forex Peace Army often reveal recurring issues, such as problems with withdrawals, a lack of support after an incident, or sudden account restrictions.

Reading these reviews is also a reminder that trading always carries risks. For example, a public news report from IG shows that 71% of U.S.-based traders using products like CFDs or spread betting end up losing money. This type of disclosure is required by regulators to help users better understand the risks involved.

Have questions about dealing with scams? Contact us for support.

Who Supervises and Controls Trading Activities?

Trading services are expected to operate under the supervision of financial authorities. These entities exist to protect investors and verify that platforms follow established regulations.

- For example, the SEC (Securities and Exchange Commission) handles this role in the United States. In Europe, oversight may come from the FCA (UK), CNMV (Spain), or AMF (France).

Being listed with one of these organizations means the trading platform has passed technical reviews, follows proper fund management protocols, and agrees to regular audits. If anything goes wrong, these bodies have the power to investigate, issue penalties, or even shut the operation down.

How Many Types of Trading Platforms Exist?

Many people associate trading platforms with mobile apps or desktop tools for stock trading. However, two main categories follow different operating models: commercial platforms and proprietary ones. Understanding how each works can help you choose a setup that matches your trading preferences.

1. Commercial Platforms

These platforms are built by third-party developers and work with a variety of brokers. Some well-known examples are MetaTrader 4, MetaTrader 5, and cTrader. They are built to support technical analysis, automated strategies, historical testing, and a wide range of assets.

🛡️Benefits of Using Commercial Platforms

- Built-in tools for charting and technical analysis.

- Compatible with more than one broker.

- Access to active user networks and learning materials.

📌Things to Keep in Mind

- Getting started may take some practice.

- Certain features depend on what the broker allows.

2. Proprietary Platforms

These are created by the broker itself and can only be used within their trading environment. Each one has its layout, functions, and setup. Some examples include eToro, Robinhood, and TD Ameritrade.

🛡️Benefits of Using Proprietary Platforms

- User-friendly layout for easier navigation.

- Seamless connection with the broker’s services.

- Dedicated support for platform-related questions.

📌Things to Keep in Mind

- Only work with the broker who developed them.

- May offer fewer technical tools than third-party platforms.

Popular Trading Platforms Compared

Trading platforms change in what they provide. Some are built for advanced charting and technical strategies, while others prioritize simplicity or mobile access. Here’s a quick comparison of popular used platforms:

| Trading Service | Key Features | Best Fit For |

| MetaTrader 4 (MT4) | Customizable layout, support for personalized indicators, and automated trading with expert advisors. | Traders use technical analysis or algorithm-based strategies. |

| eToro | Streamlined design, social trading features, and a strong focus on stocks and crypto. | Beginners or users who prefer mobile access. |

| Interactive Brokers | Wide asset selection, professional-grade tools, competitive pricing, and solid U.S. oversight. | Experienced investors and active traders. |

| TradingView | Visually rich charts, scripting capabilities, and integration with various brokers. | Visual learners and users who track market trends. |

How to Choose the Right Trading Service?

Choosing a trading platform is about more than just visuals or brand popularity. It depends on how you trade, the types of assets you work with, and how much time you can spend on research. Skipping the details might lead to fees you didn’t expect, limited functionality, or features you don’t need.

1. Based on Your Profile

- If you’re new to trading: It’s better to start with a platform that keeps things simple. Look for basic charting tools, intuitive navigation, and a demo account. Services like eToro offer mobile access, helpful educational content, and avoid unnecessary complexity.

- If you focus on technical strategies: You’ll likely want access to advanced charting tools, customizable layouts, and automation features. MetaTrader 4/5 and TradingView are both strong options for this approach.

- If you invest for the long term: For strategies based on holding assets over months or years, choose a service that provides access to international stocks, ETFs, bonds, or funds. Interactive Brokers offers all of these, along with competitive pricing.

2. Key Factors to Review

- Fees: Check whether there are charges for opening or closing trades, inactivity, or withdrawals. Some providers include costs in the spread (the difference between buying and selling prices).

- Assets available: Make sure the platform supports the markets you’re interested in crypto, commodities, or specific equities, before you register.

- User experience and access: Can you trade from a mobile device without losing important features? Is there both an app and a web version? Does the service offer a demo account with no payment required?

- Customer support: A responsive team in your language can help avoid issues when timing matters. Look for live chat, email contact, and an updated help center.

- Security audits for exchanges: Check whether the exchange undergoes regular security audits. These reviews help ensure user funds are protected and that the platform meets current cybersecurity standards.

How Can You Avoid Fraud on Trading Platforms?

As online trading becomes more common, so do efforts to trick new users. Fake platforms often rely on well-crafted tactics to look reliable. Here are some warning signs and steps you can take to protect yourself:

- Be careful of “guaranteed returns”: Any platform that promises fixed profits or daily income is likely trying to trick you. Trading always involves risk, so if something sounds too good to be true, it usually is.

- Avoid clicking on unfamiliar links: Links sent via social media, WhatsApp, or mass emails often lead to fake sites designed to collect your information. It’s safer to type the platform’s name directly into your browser and use the official website.

- Read user reviews before signing up: Sites like Forex Peace Army or Trustpilot let you see what others have experienced. If you come across multiple complaints about account freezes, withdrawal problems, or poor support, it may be best to choose another option.

- Check the license and regulatory details: Reliable platforms mention the authority that supervises them. You can look this up on the official website of the regulator (such as the FCA, CNMV, or SEC). If you can’t find the company’s name, take it as a serious warning.

- Don’t share documents without checking the site: It’s normal to be asked for ID during account setup. However, before uploading anything, make sure the website has a security certificate (HTTPS) and belongs to a registered business.

Making Informed Choices Helps You Trade More Safely

Choosing the right trading platform is one of the best ways to protect your data, your time, and your peace of mind. That’s why knowing how to spot legitimate trading services, recognize warning signs, and understand your trading style can help you make safer decisions.

At Cryptoscam Defense Network, we support people like you in identifying real signs of risk. Our work goes beyond fraud— we help you understand how other types of scams work in the crypto world, such as DeFi wallet scams and phishing attacks.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.