Over the last decade, the world of cryptocurrency has experienced explosive growth in innovation, opportunity, and, unfortunately, scams. These scams often promise high profits with little or no risk, using money from new users to pay earlier investors. Many people lose their investment before realizing what is happening.

One case that has caught a lot of attention is the Bitcoin Code scam. It appears to be an automated crypto trading platform, but it shows many signs of a typical Ponzi scheme. In this post, we’ll explain how these fraudulent platforms work and why these kinds of trading schemes should be approached with care.

Need support after a scam? Join our community today.

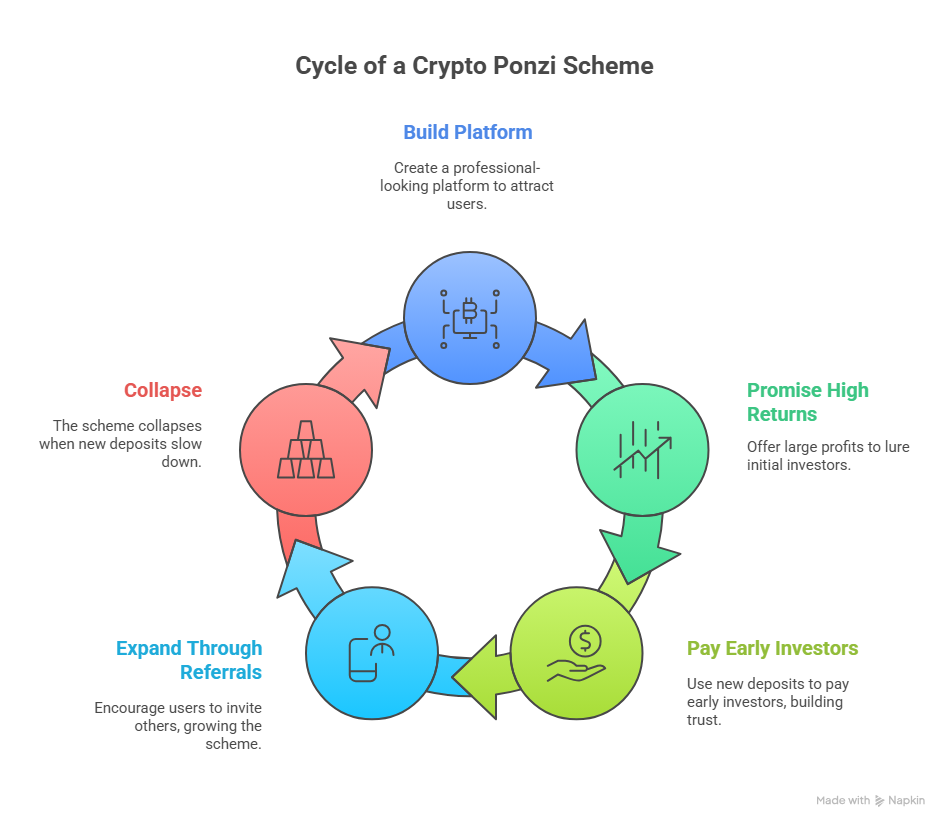

How Ponzi Cryptocurrency Schemes Work?

Ponzi schemes in crypto are built to look legitimate. They use popular buzzwords like AI trading, blockchain automation, and passive income, but their main idea is always the same: new users pay old users.

How a Ponzi Cryptocurrency Scheme Works?

- Build a Trustworthy-Looking Platform: Scammers create a clean, modern-looking website or app. They may pretend to use advanced technologies like AI bots or automated crypto trading systems. Everything is designed to seem professional and easy to use.

- Promise High Returns to Attract Users: The scheme offers large and consistent profits, often with minimal effort. These promises help attract early investors and build initial momentum.

- Pay Early Investors with New Deposits: At first, some users are paid out, using money from new users. This creates the illusion of a working investment platform and builds trust. The system seems to work, but no real profits are being made.

- Expand Through Word of Mouth: Happy investors frequently invite friends and family. The scheme rewards referrals, which helps it grow faster. In some cases, influencers or affiliates are paid to promote the platform.

- Collapse When New Money Slows Down: At some point, the number of new deposits drops. The system runs out of funds and can’t continue. Withdrawals are blocked, and the platform disappears, along with user funds.

Have questions about dealing with scams? Contact us for support.

How to Spot a Ponzi Cryptocurrency Before You Invest?

Before putting money into any crypto platform, it’s important to know the warning signs. Most Ponzi cryptocurrency schemes follow the same patterns, and spotting them early can save you from serious losses.

- Guaranteed Profits with No Risk: If a platform promises fixed returns, 2% per day or $1,000 daily, regardless of market conditions, it’s almost certainly a scam. Real crypto trading includes risk; no one can guarantee profits.

- No Clear Information About Who Runs It: Legit platforms usually share details about their team, legal registration, and physical office. If you can’t find any real names, companies, or contact info, that’s a major red flag.

- Pressure to Act Fast: Ponzi scams often use fake urgency, like countdown timers, limited spots, or last chance messages, to push you into quick decisions without research.

- No Real Product or Service: If the platform only talks about profits, but doesn’t offer a real service or explain how it works, that’s a big warning sign. Many will mention trading bots or arbitrage, but offer no proof of real services.

- Encouraging You to Recruit Others: Many Ponzi schemes rely on referral programs. If you’re earning more by inviting people than from your actual investment, it’s likely a scam.

- Difficult or Delayed Withdrawals: When users can deposit instantly but face delays or excuses when withdrawing, it’s usually the beginning of the end.

Want to go deeper? Read our guide on how to spot a credible crypto before investing in any platform.

Real Crypto Scams That Followed the Ponzi Model

Crypto history is full of big crypto scams that started like any other great opportunity. These real cases demonstrate how Ponzi cryptocurrency schemes operate and how platforms like the Bitcoin Code scam follow similar patterns.

1. BitConnect

BitConnect promised users daily profits through a trading bot that supposedly made money off Bitcoin’s volatility. The platform offered a transparent investment program and a generous referral system.

- At its peak, BitConnect had a market cap of over $2.5 billion.

- In 2018, the platform suddenly shut down. Investors lost nearly all their funds.

- Authorities later confirmed it was a Ponzi scheme. Key promoters were charged with fraud.

2. PlusToken

PlusToken was a wallet and investment app that targeted users in Asia, especially China and South Korea. It promised rewards for holding crypto in the app and referring others.

- Over 2 million users were affected.

- The scheme collected more than $2 billion in crypto.

- In 2020, several organizers were arrested and sentenced in China.

3. FX Winning

FX Winning presented itself as a professional forex and crypto trading platform offering guaranteed returns. The company grew rapidly through aggressive affiliate marketing, especially in Spain and Latin America.

- The platform attracted over 15,000 users across more than 30 countries.

- In mid-2023, it froze withdrawals and cited vague technical and banking issues.

- In 2025, Spanish authorities estimated losses of over €460 million and arrested key operators. Legal investigations are ongoing.

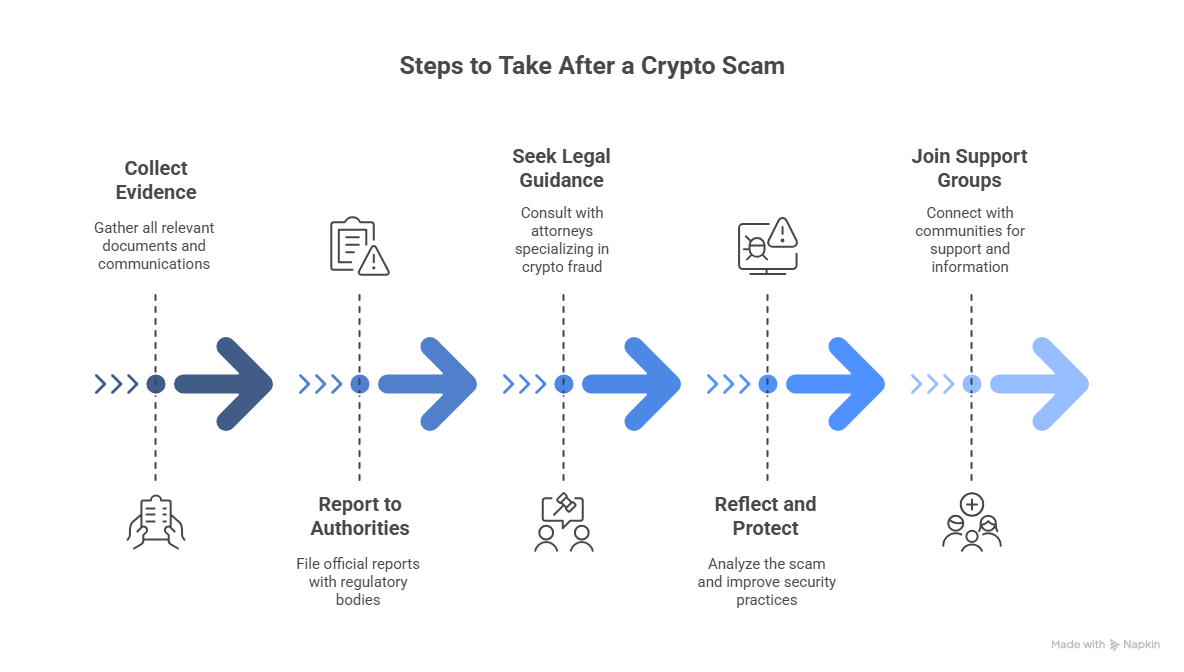

What to Do If You’ve Been Scammed

Recovering funds after a crypto scam requires fast, informed action. These steps can help protect your rights and improve your chances of recovering assets lost in a Ponzi cryptocurrency scheme:

1. Collect All Evidence

Gather as much detailed information as possible to support future reports, fraud investigations, or legal actions. This will also help demonstrate the pattern of the scam.

- Save screenshots of your transaction history, account balances, emails, and chat messages.

- Keep records of wallet addresses, blockchain transaction IDs, deposit confirmations, and login credentials.

- Document any communication with platform representatives, affiliates, or support channels.

2. Report the Scam to the Authorities

Official reports are required to open investigations and connect your case with others. Even if recovery isn’t immediate, reporting fraud helps disrupt the scam’s operation.

- In the U.S., report to the SEC.gov, Reportfraud.ftc.gov, or the FBI’s ic3.gov

- International users should contact their country’s financial regulator or cybercrime unit.

- Use platforms like Chainabuse, CipherTrace, or Whistleblower networks to flag blockchain-based fraud.

3. Seek Legal and Financial Guidance

Legal support can clarify your options, especially if group litigation or recovery programs are available in your region.

- Consult licensed attorneys with expertise in crypto and fraud cases.

- Join class-action lawsuits where applicable.

- Avoid companies that demand upfront fees or promise guaranteed fund recovery; they’re often scams themselves.

4. Reflect and Protect Yourself Going Forward

Understanding how the scam worked is important to building stronger habits as an investor.

- Identify what warning signs you missed, like fake reviews, unrealistic returns, and urgency tactics.

- Choose safe and reliable trading platforms that are licensed, transparent, and well-reviewed.

- Consider using cold wallets to store assets securely and avoid keeping large balances on platforms.

5. Join Support and Action Groups

Being scammed is emotionally and financially stressful. Connecting with others can provide information, updates, and possibly coordinated action.

- Sharing your case can help others avoid the same trap and increase visibility for enforcement agencies.

- Communities like Cryptoscam Defense Network can offer case documentation and fraud awareness education.

Learn to Detect Ponzi Cryptocurrency Scams With Cryptoscam Defense Network

Ponzi cryptocurrency schemes continue to be one of the most damaging threats in the crypto space. In 2024, according to Digwatch, the FBI reported over $9.3 billion in cryptocurrency fraud losses in the United States alone: a 66% increase from the previous year. These scams are becoming harder to detect, and trusting the wrong platform can cost you everything.

Staying safe means verifying every opportunity, avoiding pressure tactics, and recognizing unrealistic promises. At Cryptoscam Defense Network, we help you stay free of fraud through education, alerts, and real case analysis, so you can protect your assets before problems start, not after.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Frequently Asked Questions (FAQs) About Ponzi Cryptocurrency Schemes

What is A Ponzi Cryptocurrency Scheme?

A Ponzi Cryptocurrency scheme is a fraudulent investment scam that uses the hype around cryptocurrencies to attract people with promises of high returns. It works like traditional Ponzi models: early investors are paid with money from new ones, and the system eventually collapses when fresh deposits stop.

What is the Recovery Rate for Investors in These Scams?

Recovery rates in crypto Ponzi schemes are generally very low. Scammers often use blockchain evasion tools like mixers and operate across multiple international jurisdictions, making it extremely difficult for authorities to trace or retrieve stolen funds. As a result, most victims never recover their investments.

Why is Research and Education Critical When Investing In Crypto?

Being informed helps consumers recognize warning signs, avoid impulsive decisions, and choose trustworthy platforms. Investors should verify that services are regulated and consult credible sources such as the DFPI, SEC, or organizations like the Cryptoscam Defense Network, which offer resources and support for identifying fraudulent crypto activity.

Photos via Freepik.