Trust is a delicate issue in the crypto space, especially with stablecoins. Recent reports from Reuters revealed that Tether has issued over $140 billion, yet it is only now working on a full audit. From this, one clear question comes up: Are all stable coins trustworthy?

In this post, we’ll explain what stablecoins are and review the different types currently in use. We’ll also explore how to evaluate their reliability, examine the role of regulators, look at which ones have built more trust over time, and share useful tips to protect your money when including them in your crypto strategy.

Need support after a scam? Join our community today.

What Are Stablecoins?

Stablecoins are digital currencies built to maintain a steady value, usually compared to assets like the US dollar, the euro, or gold. They’re often viewed as a middle ground between traditional finance and the crypto world, helping reduce the price fluctuations in other tokens.

Each coin should be backed by assets of the same value, like fiat currency, crypto holdings, or even physical goods. This support helps keep their price stable, making them useful for payments, savings, and sending money directly to others.

Why Are They Becoming So Popular?

- They make cross-border transactions fast and simple.

- They’re frequently used across DeFi protocols for lending, trading, and yield generation.

- They offer an option for preserving value in unstable economic contexts.

In practice, many freelancers in the U.S. who work with global clients now choose to get paid in USDC or DAI. It helps them avoid traditional bank fees and gives them immediate access to their funds, free from third-party delays.

The global momentum is clear. According to Inc., the total market cap for stablecoins hit a record $251.7 billion, marking a 22% increase in 2025. This growth shows how they’re playing a bigger role in today’s crypto economy.

Are All Stable Coins Trustworthy: 3 Factors to Consider

Not all stablecoins offer the same level of confidence. Some inspire trust early on, while others bring up more questions. To decide if a digital currency is reliable, it’s worth looking past the name and evaluating a few essential aspects. That’s where the question “Are all stable coins trustworthy?” becomes more than useful.

1. Are the Audits Truly Independent?

Audits confirm if reserves are real, but they only carry meaning when done by an independent, qualified firm. Internal reports fall short compared to third-party reviews that follow professional standards. The same goes for security audits for exchanges, which show how platforms handle risk, particularly those that support stablecoins.

- Example: USDC, issued by Circle, shares monthly reports reviewed by Grant Thornton, a well-known audit company. These records show exactly how much value each token supports.

2. What Backs the Stablecoin?

The reserve backing is what helps keep a stablecoin’s price steady. This can include cash, government securities, crypto, or physical goods. What truly matters is that the assets are available, easy to verify, and aligned with the amount of tokens in use.

- Example: PAX Dollar (USDP) holds its reserve in cash and U.S. Treasuries. It also publicly releases the details monthly, giving users a clear view of its financial base.

3. Is the Stablecoin Actively Used?

Adoption matters. A stablecoin that’s supported by wallets, exchanges, and decentralized apps usually earns more credibility. More usage leads to stronger liquidity and easier transfers, which can be essential in fast-moving environments.

- Example: DAI is present on many major DeFi platforms like Uniswap, Aave, and MakerDAO. That presence makes it easy to move, trade, or store with few restrictions.

4. Who Issues It & Are They Transparent?

Transparency is not optional in the crypto world. A trustworthy stablecoin should openly share who manages it, under what rules it works, and where it’s registered. When the issuer is known and subject to regulation, users have a clearer picture of the risks involved.

- Example: GUSD (Gemini Dollar) falls under the supervision of the New York Department of Financial Services. This involves detailed reporting and legal compliance that users can rely on.

What Are the Main Types of Stablecoins?

The stablecoin ecosystem has expanded with multiple designs, and not all of them work the same way. This diversity matters when trying to answer a question many people share: Are all stablecoins trustworthy? The level of confidence changes depending on how each token is structured and how much risk it carries.

Here are the four main types of stablecoins and what you should know about each one:

1. Fiat-Backed Stablecoins

These are tied to traditional currencies like the US dollar or the euro and maintain their value through bank-held reserves. Tokens like USDT and USDC give a sense of operational stability, but still depend on centralized institutions to handle those funds.

- What’s the Advantage? Since they’re tied to a relatively stable currency, price fluctuations are not significant. This makes them useful for sending money, preserving value, or handling international payments without the sudden ups and downs typical of other digital assets.

- What’s the Risk? The actual reserves depend on how transparent the issuing company is. Tether, for example, has been questioned over the lack of consistent and full audits. USDC, by contrast, publishes routine reports, which help build more confidence between users.

2. Commodities-Backed Stablecoins

In this case, the reserves are held in physical assets like gold or real estate. These coins are less common, but they offer backing that’s tangible. A well-known example is PAX Gold (PAXG), which reflects the value of real gold.

- What’s the Advantage? Being linked to timeless resources like gold offers some shelter in uncertain economic environments. These tokens act like a digital version of holding valuable goods without the complications of physical storage.

- What’s the Risk? They tend to have limited market activity and a smaller user base, which makes the biggest transactions less common. Liquidity can also be an issue, meaning it might be harder to buy or sell in high volumes without affecting the price.

3. Crypto-Backed Stablecoins

These rely on other cryptocurrencies as collateral. One popular example is DAI, managed by the MakerDAO protocol, which keeps its fixed value using reserves in assets like Ether (ETH).

- What’s the Advantage? These systems don’t rely on intermediaries. Anyone can view the collateral and how it’s being managed in real time. This model attracts users who prefer open access and decentralized control.

- What’s the Risk? Their safety depends on assets that can be extremely volatile. If those reserves lose value quickly, the system needs to add more collateral or liquidate positions. That exposure makes them more sensitive during market downturns.

4. Algorithmic Stablecoins

This model doesn’t use reserves in fiat, crypto, or physical goods. Instead, it focuses on programmed algorithms to expand or adjust the supply based on market activity, trying to keep the price stable.

- What’s the Advantage? The entire system runs on automation. It doesn’t lean on banks or custodians, and the response to market movements happens within the rules set by the code itself.

- What’s the Risk? Since there’s no actual backing, their value depends completely on the algorithm working under any conditions. An example of this is the 2022 collapse of TerraUSD (UST), which ended in billions of dollars in losses and a general lack of confidence in this model.

Have questions about dealing with scams? Contact us for support.

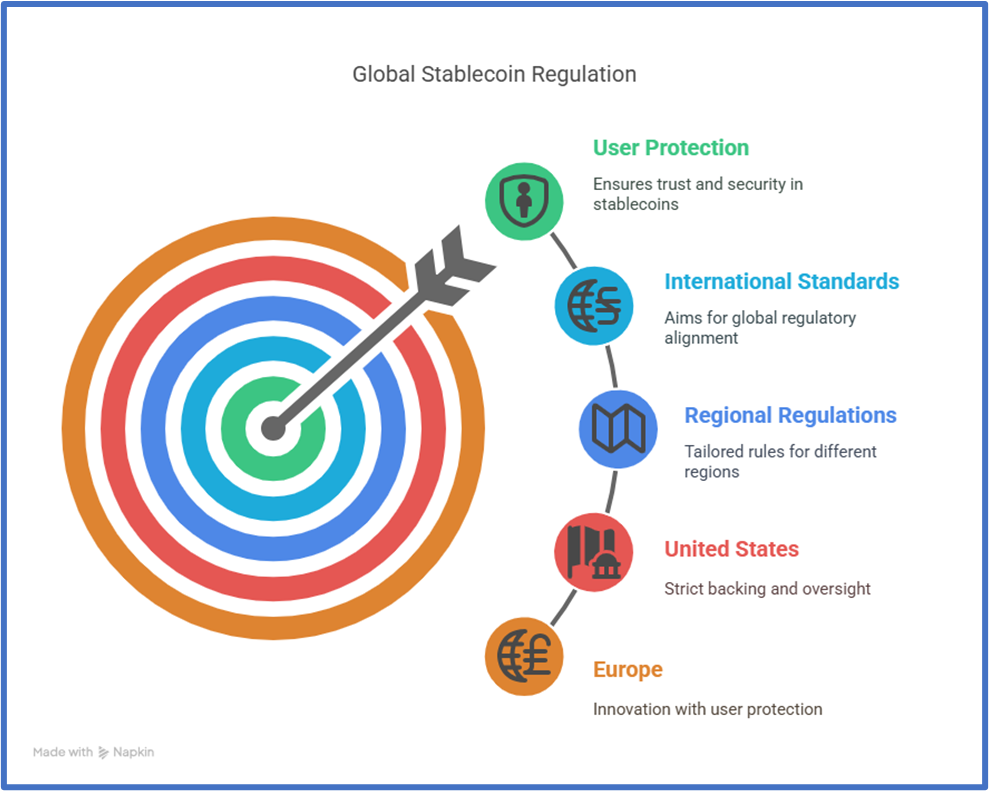

Who Regulates Stablecoins?

Regulatory efforts vary depending on where the coin circulates. If you’ve been wondering if all stablecoins are trustworthy, looking at the rules that apply in each region can help clarify things.

1. United States: Creating Regulatory Structure

Until recently, U.S. regulations were split across different agencies. The GENIUS Act now requires each stablecoin to have a one-to-one backing with liquid assets like dollars or Treasury bills, along with monthly updates on reserves.

- The SEC checks if certain coins fall under securities law.

- FinCEN maintains anti-money laundering rules.

- The Federal Reserve and OCC may also step in regarding licensing and custody.

2. Europe: Balancing Innovation and Regulation

The EU is moving forward with MiCA, a set of rules that promotes innovation while protecting users. Some member states are also preparing to launch a digital euro to reinforce local currency control.

- Issuers must hold a license and register within the EU.

- Reserves must be liquid, transparent, and not algorithm-based.

- Circulation limits help protect financial stability.

3. Latin America: Progress with Uncertainty

In this region, each country handles things differently. Most rely on modified banking laws instead of new rules specifically related to crypto. That opens the door to more risk unless each project is reviewed carefully, especially when tokens like meme coins gain popularity without proper controls.

- Some allow stablecoins for payment use, but without legal status as currency.

- Many issuers aren’t locally registered or supervised.

- There’s a high reliance on foreign platforms, which makes enforcement harder.

What Does This Regulatory Variety Mean?

- Lack of international alignment: Despite efforts in the U.S. and Europe, there’s still no shared standard. Some coins can operate with almost no checks in place.

- Adoption by large companies: Firms like Visa and Walmart are testing stablecoin transactions, which puts extra pressure on regulators.

- Better protection for users: Requirements for transparent backing and regular audits help build trust over time.

The 9 Popular and Trusted Stablecoins in 2025

Stability is the core promise behind stablecoins. However, not all of them share the same level of support, regulatory control, or adoption. That’s why evaluating each one on its own terms matters.

If you’re thinking about using stablecoins, it helps to know which ones people trust. Here are some of the most recognized options in 2025, and why they’ve earned user confidence:

1. Tether (USDT)

One of the most transacted stablecoins globally. It’s supported by a variety of assets, though the exact composition has raised frequent questions.

- Strong side: Widely accepted, with instant liquidity across nearly all exchanges.

- Weak point: Past concerns due to the absence of consistent full-scale audits.

2. USD Coin (USDC)

Issued by Circle, this stablecoin is backed by reserves held in cash and U.S. Treasuries, with third-party verification.

- Strong side: Transparent reporting, with statements reviewed by established external firms.

- Weak point: Its circulation is lower than USDT, which can limit availability in certain regions.

3. Dai (DAI)

Runs on Ethereum and keeps its value by locking in more crypto than the coin is worth, all managed by smart contracts.

- Strong side: Fully decentralized governance.

- Weak point: Price stability depends on the market behavior of its collateral, which brings technical risk.

4. TrueUSD (TUSD)

Focuses on real-time reserve transparency, using automated verification tools that offer updates minute by minute.

- Strong side: frequent access to live reserve reports.

- Weak point: Lower circulation compared to the best-known stablecoins.

5. Paxos Standard (USDP)

Operates under the New York Department of Financial Services. Its reserves are entirely held in U.S. dollars. Paxos Trust Company, the issuer, adheres to strict financial controls.

- Strong side: Clear legal structure and continuous regulatory supervision.

- Weak point: Limited presence in DeFi protocols and less visibility outside the United States.

6. Gemini Dollar (GUSD)

Launched by the Gemini exchange, this coin is licensed and regulated by the state of New York. Its reserves are held by approved banks and custodians, adding extra layers of fund security.

- Strong side: Built under legal frameworks that demand high standards in custody and asset management.

- Weak point: Low trading volume and limited use outside the Gemini platform.

How To Protect Your Stablecoin Investment?

As the use of stablecoins grows quickly, it’s more important than ever to keep your money safe. In a space where whether all stablecoins are trustworthy keeps coming up, following a few smart habits can help.

Here are a few tips to avoid common risks and use stablecoins with more confidence:

- Choose Audited and Established Stablecoins: Prefer those that publish public, third-party audit reports. Avoid tokens with unclear structures or no verifiable track record, as they may expose you to unexpected losses.

- Use Trusted Wallets: Keep your assets off centralized exchanges to avoid hacks, blocked withdrawals, or exposure through a high-risk wallet. A cold wallet or multi-signature setup keeps your stablecoins under your control and adds an extra layer of security.

- Avoid Storing Big Amounts on Exchanges: Even if they seem convenient, exchanges remain vulnerable to shutdowns, fraud, or cyberattacks. If you’re using stablecoins for savings, use regulated platforms and limit how much you keep there.

- Divide Your Holdings in Multiple Stablecoins: Each type has its weak spots. One may fail an audit; another may face liquidity problems. Diversifying between regulated, decentralized, and transparent options lowers the risk if one fails.

Safe Stablecoins: Decisions Backed By Facts

The answer to “Are all stable coins trustworthy?” isn’t always simple. As we’ve explored throughout this guide, safety levels vary depending on how each project is structured, managed, and funded. Looking into what supports a stablecoin is essential, especially when your money is on the line.

At Cryptoscam Defense Network, we offer advice and information on risks like fake investment offers, identity impersonation, and protecting your social media accounts from hackers. Want to stay ahead of digital threats? We’re here to help you do it safely and confidently.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.