Launching a crypto trading platform without a crypto exchange license can expose your business to risks that are often ignored. According to Cointelegraph, only 14% of the largest crypto exchanges currently work under an official license issued by a regulatory body.

In this post, we explain what a crypto exchange license is, why it plays a role in your growth strategy, and what conditions regulators usually request. We also explain the process to legalize your exchange and address questions that may help you avoid future challenges.

Need support after a scam? Join our community today.

What Is A Crypto Exchange License?

A crypto exchange license is an authorization granted by a regulatory authority that certifies a digital asset exchange or crypto trading platform is legally established and complies with applicable local laws. This certification shows that the company complies with a set of technical, financial, and legal obligations.

With this type of cryptocurrency license, a platform may:

- Offer cryptocurrency buying and selling services

- Facilitate crypto-fiat currency conversions

- Provide fund custody solutions

- Access payment gateways and partner with financial institutions

- Collaborate with service providers that require a licensed status

What Are The Benefits Of A Crypto Exchange License?

Operating with a crypto exchange license brings more than regulatory alignment. It positions your platform with a meaningful edge, especially when working to grow steadily and gain recognition from institutions.

This legal framework also supports the integration of crypto intelligence tools that improve blockchain compliance, user protection, and operational reliability. These are some benefits:

- Builds stronger user confidence.

- Authorizes the platform to provide financial services backed by law.

- Opens doors to partnerships with banks and licensed service providers.

- Helps reduce exposure to fraud and illegal operations.

- Creates better conditions to attract institutional investors and secure funding.

A clear case is Coinbase, which works under New York’s Bit License. That authorization has been crucial to maintaining consistent banking relationships, listing on the stock exchange, and operating seamlessly in one of the world’s most regulated environments.

What Are The Requirements For A Crypto Exchange License?

Getting a crypto exchange license means complying with regulatory obligations that change by country, but usually include common elements. Here is a clear and structured list of what’s typically required:

1. Minimum Capital

Minimum capital is a financial guarantee used to cover operational risks or unexpected losses that could impact users. This requirement also helps demonstrate the project’s reliability and financial strength to regulators.

The amount may change, but it often depends on factors like:

- The type of services your exchange will offer, such as spot trading, derivatives, and custody.

- The platform’s ability to retain client funds.

- The expected monthly trading volume.

- The financial and technical infrastructure available.

2. KYC and AML Systems

KYC (Know Your Customer) and AML (Anti-Money Laundering) systems are legal procedures designed to verify users’ identities and track financial activity within the exchange. These controls are also key to creating a reliable environment where elements like stablecoins can work with greater transparency.

They are implemented to reduce the risk of illegal conduct, including money laundering. Regulatory frameworks require platforms to:

- Confirm the identity of every user, using official documents, biometrics, or real-time verification.

- Monitor account behavior and flag suspicious transactions.

- Report unusual activity to the appropriate crypto regulation authority.

3. Internal and External Audits

Internal and external audits are regular reviews conducted to confirm if an exchange complies with the accounting, operational, and security standards required by its crypto exchange license. They are especially relevant in the context of security audits, as they demonstrate how platforms protect user data and financial activity.

These audits allow regulators to better understand how the platform works day to day. They usually cover areas such as:

- The exchange’s financial position, operational balances, and reserve status.

- Cybersecurity measures to prevent breaches and protect sensitive data.

- Implementation of verification processes, including KYC and AML systems.

- Incident management procedures and internal risk controls.

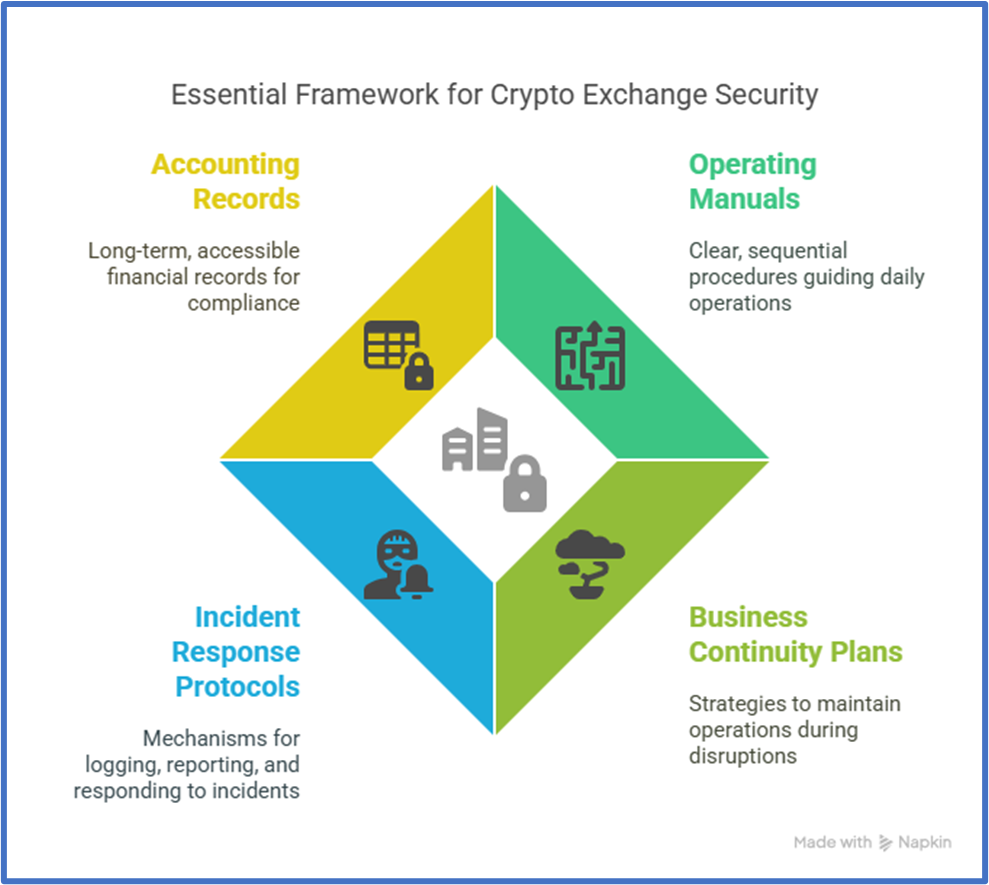

4. Internal Policies and Risk Controls

Internal policies and risk controls help structure daily operations in a safe and compliant way, as required by a crypto exchange license. They are especially important to prevent issues seen in some of the most famous fraud cases in crypto, where weak controls led to major financial losses.

These elements are examined during the license approval process and may be audited at any time. Common components include:

- Operating manuals describe internal procedures in clear steps.

- Business continuity plans for system failures, cyberattacks, or unexpected service disruptions.

- Incident response protocols with logs and reporting timelines.

- Accounting records are kept for at least seven years and are available for audit.

Have questions about dealing with scams? Contact us for support.

How To Obtain A Crypto Exchange License?

Starting the process to obtain a crypto exchange license includes more than submitting forms or setting up a company. Regulatory bodies expect platforms to prove operational consistency, financial reliability, and a real commitment to compliance practices. Here are the main steps:

1. A Well-Structured Business Plan

The starting point for applying for a crypto exchange license is a business plan that’s both solid and well-supported. This document shows how the platform will work, what services it will offer, and how prepared it is to maintain those operations over time. A complete plan should cover:

- Description of the operating model

- Will the platform be centralized or decentralized?

- Will it manage customer funds?

- Will it support crypto-to-fiat conversions or just digital asset transactions?

- Service overview

- Cryptocurrency purchase and sale

- Asset custody

- Integrations with wallets or payment gateways

- Advanced trading features, if relevant

- Realistic financial projections

- Estimated income from fees

- Operating expenses

- Profitability scenarios for short- and medium-term timelines

- Market analysis

- Target audience, operating regions, and competitors

- Expected monthly transaction volume

- Regulatory trends that could impact the business model

- Legal and compliance strategy

- Selected jurisdiction and justification

- Regulatory framework to be followed from day one

- Implementation plan for KYC, AML, and internal audit processes

2. Complete Legal Documentation

To obtain a crypto exchange license, you must gather documents that verify your company’s legal formation, the legitimacy of its funds, and the identity of its founders. This stage is often one of the most sensitive in the entire process.

Here’s a list of the most important documents that are usually needed:

- Company formation documents

- Legal name, business purpose, registered address, and shareholder structure

- Country of incorporation and official registration

- Founder information

- Copies of passports or valid government-issued IDs

- Proof of address and relevant work history

- Criminal background checks (if applicable, depending on the country)

- Proof of funds

- Previous contracts, bank statements, or investor letters

- Clarification of initial capital contributions and investor backing

- Recent tax declarations from the founding team

- Jurisdiction-specific paperwork

- Official forms from the corresponding regulatory authority

- AML and KYC policy declarations

- Complementary licenses, such as MSB in the U.S. or MiCA in the EU

3. Implementation Of Audits And Internal Controls

Before submitting your crypto exchange license application, platforms should install internal mechanisms that reflect actual operational practices. These steps usually include:

- Internal audits

- Review of current financial statements

- Verification of reserves and liquidity forecasts

- Evaluation of access management systems and user-level permissions

- Operational controls

- KYC and AML process simulations

- Security testing of storage and transaction systems

- Logging of response times during technical incidents

- Preliminary reporting

- Basic documentation to demonstrate traceability of operations

- Simplified financial reports to outline viability

- Sample compliance records as a preview of the full framework

4. Submission To The Regulatory Authority

Once you have collected all technical, legal, and financial documentation, the next step is to submit your official application to the authority responsible in your chosen jurisdiction. Here’s what to keep in mind:

- Full application file

- All official forms are properly completed

- Required attachments: business plan, audits, internal controls, AML/KYC policies

- Certified translations if any documents are in another language

- Administrative fees

- The cost varies by jurisdiction

- It may include review fees, annual renewal charges, or license issuance costs

- Ongoing follow-up

- Assign a contact person to handle communication with the regulator

- Respond promptly to any additional requests

- Keep a record of communications and application updates

What Are the Differences in Crypto Exchange Licenses by Region?

Choosing the right region to apply for a crypto exchange license requires more than comparing fees or evaluating how simple the process appears. Each jurisdiction enforces specific rules that can either support or restrict your operations, depending on the services your platform intends to provide.

To help determine which region best suits your project, we’ve prepared a complete comparison of some of the most relevant licenses by area. The table shows requirements, potential benefits, and the primary challenges associated with each jurisdiction.

Crypto Exchange License by Region

| Region / License | Requirements | Advantage | Challenge |

| Europe (MiCA) | Independent audits, compliance with DORA, KYC/AML procedures, and minimum reserves based on service type | Access to all 27 EEA countries | Long approval timelines and complex paperwork |

| U.S. (BitLicense, MSB, FinCEN) | Registration with FinCEN, compliance with BSA, high capital, and compliance standards under BitLicense | Strong global reputation and appeal to institutional clients | High costs and multiple filings per state |

| Asia-Pacific | Japan and Singapore require frequent tech updates and regular audits | Tech-driven markets with solid financial ecosystems | Intensive oversight and potential language or cultural barriers |

| Offshore jurisdictions | Simplified procedures, low capital thresholds, and no local office requirement | Easier entry and lower tax pressure upfront | Lower credibility and possible banking restrictions |

What’s the Difference Between Onshore and Offshore Crypto Licenses?

Deciding between an onshore or offshore crypto exchange license can influence both your platform’s reputation and how smoothly operations unfold from day one. Many entrepreneurs are drawn to offshore options due to lower costs and faster setup, yet they often overlook the potential trade-offs.

According to The Economic Times, around 90% of India’s crypto trading volume moved to offshore platforms after the 1% TDS tax was introduced in July 2022. This migration reflects how tax burdens and strict crypto regulation can drive activity toward less supervised regions.

Quick Definitions

- Onshore license: issued in countries with strict regulations (e.g., the U.S., EU, Japan).

- Offshore license: processed in jurisdictions with looser rules (e.g., Seychelles, the Bahamas, pre-reform Estonia).

Before deciding where to apply for your cryptocurrency license, it’s important to understand the differences. Here’s a comparison:

Onshore and Offshore Crypto Licenses: Differences

| License Type | Main Benefits | Known Risks |

| Onshore | Stronger institutional credibility Access to banks and payment processors Legal and tax protections | Higher operational costs Strict audits and technical requirements Complex paperwork |

| Offshore | Faster setup with lower capital Light regulatory burden Tax flexibility | Limited international recognition Banking and compliance risks Potential penalties if jurisdiction is concealed |

What Does It Take to Operate Your Own Crypto Platform?

Operating your crypto trading platform requires more than just obtaining a crypto exchange license. You must also choose the right technology, establish dependable support, and determine how to deliver liquidity and security to users.

1. Technology Options

Here are the main tech options available:

- Third-party licensing: Get a pre-built exchange software system that’s ready for deployment in a few months. These typically come with built-in regulatory tools, monitoring features, and automated updates.

- In-house development: Building your platform from scratch offers complete control but comes with higher costs and longer timelines. This approach is ideal if you plan to implement custom features like peer-to-peer trading or banking integrations.

2. Practical Use Based on Exchange Type

The technology and compliance needs are different if you have a centralized exchange (CEX) or a decentralized exchange (DEX):

- CEX: You’re responsible for customer funds, which requires secure custody systems, external certifications, and ongoing audits.

- DEX: You can reduce custodial responsibilities, but you’ll need to manage smart contract validation, blockchain fees, and governance structures.

Example: AlphaPoint often launches licensed white-label platforms within 10 to 12 months, including full compliance features and local regulatory support.

![Crypto platform operation options: third-party licensing, in-house development, CEX management, and DEX management]](https://cryptoscamdefensenetwork.com/wp-content/uploads/2025/07/AD_4nXfNq-FGM12hvkbcRb6-2Up3PhRjkJJL3vhTbO6Tms9KHzfO3NKRZ4aWvOvrksSDIomgCNy7RcxgQw_NJ2Bm_g0kh1sBb0ZSK8RmeVsz7idMnwPpT78WxX1bUFijBh8feyufbk9ZGQ.png)

Choose Licensed Platforms to Protect Your Crypto

Choosing a crypto platform should start with verifying that it holds a valid crypto exchange license: a platform that follows clear rules for protecting your funds and personal data.

At Cryptoscam Defense Network, we expose fake licensing scams, detect harmful software, and explain how to protect your social media accounts from hackers linked to crypto platforms. Reach out to us, we’re here to support you.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.