Sending money through Zelle may be convenient until the payment is deposited into the wrong hands. According to the Federal Trade Commission, over 330,000 impersonation scams were reported in 2023, and many of those involved payment platforms like Zelle.

In this post, we’ll show you how Zelle business account scams work, what warning signs to watch out for, and what steps you can take to protect your business. With more than 143 million users and over $481 billion transferred in 2023, Zelle has become a frequent target for scammers, according to MarketWatch.

Need support after a scam? Join our community today.

What is Zelle & How Does It Work for Businesses?

Zelle is a digital service that lets you send and receive money in just a few minutes, using only a phone number or email address. While many people use it to split bills or make payments between acquaintances, it’s also become a useful tool for small businesses to get paid.

Unlike other platforms, Zelle moves funds between bank accounts, with no extra fees, provided both sides use a participating bank. That simplicity has led many entrepreneurs to set it up as a quick and convenient payment option for their customers.

What are the Differences Between a Personal Zelle Account and a Business-Use Zelle Account?

Right now, Zelle doesn’t label accounts as “personal” or “business.” What happens is that some banks allow Zelle to be used with business checking accounts. That setup is what people refer to when they talk about using Zelle for business. Here’s how the two types of use typically differ:

- Purpose: A personal account is meant for sending money to friends or family. Business use focuses on customer transactions.

- Recipient name: With a personal account, the user’s name is shown. In business accounts, the company’s name may appear, which builds more trust.

- Access and setup: Only certain banks offer Zelle for business use. It usually requires an extra verification step.

- Service terms: Some conditions vary depending on the account type. Using a personal account for sales might go against bank policies.

⚠️To reduce risks and avoid Zelle business account scams, it’s best to use the type of account that fits your activity.

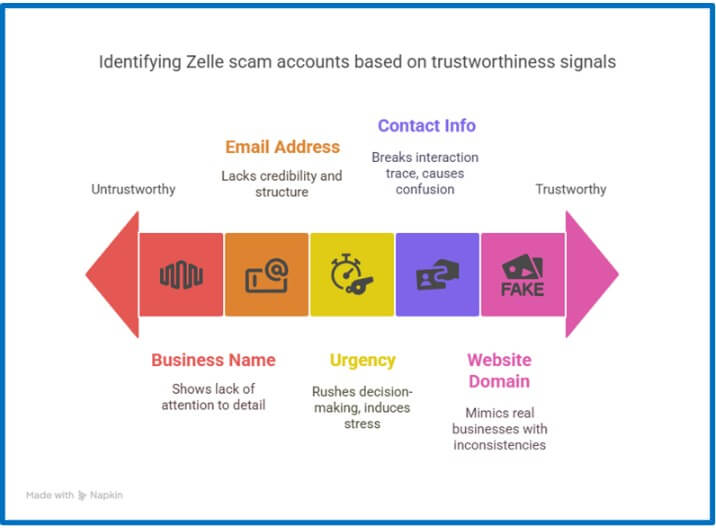

Top 5 Signs of Zelle Business Account Scams

As more businesses start using this platform, fraud attacks have become more sophisticated. In many cases, Zelle business account scams begin with small signs that are easy to ignore. Here are five of the most common signs:

1. Business Name with Spelling Errors

Legitimate businesses pay attention to how they present themselves. Their name, logo, and how each word is written reflect their reputation. So, if you come across typos, all caps, or names that look like imitations of well-known brands, take it as a warning.

These mistakes are typical of fake accounts pretending to represent real companies. It’s also common to see names that feel overly generic or intentionally similar to existing brands, with just a minor variation to confuse the recipient.

2. Non-corporate Email Addresses

Most real companies use emails like @companyname.com. It shows they’re legit and have an actual business. If someone messages you from a @gmail.com, @yahoo.com, or @outlook.com address and wants to do a Zelle transaction, it’s a good idea to double-check before doing anything.

Many Zelle scams use personal email accounts to pretend they’re from well-known companies. They might copy logos or write like a real brand, but the email isn’t official. If something feels off about the address, take a moment to check who you’re dealing with.

3. Pressure to Complete the Sale Quickly

Artificial urgency is a common move in Zelle business account scams. Scammers tend to apply pressure right away. Phrases like “only today,” “selling out fast,” or “you’ll lose it if you wait” are meant to add stress and rush your decision.

In a legitimate sale, it’s normal to have time to review details, ask questions, and double-check the offer. If you’re being rushed to pay, there’s likely a reason they don’t want you to look closer.

4. Contact Info Changes Without Explanation

A real business usually keeps things consistent. If the person suddenly changes their number, email, or profile without a clear reason, it’s something to watch out for. This kind of switch can be a sign that something’s not right, especially if you’re talking about sending money through Zelle.

Scammers often say there was a phone issue or that you’ll now talk to someone else on the “team.” These changes are meant to confuse you. If this happens right before they ask for payment, or their tone suddenly feels off, take a moment to double-check who you’re talking to.

5. Messages From Unofficial Domains

Scammers often send emails or create websites that look like real businesses, but with small changes. At first, everything seems fine. But if you look closely, you might notice weird spellings, unusual web addresses, or links that take you somewhere else.

These tricks are common in Zelle scams: the email might have no clear signature or come from a domain that doesn’t match the company’s real website. If something feels off, don’t do anything. Take a moment to check the details before you decide to send any money.

Have questions about dealing with scams? Contact us for support.

What Are the Most Common Scams Involving Zelle Business Accounts?

When scammers decide to use Zelle pretending to be real companies, they follow patterns that are easy to miss if you’re not paying attention. We’ll walk you through the most common scams and how they usually work so you can spot warning signs before it’s too late:

1. Fake payments with edited receipts

One of the most common scams happens when someone claims they have already sent a Zelle payment and shares a fake receipt. The document looks convincing: it includes amounts, logos, and even transaction references.

But the money never arrives. Many business owners trust the image of the receipt without confirming the transfer, which makes the scam easier to execute.

2. Phishing via text or email

In this case, the scammer pretends to be Zelle or your bank. You might receive a message asking you to “verify your account” or confirm a payment. Once you click the link, you’re taken to a fake site that captures your login information. This method is one of the most frequent access theft tactics in Zelle business account scam cases.

3. Brand impersonation

Here, the scammer creates a fake account using your business name or logo to trick your customers. They might send messages through social media, email, or even WhatsApp, offering fake promotions and requesting Zelle payments to an account that has nothing to do with your business.

What are the Pros and Cons of Using Zelle as a Business?

Zelle has gained popularity among business owners who need to receive payments quickly. Its simplicity and reach make it an appealing option, but it also comes with some risks. Before adding it to your payment process, it’s worth taking a closer look at both sides:

Pros of Using Zelle for Your Business

- No extra fees in participating banks: In most cases, sending or receiving money through Zelle doesn’t include any charges. That’s helpful for small businesses handling a high number of payments.

- Instant transfers: Payments arrive in just a few minutes, even on weekends. This allows sellers to confirm purchases or complete deliveries faster.

- Easy setup linked to your phone number: There’s no need to download another app or complete long forms. All it takes is a phone number or email to receive money directly into your account.

Cons of Using Zelle for Your Business

- No support in case of disputes: If a customer claims they never approved the payment, Zelle won’t step in. There’s no way to request a refund.

- Accounts may be exposed to unauthorized access: There have been reports of compromised accounts and fraudulent use, sometimes caused by phishing or even a targeted cyberattack.

- Hard to track in fraud situations: In cases of Zelle business account scams, available details might not be enough to file an effective complaint.

How To Set Up a Zelle Business Account?

If you’re considering using Zelle for your business, the first step is activating the business feature directly through your bank. Not all banks support this option, so it’s important to check whether your institution allows commercial payments through Zelle.

The process is simple if your bank is compatible. These are the basic steps to set up Zelle for business use:

- Open a checking account under your business name (not personal).

- Log in to your banking app and find the option to activate Zelle.

- Register an email or phone number that belongs exclusively to your business.

- Verify your identity and complete any additional forms your bank may request.

Some banks ask for extra details, such as your tax registration or the trade name, that customers will see when they send payments.

⚠️ Important: Using a personal account to receive payments for services can lead to problems with your bank or confusion for your clients. This is a common mistake found in many Zelle business account scam cases, often resulting in financial loss for both sides.

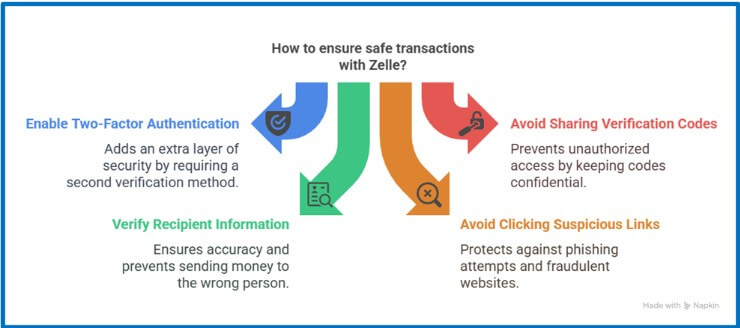

How to Make Safe Transactions with Zelle?

Using Zelle can be practical for businesses, but every step of the process needs to be handled with care. While the app wasn’t originally built for commercial use, many companies now rely on it to receive payments. We’ll show you a few essential tips to help you stay safe:

- Turn on two-factor authentication through your mobile banking app. This blocks unauthorized access if someone gets your password.

- Never share verification codes, whether by text or phone call.

- Double-checking the recipient’s information using another method, a quick phone call, or a company email, can prevent serious problems.

- Avoid clicking links that claim to “verify” a payment. If someone asks you to visit an external site, don’t trust it.

How to Prevent Zelle Business Account Scams?

Preventing fraud is always easier than dealing with the consequences. Zelle business account scams can be avoided by applying simple, consistent measures. We’ll show you a few actions you can start taking today:

- Train your team: Teach your team to spot fake links, strange behavior, and suspicious emails. If someone sends a number to confirm a payment, pause and ask: how can you check if a number is fraud? Search it first.

- Stick to corporate emails and verified profiles on social platforms: When your contact channels are clear and trustworthy, it’s harder for someone to impersonate your business.

- Publish your payment terms in a visible place: Add them to your invoices, website, or a dedicated page with your official payment methods. This prevents confusion and helps protect you against unfair claims.

Avoid Zelle Business Account Scams with Help from CDN

Now that you’ve seen how Zelle business account scams affect businesses, it’s clear that many warning signs appear early. A fake invoice, a copied profile, or a suspicious email aren’t small details—they’re signs you shouldn’t ignore.

At Cryptoscam Defense Network, we teach you how to prevent many types of digital fraud, like malicious links or using everyday documents to trick people. Our mission is to help users detect fraud quickly, protect their identity, and in serious cases, avoid losing money in crypto or money.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.