Are you thinking about getting a car loan but noticing big differences between the options? The reality is that one of them may be a scam. Auto loan fraud has increased by 105% over five years and accounts for $2 billion out of the $3.2 billion in total fraud, according to the CFO.

Given this alarming trend, in this post, we’ll talk about auto loan fraud, how it affects buyers and lenders, and how scammers work. We’ll also share effective tips to protect yourself and explain what steps to take if you ever become a victim.

Need support after a scam? Join our community today.

What is Auto Loan Fraud?

Auto loan fraud is when scammers use dishonest tactics in car financing or leasing. They may falsify information on loan applications, add hidden fees, or manipulate terms to make a deal seem better than it is. This type of fraud can leave borrowers with unexpected costs, higher debt, or even a vehicle they can’t legally keep.

Who Is at Risk of Auto Loan Fraud?

Auto loan fraud affects both consumers and lenders:

- Consumers can experience financial limitations or even lose their vehicles if they fall for a scam.

- Lenders risk financial losses from unpaid loans and could receive legal consequences if they violate credit regulations or unknowingly facilitate fraud.

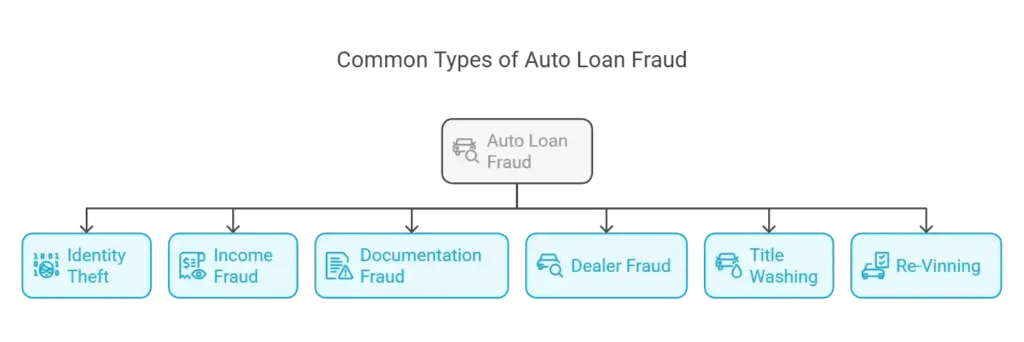

What Are the Most Common Types of Auto Loan Fraud?

For many people, getting an auto loan is the only way to afford a vehicle and secure reliable transportation. However, some take advantage of this system to commit fraud. In fact, in 2024 alone, an estimated 160,000 auto loan applications will include Social Security numbers that belong to deceased people, according to Auto Remarketing.

Here are some of the most common types of auto loan fraud:

1. Identity Theft

Scammers collect personal information through a loan application and use it for fraud. For example, they may ask for your Social Security number, claiming it’s needed for a credit check, and then use it to open fraudulent accounts in your name.

According to the 2024 Auto Lending Fraud Trends Report by Point Predictive, synthetic identity fraud—where scammers create fake identities using real and fake information—has grown by 98%, showing a major change in fraud tactics.

2. Income Fraud

This occurs when someone uses fake identities or fabricates details about their employment or income to qualify for a loan they wouldn’t normally receive. For example, an applicant might submit forged pay stubs showing a higher salary to secure a larger loan.

3. Documentation Fraud

Dishonest dealers or people may inflate a vehicle’s price or alter loan documents to secure a higher loan amount. For example, a dealer might modify a loan application to list a higher sales price than the actual value of the car or include non-existent accessories to increase the financing total.

4. Dealer Fraud (Yo-Yo Financing)

This happens when a car dealership lets a customer take a car home under certain loan terms but later claims the financing was not approved. The dealership then pressures the buyer to accept a higher interest rate or pay a larger down payment to keep the car.

5. Title Washing

This involves altering the vehicle title to hide its accident history or salvage status, deceiving lenders and potential buyers. For example, a flood-damaged car may have its title changed to remove any mention of its past, making it appear problem-free.

6. Re-Vinning

Scammers start a VIN scam by removing a car’s original Vehicle Identification Number (VIN) and replacing it with a fake one from a legally registered vehicle. This makes a stolen car appear legitimate, misleading both the buyer and the lender.

Have questions about dealing with scams? Contact us for support.

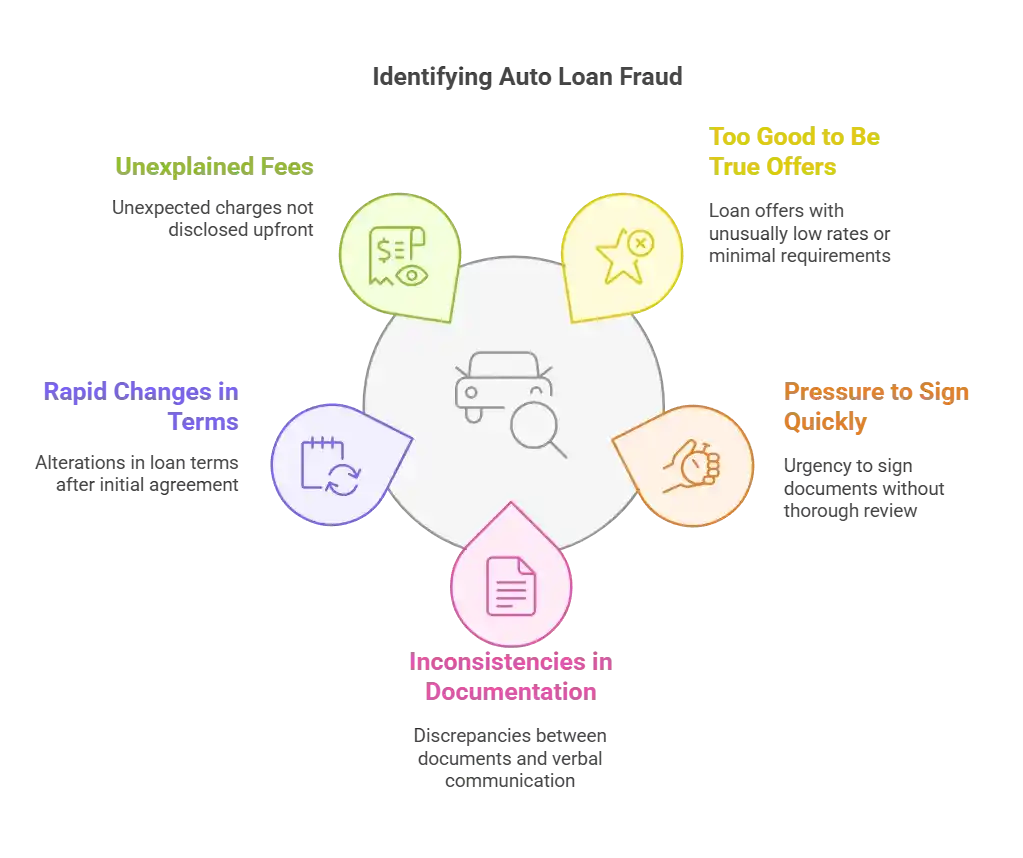

How Can You Identify Auto Loan Fraud?

Financing a car should be simple, but some lenders take advantage of borrowers with hidden fees and dishonest terms. Here’s how to recognize and avoid auto loan scams.:

1. Offers Too Good to Be True

If a loan offer seems exceptionally favorable with unusually low interest rates or minimal credit requirements, it could be a bait to catch unsuspecting borrowers. Such offers often come with hidden fees or clauses that are unfavorable to the borrower.

2. Pressure to Sign Quickly

Dealers or lenders who pressure you to sign loan documents quickly frequently do so to prevent you from reading the fine print, where fraudulent terms may be hidden. Always take your time to review all documents or have them checked by a professional if necessary.

3. Inconsistencies in Documentation

Look out for discrepancies in the loan documentation, such as mismatched details compared to what was verbally communicated. Fraudsters may alter or forge documents to deceive borrowers, so always verify that details like interest rates, loan total, and personal information are accurate and consistent.

4. Rapid Changes in Loan Terms

Be cautious if a lender changes the terms of your loan after the initial agreement. This could include a higher interest rate or different loan terms than originally agreed upon. Some scammers finalize the sale under one set of terms only to modify them later.

5. Unexplained Fees or Charges

Review your loan agreement for any unexpected or unexplained charges. If you notice additional fees that weren’t disclosed initially, such as high processing or documentation fees, it could be a sign of fraud. Ask for a detailed breakdown of all charges and question any item that wasn’t discussed upfront.

Learn about other types of vehicle-related fraud, including scam practices at the Department of Motor Vehicles (DMV).

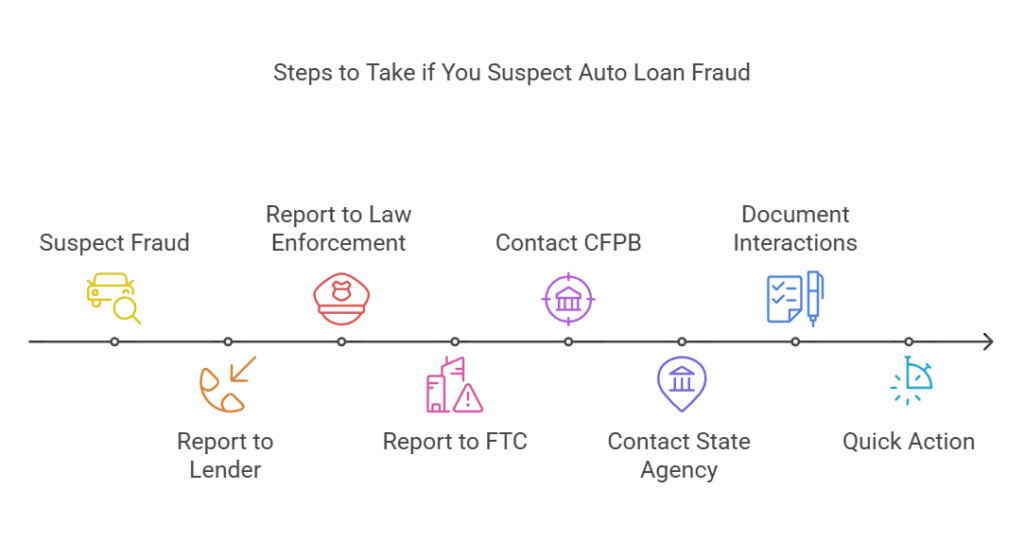

What to Do if You Suspect Auto Loan Fraud?

If you think you’ve been a victim of auto loan fraud, it’s important to act fast to reduce the risk and resolve the issue. Here’s what you should do:

1. Report the Fraud

Contact your lender immediately to report any suspicions of fraud. Clearly explain your concerns and provide any evidence you have. You should also report the incident to local law enforcement and the Federal Trade Commission (FTC), as they can investigate and take further action against fraudulent activities.

2. Contact Relevant Institutions

Beyond your lender and law enforcement, there are additional organizations that can help. Reach out to the Consumer Financial Protection Bureau (CFPB) and your state’s consumer protection agency. Filing a complaint with these agencies can also alert others and help contribute to stronger fraud prevention measures.

3. Act Quickly and Keep Records

Time is critical when dealing with fraud, so don’t delay. The sooner you report the issue, the better your chances of resolving it without major financial consequences. Keep detailed records of all interactions, including names, dates, and conversations with your lender, law enforcement, and any regulatory agencies.

Having organized documentation can make a huge difference if you need to dispute charges or start a fraud investigation process.

Now that you understand how to recognize auto loan fraud, you can make informed decisions when applying for a car loan. Fraud is a growing problem in the auto industry, with an estimated $7.9 billion in fraud loss exposure, according to Point Predictive. To reduce your risk, always choose legitimate lenders that follow regulations and are monitored by the right authorities.

If you want expert guidance to navigate potential fraud risks or stay informed about new scam techniques, Cryptoscam Defense Network offers a community with valuable fraud prevention resources and support to help you make safer financial decisions.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future frauds.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Frequently Asked Questions (FAQs) about Auto Loan Fraud

How Can I Check If a Car Dealership is Legitimate Before Applying for a Loan?

To verify a dealership’s legitimacy, research its history and reputation online through customer reviews and ratings on platforms like Google or Yelp. Check if they are licensed by your state’s Department of Motor Vehicles (DMV). Also, membership in professional associations like the National Automobile Dealers Association (NADA) is a good sign.

What Are the Warning Signs of a Fraudulent Online Loan Offer?

Be cautious of online loan offers that demand upfront fees, guarantee approval regardless of credit history, or lack clear contact information. Unsolicited offers and lenders who pressure you to act quickly are warning signs suggesting potential fraud.

Can Auto Loan Fraud Affect My Credit Score, and How Can I Prevent It?

Yes, auto loan fraud can negatively affect your credit score if a fraudulent loan in your name goes unpaid. To protect yourself, regularly monitor your credit report, set up fraud alerts, and report any suspicious activity to the credit bureaus as soon as possible.

Photos via Freepik.