Anyone with a smartphone and a basic app can now get into a credible crypto. But that same simplicity has made it easier for crypto scams to multiply. In 2024, the FBI reported over $9.3 billion in losses from fraud related to cryptocurrencies, a jump of 66% compared to the year before.

How do you distinguish between a genuine opportunity and something meant to defraud you? In this post, we’ll show you how to spot a credible crypto project, the warning signs you shouldn’t ignore, the tools that help you verify a coin’s legitimacy, and real-world cases that ended in very different ways.

Need support after a scam? Join our community today.

What Does It Mean For A Crypto To Be Credible?

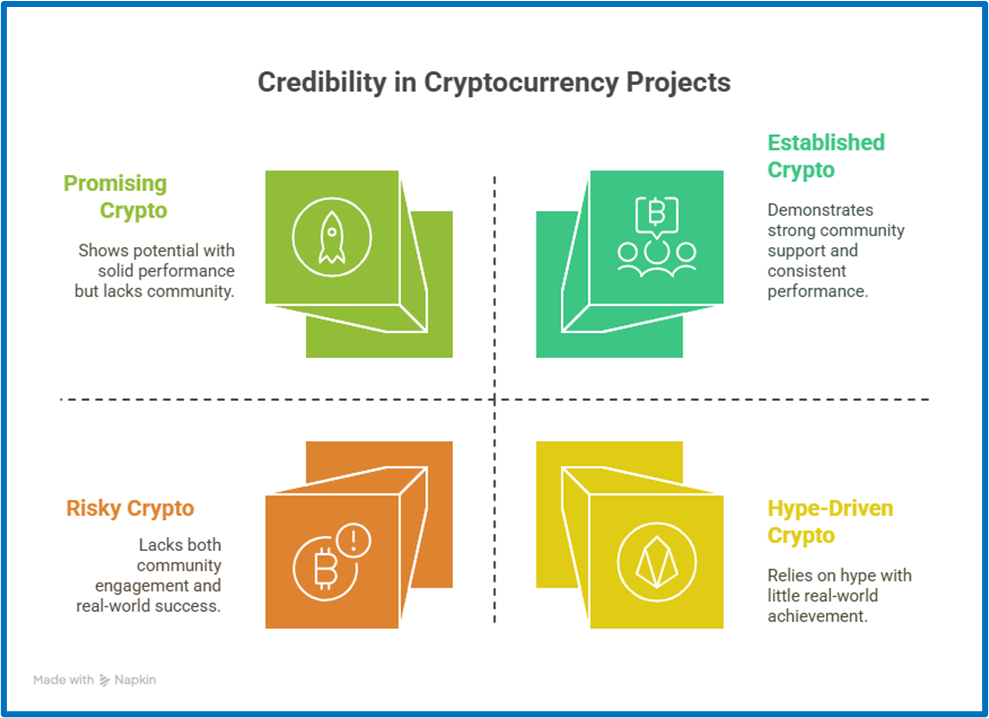

A crypto is credible when it shows transparency, real-world use, an experienced team, third-party audits, and an active community. In a space crowded with new tokens, bold claims, and constant speculation, the idea of credible crypto continues to gain attention.

Unlike coins driven by early hype, a credible crypto earns trust through:

- Real-world performance that shows it can operate under pressure: With over 460 million crypto users globally, according to Statista, real usage matters. Credible projects prove themselves through transactions, integrations, and reliability, even in down markets.

- Long-term resilience, even when markets fluctuate: On public platforms, users demand stability. A trustworthy crypto keeps building, releases updates, and stays active regardless of price swings.

- Value beyond price, reflected in how it meets user expectations: People value reputation and transparency. Projects that communicate clearly and deliver real progress tend to earn long-term support.

Why Some Cryptos Seem More Trustworthy Than They Are?

Sometimes, our minds play tricks on us—making us trust something just because we’ve seen it often. This is where two common mental shortcuts come in: availability bias and illusory truth effect.

These biases can influence how people see a crypto project, especially when they’re new to the space. A coin that pops up everywhere—on YouTube, Twitter, or news sites—can start to feel more trustworthy, even if it hasn’t earned that trust.

🔒 What to watch out for:

- Repetition doesn’t equal reliability: Just because you see a coin often doesn’t mean it’s secure or valuable.

- Don’t rely on visibility alone: High exposure is often driven by marketing, not merit.

- Always cross-check: Use third-party research and independent reviews before making decisions.

- Focus on the fundamentals: Check if the crypto meets key criteria like real-world use, liquidity, and a solid technical base.

Perception matters—but in crypto, being popular isn’t the same as being credible. Take a step back from the noise and look deeper before deciding.

7 Elements That Help Build Trust in a Credible Crypto

When deciding if a digital currency deserves your trust, there are specific aspects worth paying attention to. A credible crypto tends to show clear signs of transparency, technical consistency, and practical utility.

Here are the elements users value most when evaluating a crypto project:

1. A Clear and Technical Whitepaper

The whitepaper is the core document that explains a cryptocurrency’s purpose and how it works: what problem it is trying to solve, the token’s role, and the system’s structure.

When professionally written, this document provides detailed explanations on key elements such as monetary supply, consensus mechanism, token functionality, and protocol architecture. Its goal is to inform, not promote. If the content feels vague or overly commercial, it’s worth pausing to reassess.

🛡️Positive example

The original Bitcoin whitepaper, released in 2008 by Satoshi Nakamoto, is just nine pages long, yet it clearly explains the double-spending issue and how the network addresses it using a proof-of-work system. Its clarity and directness helped position Bitcoin early on as a credible crypto.

❌Problematic example

Bitconnect’s whitepaper lacked technical depth and read more like a sales brochure. It failed to explain the actual system behind the token.

2. A Verified and Experienced Team

A verified and experienced team is one that publicly shares its members’ identities, professional backgrounds, and specific roles within the project. This transparency helps demonstrate that the leadership has the necessary skills and long-term vision to guide the crypto’s development.

A visible team allows the public to investigate their track record, evaluate their past projects, and judge their ability to manage technology and trust. In any credible crypto, this level of transparency is a requisite.

🛡️Positive example

Ethereum’s team, led by co-founder Vitalik Buterin, was known from the start. Buterin’s technical background and continued involvement in the ecosystem have strengthened the project’s credibility.

❌Negative example

With OneCoin, founder Ruja Ignatova hid critical information and avoided external audits. Eventually, it was revealed that the project had no real blockchain and operated as a fraudulent scheme.

3. An Active Community and Ongoing Support

An active community and solid support can be seen through regular participation by users, developers, and moderators on platforms like GitHub, public forums, or support channels. This level of engagement suggests that the project is alive and growing.

A credible crypto values feedback. It corrects bugs, shares updates, and maintains open communication. Silence, closed channels, or lack of response are strong warning signs.

🛡️Positive example

Cardano (ADA) has fostered a strong community through open conferences, public discussions, and visible contributions to GitHub.

❌Negative example

Projects like Bitconnect, though they maintained communication channels, only shared promotional content and dismissed legitimate criticism, until they disappeared from the market.

4. Independent Audits

External audits are technical reviews implemented by independent firms to analyze the actual code of a cryptocurrency. These evaluations determine weaknesses, poor practices, or errors that could compromise the system or user funds.

Third-party reviews add a meaningful layer of trust. Any serious project intended to be seen as a credible crypto should welcome this kind of scrutiny.

🛡️Positive example

Polygon (MATIC) has undergone audits by respected firms such as Certik and Quantstamp. Their reports are public and detail findings, issues, and solutions, demonstrating transparency.

❌Negative example

The Squid Game Token had no public audits or verifiable documentation. It launched suddenly, grew via viral marketing, and disappeared with millions in user funds. The lack of independent review was one of many red flags.

5. Real-World Use Cases

Real-world use is one of the most valuable indicators of a project’s viability. While not all cryptocurrencies achieve it, those that are used in platforms, games, payment systems, or smart contracts show that they solve an actual problem.

🛡️Positive example

Chainlink (LINK) enables smart contracts to access real-world data and has been adopted by various DeFi platforms.

❌Negative example

Bitgert (BRISE), despite heavy marketing, lacks real integrations. There’s little evidence of adoption or practical use outside speculation.

6. Listing on Recognized Exchanges

An exchange is where cryptocurrencies are traded, and centralized platforms like Binance, Kraken, or Coinbase apply screening processes before listing a coin. Being listed doesn’t guarantee quality, but it shows the project met at least a minimum standard.

Exchanges review a project’s legitimacy, technical documentation, and history, so coins listed only on unregulated platforms should be evaluated with caution. Security of centralized exchanges has become a relevant topic because these platforms often have better protocols, clearer accountability, and stricter listing rules.

🛡️Positive example

Solana (SOL) gained early listings on platforms like Binance and Kraken, backed by solid documentation and a transparent team.

❌Negative example

The Squid Game token was never available on reliable exchanges. It was sold only through unregulated platforms, making it easier for its creators to vanish with investor funds.

7. Open-Source Code

Open-source code means that the software behind a cryptocurrency is publicly accessible, allowing anyone, developers or users, to examine, replicate, or audit it. This promotes transparency and invites collaboration.

When the code is hidden, users have no way of knowing how the system works or what risks it might carry. In contrast, open access builds trust, an essential quality in any credible crypto.

🛡️Positive example

Bitcoin has always been open-source. Its GitHub repository includes thousands of community contributions and constant review.

❌Negative example

Bitconnect never published its code. Its inner workings remained a mystery, which enabled fraudulent mechanisms. The lack of access was a clear warning sign.

What Are the Warning Signs of an Unreliable Crypto?

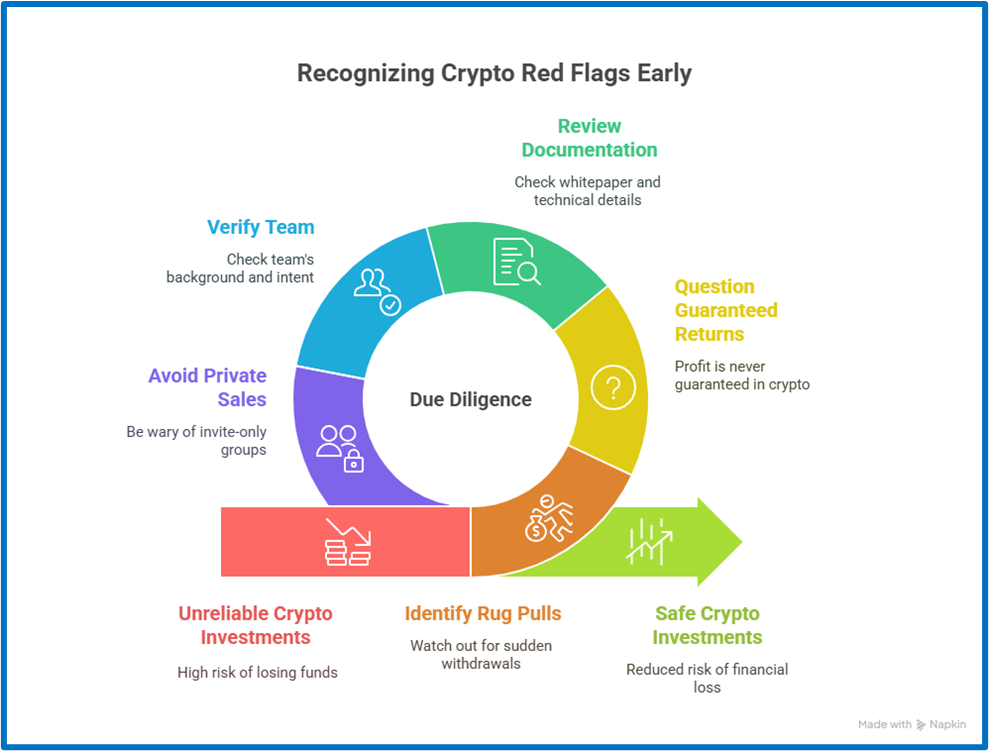

With thousands of projects active at any time, spotting red flags can help protect you from scams. Unlike a credible crypto, which is based on transparency and real use, some are only created to collect money quickly and disappear. These are some common warning signs:

- Rug pulls: These happen when developers suddenly withdraw all funds after securing investments. According to Chainalysis, rug pulls led to over $2.8 billion in losses in 2021.

- Promises of guaranteed returns: Profit is never guaranteed in crypto. When a project makes that promise, it’s worth being careful.

- No whitepaper or technical documentation: If you can’t read how it works or what problem it solves, that’s a serious risk.

- Anonymous or unverifiable team: If you can’t see who is behind the project, you can’t judge their experience or reputation.

- Sales limited to private channels: If a coin is sold only through Telegram or invite-only chats, it avoids public review and creates risk.

In many cases, people find out too late that they’ve been scammed. That’s why crypto recovery companies exist—to help victims track and recover their losses. But it’s always better to catch the warning signs early.

Have questions about dealing with scams? Contact us for support.

What Tools Can Help You Check If a Crypto Is Credible?

To measure a project’s potential, you need tools that evaluate its structure, activity, and visibility. Figuring out if a coin qualifies as a credible crypto means using multiple sources and combining technical data with market behavior. These are some of the most practical tools:

- Blockchain explorers: Platforms like Etherscan let you view transactions, inspect smart contracts, and confirm a coin’s actual usage. If there’s little activity, it’s worth digging deeper.

- Market tracking platforms: Sites such as CoinGecko and CoinMarketCap display real-time data on price, volume, liquidity, and rankings. This helps place a coin in context within the broader market.

- Technical and chart analysis: Tools like TradingView and CryptoCompare offer pricing patterns, trend indicators, and historical comparisons for those looking beyond surface value.

- Security audits: Services like Certik and Hacken review smart contracts and publish findings. When a project makes improvements based on those reports, it reflects accountability.

- Holder and contract verification: Some coins attempt to simulate demand. Reviewing token distribution lets you see whether there’s real adoption or if most holdings are controlled by a few wallets.

Examples of Cryptos That Evolved from Doubtful to Credible

A few digital coins gained legitimacy as credible cryptos through consistent development, wider adoption, and tangible responses to instability. Here are some of the most popular credible crypto coins:

1. Bitcoin

Back in 2010, someone traded 10,000 BTC for two pizzas—at a time when the idea of digital money still felt experimental. With a decentralized foundation, resistance to intervention, and a controlled supply, Bitcoin grew into the most recognized store of digital value worldwide.

2. Ethereum

Initially met with skepticism due to its technical complexity and dynamic structure, Ethereum proved its value through smart contracts. It now guides much of the DeFi and NFT economy and continues to adapt through major updates, like its shift to proof of work.

3. Steem and Burstcoin

Steem launched as a content platform with token rewards. Burstcoin took a different route, using hard drive space for mining. Both projects faced hurdles, but built committed communities and practical applications that helped solidify their place in the crypto world.

Beyond history, liquidity is important because coins with high trading volume usually make transactions faster and easier. According to CoinMarketCap, Bitcoin and Ethereum together account for over 60% of the total daily crypto volume worldwide.

Examples of Cryptos That Went from Credible to Questionable

Some platforms that once inspired confidence later exposed deeper problems. Though introduced as potential credible cryptos, they eventually showed gaps in structure, trust, or transparency:

1. OneCoin

Framed as a tool for financial education with ambitious returns, OneCoin appeared legitimate at first. But it lacked a blockchain entirely. In 2023, its founder received a 20-year sentence for running a global fraud scheme.

2. Bitconnect

It promised daily profits through an automated lending system. The numbers looked good—until the structure unraveled. In 2018, it collapsed in what became one of the most notorious exit scams, with investors losing more than $2 billion.

3. Terra (LUNA)

Fueled by the hype around UST, its algorithmic stablecoin, Terra aimed to provide stability without reserves. By May 2022, the system collapsed, wiping out nearly $60 billion in market value. The event served as a reminder: visibility doesn’t define a credible crypto; structure does.

Evaluate Before You Invest: Signs of a Credible Crypto

Putting money into a coin without checking its integrity can drain your time, resources, and confidence in the space. But when you know what defines a credible crypto, like real use cases, a visible team, or third-party audits, it gets easier to spot the ones that don’t hold up.

At Cryptoscam Defense Network, we recommend reviewing independent platforms, using tools like CoinMarketCap or Etherscan, and staying grounded when facing hype and big claims. If you want to go deeper, check out our article Crypto Intelligence News, where we break down practical ways to evaluate crypto projects.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future fraud.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

| Keyword | Credible crypto |

| Meta description | |

| Slug | credible-crypto |

| Palabras | 2500 |