Although checks are not the most common payment method today, many still receive and send them. Therefore, if you recently wrote a check and want to verify that the right person received it, it is important to take precautions to prevent it from being intercepted and modified by fraudsters.

Methods such as using indelible ink, sending checks directly from the bank, or using secure mail services can help reduce the risk of fraud. In this post, we explain what check-washing fraud is, how to identify signs that a check has been altered, and what measures you can take to protect yourself from this type of scam.

Need support after a scam? Join our community today.

What is Check-Washing Fraud?

Check-washing fraud is a type of check fraud that involves altering a written check using chemicals to erase the original ink. This allows fraudsters to rewrite the payee’s name and often increase the dollar total, ultimately cashing the check for their benefit.

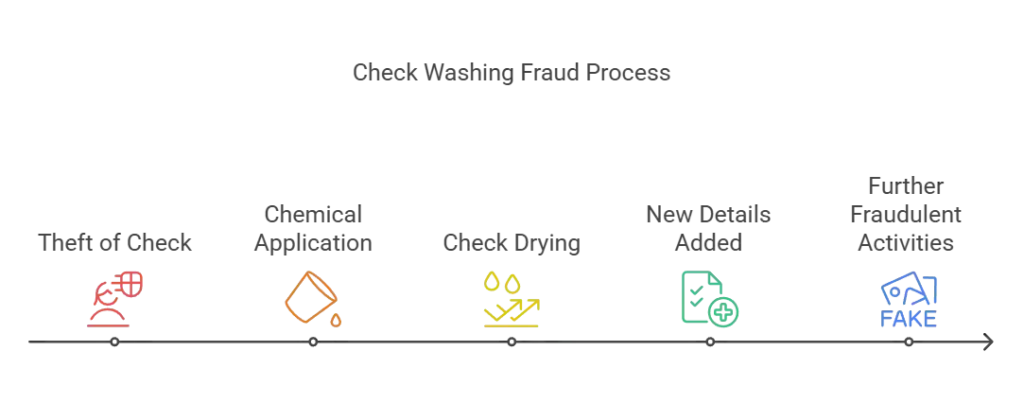

The way fraudsters alter checks involves the following steps:

- Step 1: A check is stolen, either from mailboxes or directly from personal or business premises.

- Step 2: Criminals use household chemicals like acetone or bleach to “wash” the ink, erasing key details without damaging the paper.

- Step 3: The check is dried, and new details—such as the fraudster’s name—are added to redirect the funds.

- Step 4: Information from stolen checks may also be used to create fake checks, forged IDs, or new checks in the victim’s name, leading to further identity theft and financial fraud.

Fraudsters might also target scanned checks or other documents, using the information to reproduce fake checks. Recognizing what fake checks look like can help identify fraud early and minimize risks.

How to Recognize a Fake Check?

Identifying a fake check is simple if you know what to examine. According to a 2024 survey by the Association of Financial Professionals, 65% of organizations reported check-related fraud. Understanding the key security features of a check can help you spot fraud before it happens.

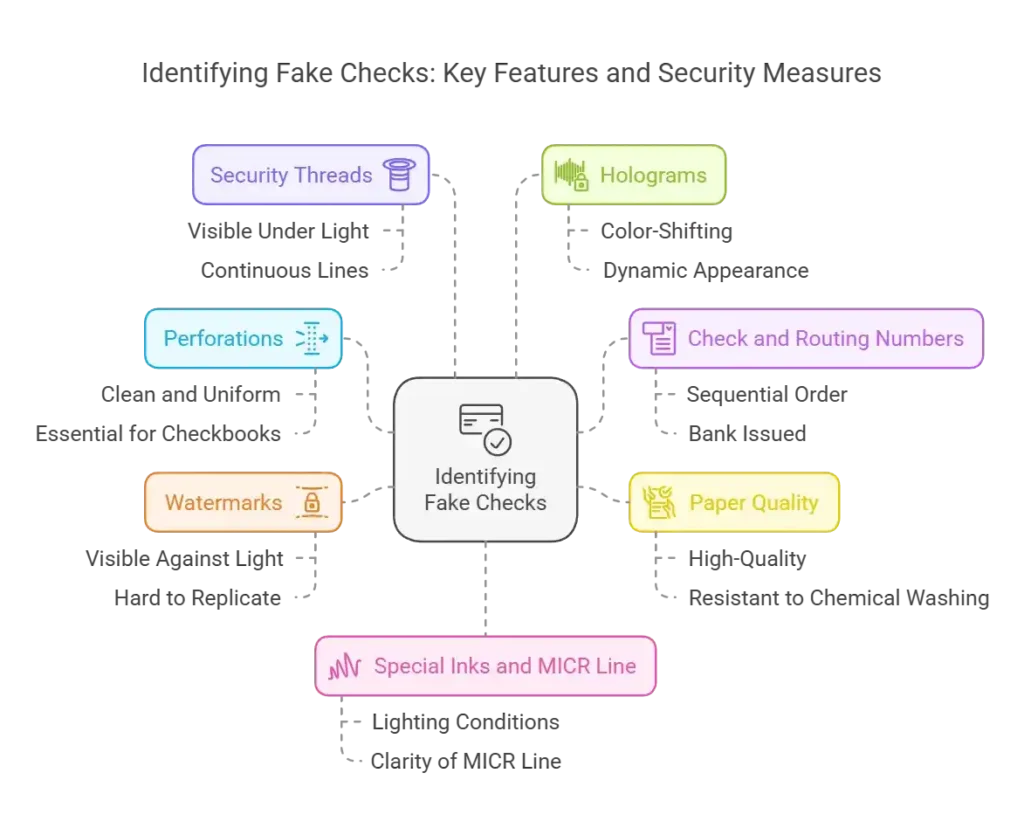

Here are key indicators to identify a fake check:

1. Lack of Uniform Perforations

Legitimate checks typically have clean, uniform perforations along the edges, designed for easy removal from checkbooks. These precise perforations guarantee a perfect tear without damaging the check. If a check lacks these perforations or has uneven, crudely torn edges, it might be fraudulent.

2. Missing or Inconsistent Numbers

Check and routing numbers must be printed and properly aligned for accurate bank processing. Check numbers should follow a sequential order matching the checkbook’s records while routing numbers must correspond to the issuing bank. Discrepancies, fading, or misalignment in these numbers are common signs of manipulation or fraud.

3. Poor Paper Quality

Genuine checks are printed on durable, high-quality paper designed to resist tampering methods such as chemical washing. Low-quality paper, stains, or fading often indicate that a check has been altered or is fake.

4. Missing or Poorly Replicated Watermarks

Most authentic checks display a watermark when held up to the light, acting as a critical marker of authenticity. This feature is intricately designed to be difficult for forgers to replicate accurately. If a watermark is missing or poorly replicated, the check is likely fake.

5. No Security Threads

Genuine checks include metallic security threads embedded in the paper. These threads are visible under light and form continuous lines, which are extremely challenging for fraudsters to duplicate. Their presence helps confirm the check’s authenticity.

6. Fake or Low-Quality Holograms

Many checks feature holograms that shift colors or patterns when tilted. These intricate designs are nearly impossible for counterfeiters to replicate and serve as a sophisticated layer of security.

7. Smudged Ink or Irregular MICR Line

The MICR (Magnetic Ink Character Recognition) line at the bottom of a check is crucial for bank processing. If this line looks smudged, poorly printed, or misaligned, it could mean the check has been altered or is not genuine.

Have questions about dealing with scams? Contact us for support.

What Steps Can You Take to Prevent Check Washing Fraud?

Now that you know how to identify a fake check, you should learn how to protect yourself from them. While the safest way is to ask the sender to use secure mailing methods, if that is not possible, you can:

1. Use Alternative Payment Methods

One of the most effective ways to avoid check washing is to use alternative payment methods. Online bill payments, credit and debit cards, or even digital wallets offer a safer way to manage transactions without the risks associated with physical checks.

2. Better Mail Security

Regularly monitor your mailbox and opt for a locked mailbox if possible. If you’re traveling or find it hard to check your mail regularly, ask the postal service to hold your mail until you can. This prevents your checks from sitting unattended in your mailbox, where they could be easily stolen.

3. Verify the Legitimacy of the Sender

Before cashing a check, confirm that it comes from a legitimate source. Scammers often send fake or altered checks, convincing recipients to deposit them and send money back before the check bounces. If you receive a check from an unknown sender, contact the issuing bank using official contact details (not those provided on the check) to verify its authenticity.

Learn about chargeback fraud and how to prevent it to avoid financial losses while protecting your business from fraudulent transactions.

Stop Check Washing Fraud Before It Happens with CDN

While checks may not be the primary payment method, they remain susceptible to fraudulent activities like check washing. According to the 2024 Fraud Survey by Abrigo, 51% of check fraud victims reported being targeted two or more times.

At Crypto Scam Defense Network (CDN), we understand that some fraud tactics, including check washing, can be difficult to recognize. That’s why we are dedicated to providing fraud detection techniques and online fraud prevention strategies to help you protect your assets.

We Want to Hear From You!

Fraud recovery is hard, but you don’t have to do it alone. Our community is here to help you share, learn, and protect yourself from future frauds.

Why Join Us?

- Community support: Share your experiences with people who understand.

- Useful resources: Learn from our tools and guides to prevent fraud.

- Safe space: A welcoming place to share your story and receive support.

Find the help you need. Join our Facebook group or contact us directly.

Be a part of the change. Your story matters.

Frequently Asked Questions (FAQs) about Check Washing Fraud

What Should I do If I Suspect a Check has Been Altered?

If you notice inconsistencies, such as smudging, missing details, or suspicious handwriting, immediately contact the issuing bank to verify its authenticity. You should also report the fraud to the police and your bank to help prevent unauthorized transactions.

Can Digital Payments Completely Prevent Check-Washing Fraud?

While digital payments reduce the risk of check-washing fraud, they are not entirely fraud-proof. Scammers may still create phishing attacks or commit data theft. Using secure online platforms and verifying transactions can help protect your finances.

How Can I Tell If a Website Offering Check Processing Services is Legitimate?

Before using any check writing or processing service, check for security indicators like “https://” in the URL, a valid business address, and customer reviews. You can also use a legitimate website checker to confirm its authenticity and avoid fraudulent platforms.

What are the Risks of Cashing a Check from an Unknown Sender?

Cashing a check from an unknown source can put you at risk of fraud. If the check is fake, your bank may withdraw the funds after you’ve used them, leaving you responsible for the amount. Always verify the sender before depositing a check.

Can I Recover Lost Money from a Check-Washing Fraud Case?

Recovery depends on how quickly you report the fraud. Banks may be able to reverse the transaction if it’s detected early. However, if too much time has passed, legal action or fraud prevention networks like CDN may guide your next steps.